- InvestiBrew

- Posts

- 🗞 Let's Go Stock Picking

🗞 Let's Go Stock Picking

After this month's delayed economic data, it's pretty clear where we should be looking as far as the next profitable trade ideas go, so let's get into it.

WHILE YOU POUR THE JOE… ☕️

Investment Opportunities Driven by Valuations, Vanguard

I guess we can trust Vanguard’s outlook on where opportunities can be found across financial markets right now.

Here’s the nutshell:

The S&P 500 is the most overvalued market in the world

Only opportunities in the United States are found in “value” stocks and small caps

Let’s expand a bit on the idea of “value” and where it stands right now ⬇️

Value / Growth Relationship (orange), Crude Oil Futures (white)

In the orange spread, you can see how value stocks ($IVE) are beginning to outperform growth stocks ($IVW), so far, so good for Vanguard.

But,

Crude oil isn’t catching up to this narrative, so you have to consider the fact that this move won’t have much economic growth attached to it.

Which is why our stock selection is shifting to a very specific niche right now. 👀

A niche that has delivered over 10% portfolio returns for our Deal Room members. This is an opportunity you can grab onto right now.

Get a 7 Day Free Trial, and 10X your membership investment likely before it’s even due:

Speaking of niche opportunities, let’s get on with today’s email 📧…

A DIFFERENT MARKET

Forget Everything You Know

Warren Buffett and Charlie Munger were successful at two things:

Compounding capital

Romanticizing the stock market through value investing

However, times have changed, and so have the ways that information gets spread around in markets.

Far from saying that the efficient market theory is alive, we are in an industry that gets pretty close to it.

Let me explain,

Turnover Ratios for S&P 500 Trading

The turnover ratio, or how much money goes in and out of the stock market, is on a secular decline that started last decade.

In other words, there is much less trading in the stock market. 📉

Think about it, though, every retail trader you know (maybe even yourself) trades way too much and way too often, so they are literally going against the industry trend and paying the price for it.

They also don’t represent a big percentage of all the money that is moved in the financial markets, which means the big guns (investment banks and hedge funds) aren’t trading that often either.

I can attest to this, as my final days at Goldman Sachs were dedicated to studying the trading department.

This is what I found:

New trading hires needed to have a programming or mathematics background (quants)

Old trading employees were being trained on a new strategy that is much slower in nature

Leaving you with two options, that is, if you really want to perform in the financial markets.

Either become a world-class programmer, or learn long/short equity trading.

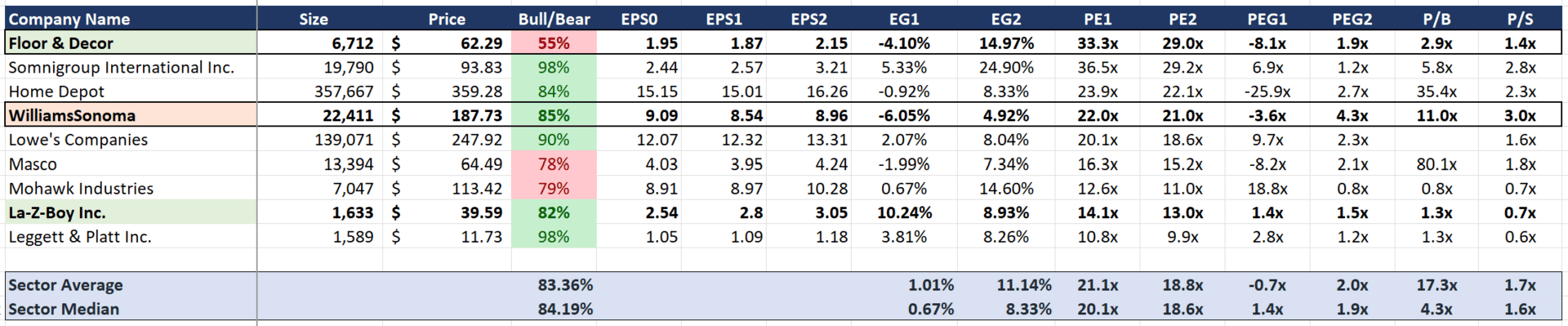

Comps Spread for the Furniture Industry, InvestiBrew

Here’s a quick way to learn the approach, which is super counterintuitive to everything we have learned from Buffett and other value investors.

You must identify the industries that are positioned for breakouts/breakdowns, then dig deeper into them and find the outlier stocks and the reasons why they trade that way.

In previous newsletters, I showed you why the retail and furniture space was a good place to start finding some ideas:

Floor & Decor (FND) is the “expensive” name there at a forward P/E of 29x

Williams-Sonoma (WSM) is the “cheap” name at a forward P/E of 21x

Differentiating them is the forward EPS growth expectations set for the next 24 months, 15% and 5% respectively.

This is why FND has outperformed WSM since we put on this long/short equity trade.

Now that you understand how today’s market works and how it will keep on working, it’s time to get yourself some “premium” stocks and find the proper hedges to go along with them.

Then you have a market-neutral portfolio that lasts from 1-3 months on average, and align yourself with how the big money is currently trading and investing.

