- InvestiBrew

- Posts

- 🗞 Duolingo Multi-Bagger: Day 2

🗞 Duolingo Multi-Bagger: Day 2

It's day 2, let's go over Duolingo's financials and some of my valuation cases for the stock's future.

WHILE YOU POUR THE JOE… ☕️

Example of what not to do, X.com

It’s Day 2,

Yesterday, we covered some of the reasons why I like the information and business services space and, initially, why I identified Duolingo as a potential acquisition target.

Today, we’ll review the specific reasons this stock is worth considering, given its current discount and upside potential.

My goal is that you don’t end up like that X/Twitter user, risking a significant portion of his net worth in the hopes that a couple of drawings will predict the future.

That said,

Make sure you grab a copy of Duolingo’s financial/valuation model to follow along today, it’s part of your 7 Days Free Trial to the Deal Room.

Speaking of Duolingo’s setup, let’s get on with today’s email 📧…

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

CREATING SHAREHOLDER VALUE

Focus On What Matters

Sometimes, stock prices deviate largely from the underlying business value, and that’s exactly where you need to act as an investor.

Now,

If you’ve been following Duolingo on financial media channels for a while, this image won’t be new to you ⬇️

Duolingo Stock Price vs Revenue, Fiscal.ai

This is a start, but it’s not enough for you to justify a big purchase in Duolingo.

After 12 years in this business and exposure to institutions like Goldman Sachs & Citigroup, I can tell you these are some of the profitability metrics that matter more for valuations and investor decisions:

ROIC

FCF as a % of Sales

FCF Yields (divided by Market Cap)

After falling to less than 30% of its 52-week highs, Dulingo has still managed to post decent growth rates in all these metrics.

So, if the business is still doing well, why is it falling?

In this newsletter post, I broke down why you should have gone short on some SaaS stocks like Salesforce and Duolingo.

The “AI is going to kill SAAS” narrative was way too strong.

Not anymore, though.

I mean, AI could still “kill” some of these businesses, but at today’s price, the narrative is pretty much priced in already.

More on that later.

First, let’s go over a few things:

Duolingo Profitability Metrics, InvestiBrew

Since FY’21, Duolingo’s ROIC has risen from -9% up to 21% as of the last twelve months.

But wait, there’s more.

Free cash flow, as a percentage of sales, carries similar expansion themes:

2% in FY’21

37% in the last twelve months

Yet, as we already know, the stock has gone nowhere.

Paying Subscribers, Duolingo

What has gone somewhere is the number of active Duolingo users:

135.3 million monthly active users, up 20% YoY

11.5 million paying subscribers, up 34% YoY

$281.9 million total bookings, up 33% YoY

These matter for future value creation because of the high operating margins (11.6% as of the last twelve months).

Which looks something like this ⬇️

Valuation

Duolingo Income Statement, InvestiBrew

Your eyes don’t deceive you; there’s been a massive improvement in Duolingo’s income statement over the years.

From steady growth across the board to expanding margins year after year.

Moving past current data, I’ve taken the Wall Street consensus revenue growth rates for my forecasts, but here’s where it all starts to build up for the bulls:

My Selling, General, and Administrative (SG&A) costs are above consensus

Same goes for Research & Development (R&D) expenses

Wall Street analysts see these as much lower over the years, which makes sense given that AI computing costs are lower due to broader availability.

However,

I am taking a conservative view, expecting Duolingo management to sacrifice margins to expand and retain their tangible addressable market (TAM).

All told, here’s how we differ:

FY’25 EPS: $3.99 vs $11.88 consensus

FY’26 EPS: $6.04 vs $7.93 consenus

FY’27 EPS: $8.39 vs $9.39 consensus

Valuation results are driven by these forecasts, so whatever targets I give you shortly will likely be on the conservative end of the spectrum.

Such as:

Duolingo DCF Valuation, InvestiBrew

Taken at face value, these forecasts give us a discounted cash flow (DCF) valuation of $321.41.

Roughly 115% higher than today’s price.

Again, that’s on a conservative basis given the distance between my EPS forecasts and the Wall Street consensus.

