- InvestiBrew

- Posts

- 🗞 Bond, Bear Bond

🗞 Bond, Bear Bond

Greenland is at play again, and markets seem to be leaning on the "Sell America" trade now, but it goes much deeper than that.

WHILE YOU POUR THE JOE… ☕️

Natural Gas Futures, Thinkorswim

Natural gas rices are up nearly 50% over two days alone. 🔥

As Trump begins to lean more on a potential Greenland acquisition, this is becoming a real issue with massive implications on the U.S. economy and stock market.

Why?

Natural gas prices affect electricity and utility costs, especially now in this unusually cold winter. This isn’t something that helps the Fed make a decision on further quantitative easing (cutting rates).

In fact, knowing where the Fed is right now, and how that will affect markets moving forward is the purpose of today’s newsletter.

Because it all centers around liquidity and where the stress is being felt around the financial system.

Before we get there, check this out:

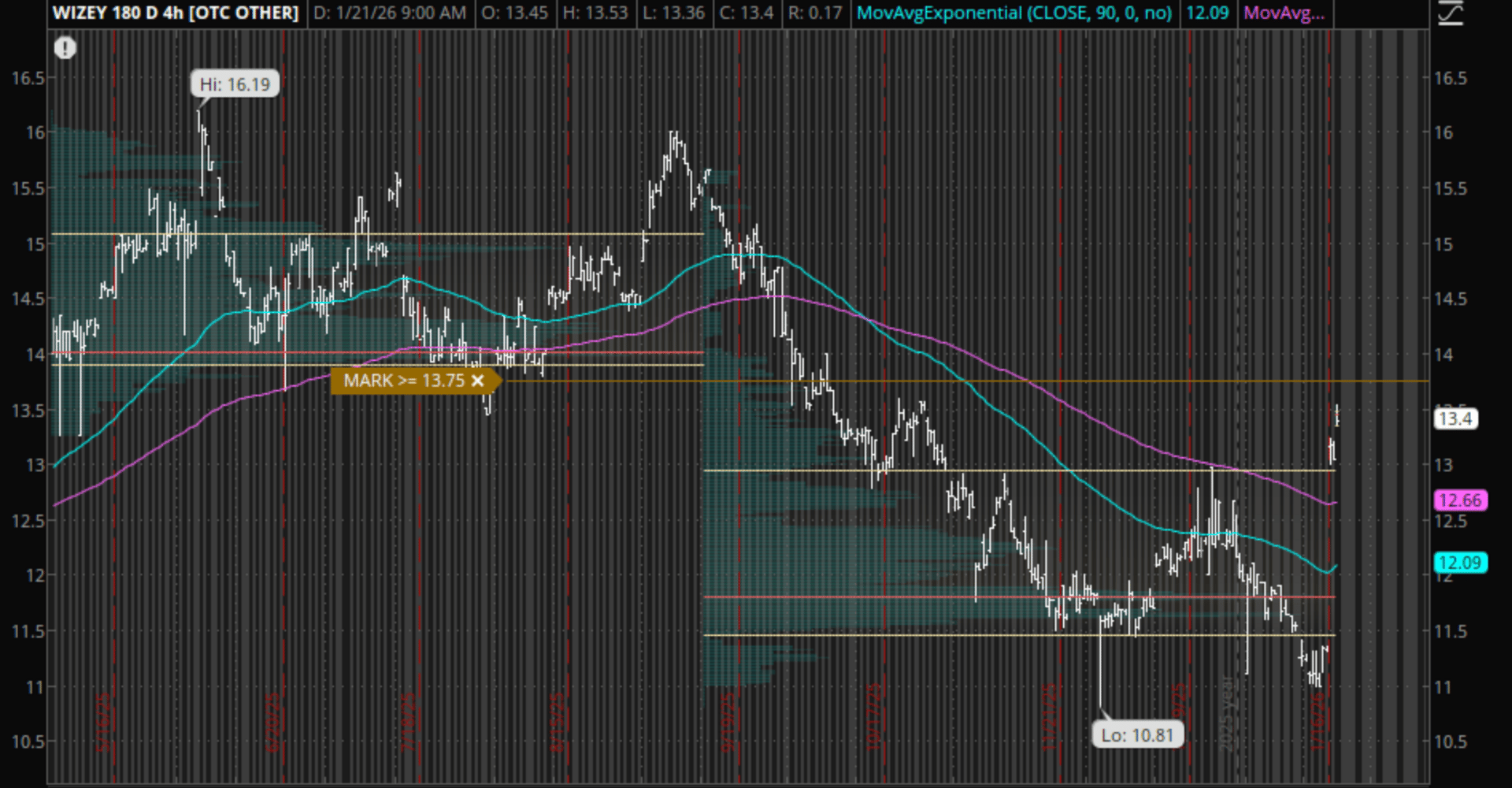

Wise Stock, Thinkorswim

Wise PLC (WIZEY) is now up over 25% in a single week for us. Stock was pitched inside my Deal Room right at the bottoms, with a short hedge in Synchrony Financial (SYC) which we already took profits on.