MercadoLibre Long Candidate, PDD Holdings Short Candidate

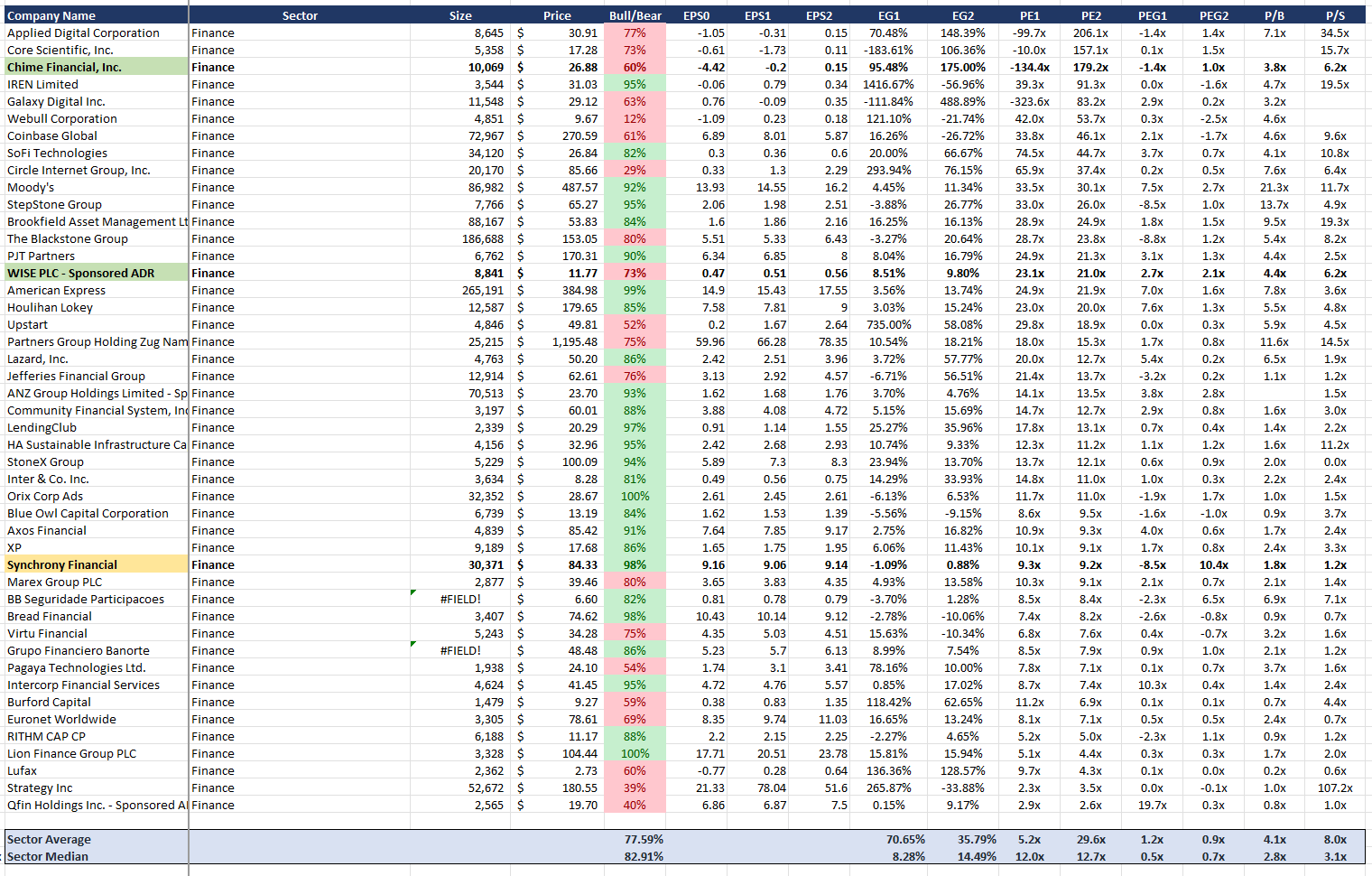

Wise & Chime Financial Long Candidates, Synchrony Financial Short Candidate

Knife River Long Candidate, United Rentals Short Candidate

These premiums and discounts are just the beginning of coming up with an idea; there is a lot more work that goes into putting on a winning trade.

Such as:

Financial & Valuation modeling

Modeling the long/short spread and making sure it works

Managing risk parameters and catalysts

If that’s all new to you, that’s okay.

Because I have a gift for you today, after you take away this list of stock picks, to go digging into.

With a 7 Day Free Trial in our Deal Room, you’ll be exposed to how a Goldman Sachs analyst puts together these ideas, models them, and puts them to work in real time.

Grab a seat in our Deal Room, it’ll change the way you look at trading forever. ✅

Also,

Knowing how sluggish stock returns could be in the next decade, broken down by Vanguard, here’s a way for you to diversify your investments in an entirely different market ⬇️

Wall Street Isn’t Warning You, But This Chart Might

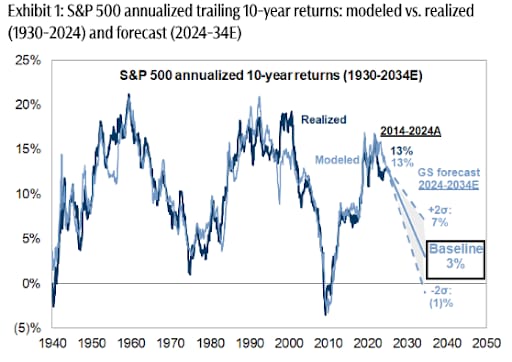

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

GO AND MAKE IT HAPPEN

Taking Inventory

Outperforming the market doesn’t have to be a science or an art.

But it should be a systematic process you can repeat month in and month out, using some of the concepts we’ve broken down for you today.

It’s exactly how I can achieve returns like this (a managed client account, running since late October 2025) ⬇️

Why would someone trust me with their savings?

Simple.

I don’t trade based on chart patterns and other useless information; I use the real edge that is very much alive today.

Now you can learn the fundamental truths of this strategy, completely for free, in this five-day email crash course below.

To your success,

G 🥃