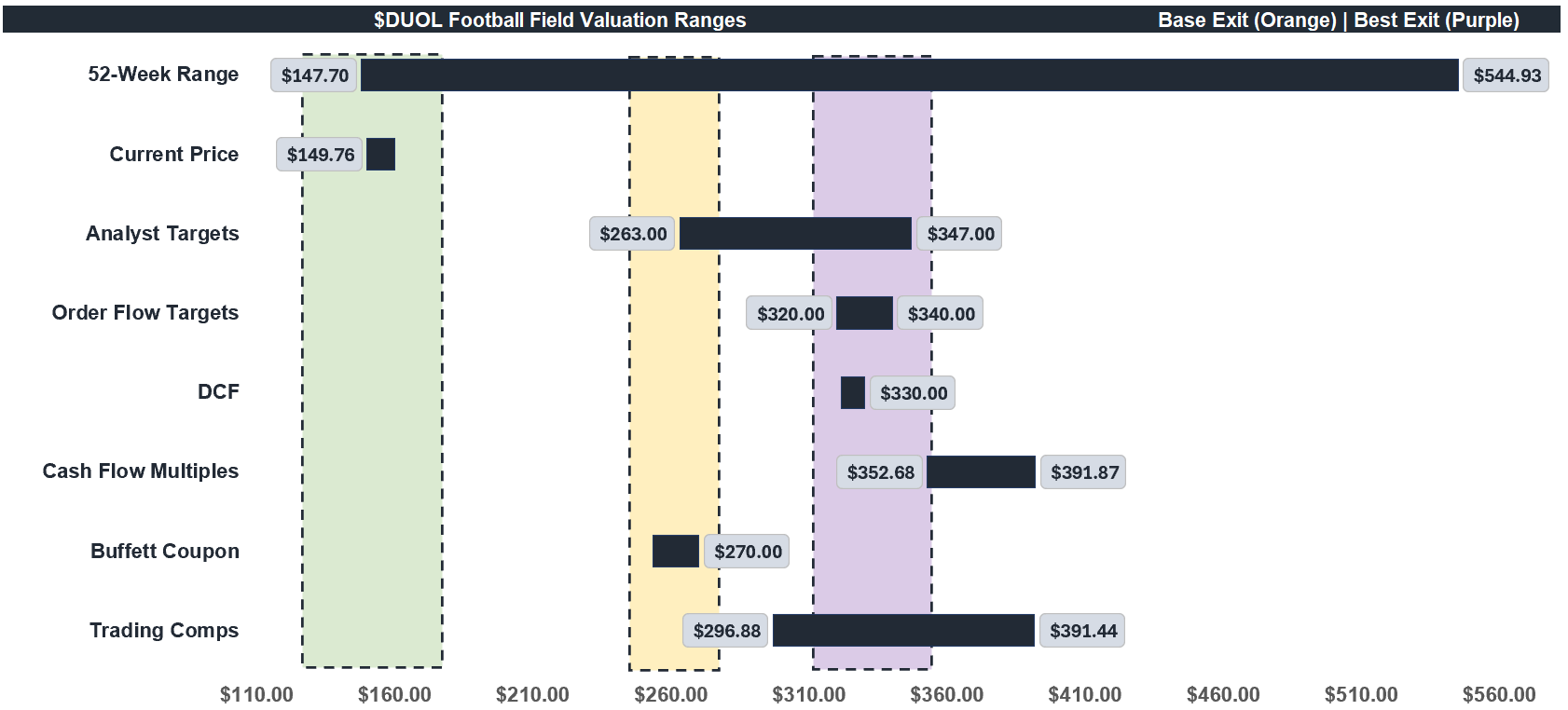

Duolingo Football Field Valuation Ranges, InvestiBrew

By other valuation methods, a sort of sanity check, this price seems reasonable.

In a nutshell, this is where the most likely valuation outcome will be:

$270 per share on a base case

$330 per share on a best-case

Duolingo has traded there in the past, passing another sanity check moving forward.

In fact, this is likely to be a magnet range for the stock, considering this is what the market profiles look like now ⬇️

Duolingo Stock, Thinkorswim

Current prices are what’s known as a low-volume node (LVN), where the current valuation targets represent fat tails, or high-volume nodes (HVN).

Another check for you and me, the bulls. 📈

The question is, when is the right time (and price) to buy into this idea?

Let’s tackle that next 👀

Timing Your Entry

Duolingo Volatility Cycles, InvestiBrew

I’ve shown you time and time again how volatility cycles work. You stay away when volatility is high and come rushing in when it’s low.

Over the past five years, Duolingo’s volatility looks something like this:

5.1% on the high end

4.7% on the low end

After months of trading at double the normal range, we are now entering the opposite extreme, where volatility is sustained at or below 4.8%.

In other words,

This is exactly where institutions LOVE to place their big buying blocks, so don’t be surprised to see a few of them in the next 13-F.

Top Duolingo Fund Holders, Gurufocus

For reference, here’s the latest filing from November, 2025.

Already crowded, isn’t it?

Duolingo Returns Probability, InvestiBrew

Here’s another useful tool: understanding Duolingo’s return probabilities.

Yesterday, the stock’s bottom was around -3.5%, which you can see very well has a 10% probability of happening.

Because the professionals know this is such a low-probability scenario, they bought the dip and the stock recovered accordingly.

What does this mean for you?

The macro volatility cycle is turning in favor of us bulls, and the micro can tell you when to buy.

Just look for those low-probability ranges and commit to your views.

So the stock is a buy, now what?

Tomorrow, I will show you the last (and probably most important) part of how professionals actually trade.

Which is answering the question: “What if I’m wrong?”

Going back to the AI will kill the SaaS stocks story; there are a few who still have some pain left to feel.

One of them is the perfect short candidate to hedge our Duolingo longs.

Deal Room members have the entire Excel model covering this idea, which left us at a net profit yesterday even as Duolingo fell.

You can access it right now, included in a 7 Day Free Trial. ⬇️

See you tomorrow,

G 🫰