Literally risk-free from now on, and deep in profits.

Our next deal is right around the corner, get 7 Days Free right now and be part of it.

Speaking of liquidity and the Fed, let’s get on with today’s email 📧…

Automation Isn’t A Strategy

Financial tools promise clarity, but many leaders still don’t trust the numbers they’re seeing.

The real villain isn’t AI.

It’s relying on automation without judgment, context, or accountability.

The Future of Financial Leadership: Why AI Isn’t Enough is a free guide that explores why growing companies need more than dashboards. They need experienced guidance alongside their tools.

BELAY Financial Solutions provide that partnership: AI-fluent, U.S.-based Financial Experts who bring strategy, clarity, and confidence to every decision.

THE BEGINNING OF THE END

Knock Knock Bear Market

Mag 7 & AI Names, InvestiBrew.

The biggest constituents in the S&P 500 have all fallen into correction / bear market territory.

By definition:

Correction: 10% below 52-week highs

Bear Market: 20% below 52-week highs

The only exception is Google, but that doesn’t take away from the fact that we are now entering into very dangerous territory for stocks overall.

I think I have a pretty good idea as to why this is.

All good traders know that macro drives decision-making, we also know that retail traders have no clue as to what’s happening in macro most of the time.

If that’s your case, thank you for being here, let’s fix that from the top.

Starting with money markets. ⬇️

Global Liquidity Index vs S&P 500, TradingView

The way money trickles down the financial system drives most of the price action in asset classes, especially stocks.

More money is injected into the system

Gets to the hands of corporations and consumers

Credit and spending start flowing

Earnings and valuations start to rise on bullish forecasts

Inflation goes up, money gets extracted from the system to slow it

That’s as fundamental as it gets, which is why you should pay attention to where liquidity is going.

Right now, countries like China and the EU Zone are tightening their liquidity measures. In other words, there’s a lot less printing going on, which hurts the overall Global Liquidity Index (GLI).

The U.S. has a pretty reliable indicator for liquidity, which is the M2 Money Supply. More than just how much money there is in the system, you can look at the rate of change as your way to understand policy and outlooks.

Money Supply Rate of Change, InvestiBrew

You can correlate the rate of change in M2 Money Supply with how the S&P 500 did during those periods.

2022: Contraction in liquidity and S&P 500 decline

2020: Biggest liquidity injection and record S&P 500 rally

The latest quarter has shown you a massive slowdown in money supply growth, potentially as excess has formed in valuations for stocks and real estate.

Keep in mind, the Fed is worried about inflation getting out of hand again, so that also plays a role.

However,

This could just be a normal measure against potential issues in the future, though I think it goes deeper than that.

I think we’re about to run into some sort of financial crisis…

Let me explain:

Fed Overnight Repo Facility Tapping, FRED

The Fed has been needing to tap their repo facility a lot recently, with the biggest cash swaps happening between November 2025 and January 2026.

This is not a sign of a healthy financial system, if anything it means credit is beginning to tighten toward dangerously cold levels.

Fed Overnight Repo Facility Tapping, FRED

In fact, the last time we had such an aggressive level of tapping was in the Great Financial Crisis of 2008. 🐻

Excess needs to be erased.

Guess where most of that excess is right now? Yep, U.S. tech names.

However,

This is where you should be careful about your thinking. Don’t go all gungho on the market and start buying puts on the S&P 500, or shorting these tech names.

Oil and Dollars Correlation, InvestiBrew

What can we expect from the falling liquidity cycle now, and where is most money going to be rotating into?

We have a rare phenomenon happening between the U.S. Dollar and crude oil.

Correlations have trended significantly higher since 2023, just as the liquidity cycle started to fall off.

Now that this decline might accelerate again, there is going to be a scarcity effect for dollars (since there will be less printing and even some contraction in supply).

So,

I want to reiterate some of my industry views going into the quarter:

Bullish Energy Stocks

Bearish EURUSD

Bullish Services

Bullish Domestic Consumption

Which all seems to line up with where the market is starting to bet:

Industry EPS Growth & Valuations, InvestiBrew

These are the areas where Forward EPS growth is the highest, and so are the Forward P/Es for that reason.

You can get pretty good odds of beating the S&P 500 this year by exposing your money to these ETFs.

Or,

You can get double-digit upside much quicker by having the right stock selection framework (like our WIZEY/SYF setup).

Here’s the best part…

7 Days Free are on the table for you right now, why miss it?

To your success,

G 🫰