- InvestiBrew

- Posts

- 🗞 2026: A Defensive Year

🗞 2026: A Defensive Year

From private equity to massive stock selling, everything points to 2026 being a defensive rotation year.

WHILE YOU POUR THE JOE… ☕️

Tail Risks View, Goldman Sachs

When the “masters of the universe” speak, do you listen?

Because 2026 looks like a year where tail risk hedging will make a huge difference, at least that’s what Goldman Sachs thinks. 🧠

We all know what’s happening right now:

S&P 500 and most stocks at all-time high valuations

Fundamentals don’t add up as the Equal-Weight S&P 500 falls behind

Consumer and housing indicators signal recession

All told, in combination with this newsletter, I think the odds are pretty high for trillions of dollars rotating into defensive areas this year.

On that note, I want you to go back to this chart ⬇️

JPM / GS Ratio, InvestiBrew

Speaking of defensive rotations, let’s get on with today’s email 📧…

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

EXUBERANCE ROYALE

Too Much Money

Buyout Valuations, Goldman Sachs

What do you buy when the stock market is the most expensive it’s ever been in history? 📈

The big guys seem to have the answer, and it’s private equity stakes in businesses related to artificial intelligence, memory, and some property overall.

However,

The alternative asset class has officially gotten too crowded, which is why these investors are willing to overpay as long as they have control over the future of these businesses and their turnarounds.

This comes at a cost though.

FedWatch Tool, CME

According to the FedWatch tool, there is only a 9.4% chance that the Fed will cut interest rates in the January 28th meeting.

After all, real rates are already low at 1.4% (10yr yield minus 2.8% PCE inflation).

Cutting now would be a colossal mistake, especially as the economy faces a real risk of stagflation this year, rate cuts would only make this situation worse.

How does that affect these private equity buyers, and more importantly, you?

Simple:

No more cuts would significantly slow the pace of appreciation & LBO refinancing

In other words, dealmaking slows, valuations collapse, and distressed asset trading kicks in.

That’s where you and I can make life-changing returns.

Private Equity Exit Type, Goldman Sachs

These private equity buyers have a lot in common with the biggest stock market investors of modern history.

They’ve all been getting rid of “vintage” investments, or those that have been held for five years or longer. 🗓️

Other investors doing the same ⬇️

Warren Buffett: Sold BAC, AAPL, VRSN, DHI, NUE

Stanley Druckenmiller: Sold PLTR, NVDA

Peter Thiel: Sold PLTR, NVDA

These were all part of those vintage holdings we’re talking about, building a new base of dry powder for them to start looking into new (better) opportunities.

Rotations Rotations

S&P 500 Sector Weighings, LSEG

For what seems like forever ago, it has been the AI sector that took over the S&P 500 index.

Now, if what we just wrote above is right, that’s about to change during the entire year. 👀

Which also means billions of dollars could come out of the information technology sector, and rebalance into other attractive setups.

Let’s define attractive:

High Growth

Reasonable Valuations

If overpriced, can we justify that premium?

After hours of digging this up, here’s what I came up with (so you don’t have to) ⬇️

Sector Growth & Valuation Breakdown, InvestiBrew

When it comes to above-average growth, there are really three industries I want you to focus on ⬇️

Auto Tires-Trucks

Business Services

Basic Materials

Now, only one of these has above-average multiples in terms of Forward P/E, and that’s Auto Tires-Trucks.

If you still subscribe to the idea of value investing, then focus on business services & basic materials, where I will most likely dig up the best and finest for you.

Reserved for my Deal Room members, and included in your 7 Day Free Trial. ✅

Let’s go back to Auto Tires-Trucks…

Auto Tires-Trucks Comps Spread, InvestiBrew

If you’ve been with me for a while, you know that most of my investment/trading returns come from two factors:

An above-average EPS growth rate (justifiable)

Accompanying Forward P/E premium

On that note, there are a couple of outliers in the sector, which I would consider looking deeper into for future reference when/if the sector begins to break out.

These are:

Ploaris (PII)

Hesai Group ADRs (HSAI)

In case this view is wrong, and the sector does not deliver on current expectations, here is wher the second aspect of my flagship strategy comes into play.

Which is hedging in a long/short equity strategy format.

So here’s my short pick candidate:

BorgWarner (BWA)

Whether this trade works or not is up to a few factors, modeling, and deeper dives into each business and the setup going into the next quarter.

All of which will be made available to you (eventually) in this newsletter.

But, for those who are active traders…

You can join my Deal Room and have access to these insights and models before everyone else, and get results like these ⬇️

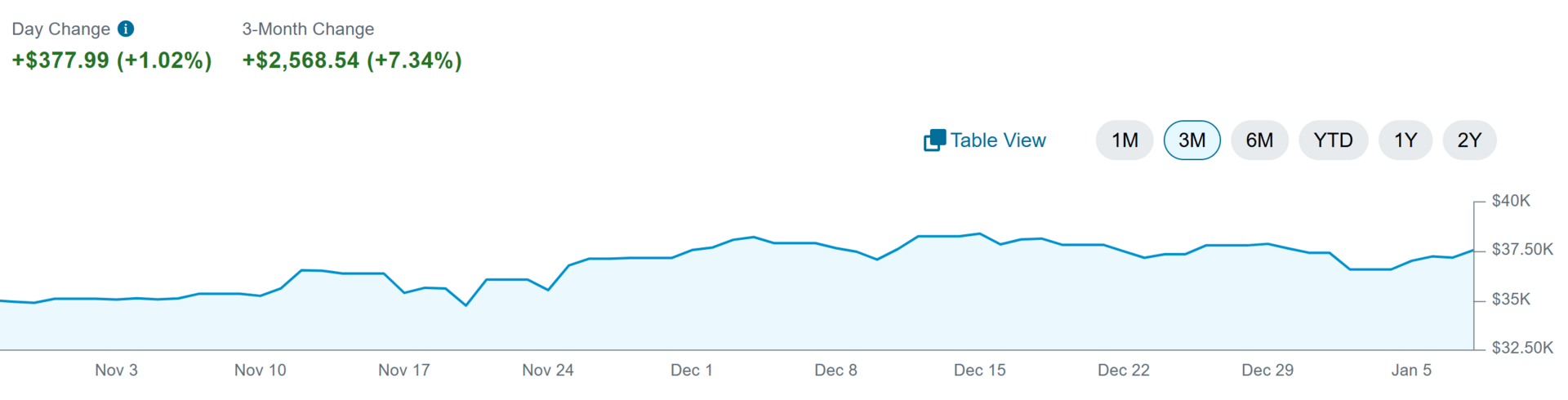

Client Managed Account, InvestiBrew Asset Management

See you in my next issue, or…

I will onboard you with all my current deals inside your 7 Day Free Trial to the Deal Room.

To your success,

G 🫰