- InvestiBrew

- Posts

- 🗞 Our Next Trade Setup

🗞 Our Next Trade Setup

The dust has settled, and all data points to this one hot area filled with trade opportunities.

WHILE YOU POUR THE JOE… ☕️

Only 22,000 jobs were created in the economy last month…

Not only is that one of the weakest readings since the pandemic, but also the job numbers for June were revised lower by 27,000 jobs, too. 📉

Also the first negative month since the pandemic.

All this to say, what exactly is going to drive GDP higher for the next quarter or two?

By the way, that is the question we always begin with when coming up with a trade idea. 💡

And it’s exactly what you’ll be able to answer after taking our long/short equity crash course.

We’ve boiled the entire thing down into 5 chapters you can take home now for free, all delivered straight to your inbox.

Sign up below, and I’ll see you on day 5 for your very first pro-level trade idea setup! ⬇️

Turns out, GDP is being driven mostly by inflation, not earnings or productivity growth (despite what the AI narrative may say).

Which is why the latest set of business data is so important to generating the next big trade idea.

Speaking of trade ideas, let’s get on with today’s email 📧…

ZOOMING INTO CHAOS

One Man’s Trash…

This is the $FTXR ETF, which tracks the United States transportation sector.

Now trading at 95% of its 52-week high and poised to break out given how aggressively it’s been rallying lately.

However,

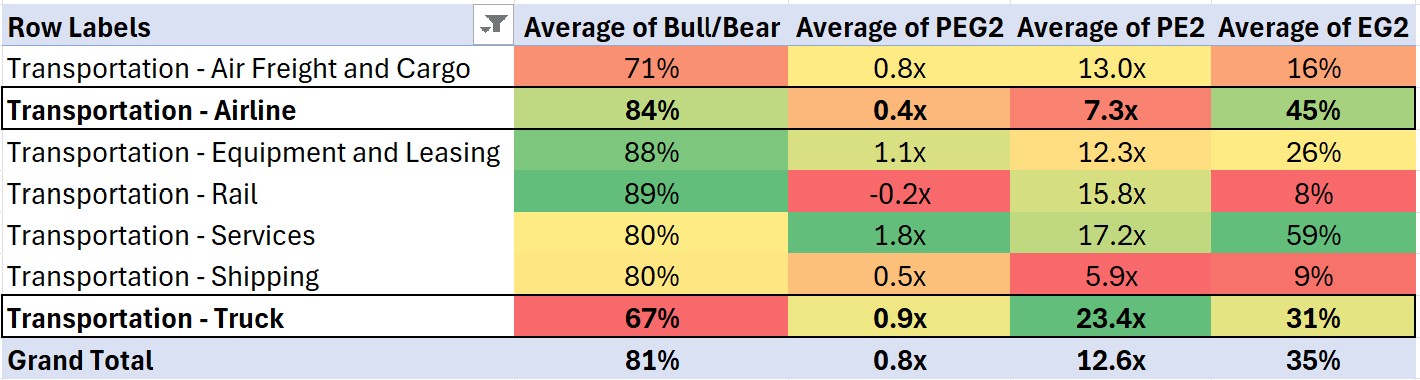

When I break down the current data inside the transportation sector, there are really only two areas in which I’m interested in:

Airlines

Trucking

Here’s what they look like next to the rest of the space ⬇️

Both look attractive to me for different reasons, most of which you can figure out but just looking at this table alone.

That is, if you’ve been through our flagship program, The Sovereign Trader, of course. 👀

If not, then let me just give you the clear-cut reason behind my interest in these two:

Airlines: Markets aren’t buying the 45% EPS growth just yet, could be a good tailwind if analysts start to boost them and institutions begin buying.

Trucking: Seems like a premium is being assigned in expectations of EPS expansion, our job is to figure out if that expansion can happen or not.

Lucky for us, we just got the two PMIs last week, and some data points confirm that this EPS expansion 📈 the market is pricing in could very well take place.

Just look at these comments ⬇️

In case you didn’t know, trucking and housing are typically the most powerful leading indicators of the US economy.

And they’re both contracting hard. 🐻

For trucking specifically, conditions are “Much worse than the Great Recession of 2008-09.”

While that may sound like danger, I see opportunity.

So I got digging.

Our thesis as far as retail and wholesale trade is still ongoing, and some of our picks have played out nicely.

Such as $LULU being down over 15% after earnings, a stock we called a short candidate in our search for opportunities in retail / wholesale.

Or $DLTR being up over 20% since that very same call.

Anyways, 💰️

There is a lot of action still happening in wholesale and retail, as seen in the Services PMI quarterly trends, which extended into Business Activity and New Orders.

However,

There’s one little problem ⬇️

Prices are still going up. 📈

As we’ve broken down before, where Services prices go, so does CPI and PCE, so again, this might be a very hard FOMC meeting coming up.

Seems like inflation is single-handedly carrying the economy forward, as the only sector still pumping is services.

So, we have to look into a services company in the transportation sector that is able to sustain its margins better than the traditional players can.

Enter the Peer Comps ⬇️

Well would you look at that, Landstar stock is right at the top of the queue!

The reason is that this company doesn’t just offer truckload transportation services, but also logistics and proprietary software to ease the industry’s activity.

As wages go up, and margins get squeezed from tariffs and worried customers, this software is not only going into high demand, but is also Landstar’s savior in this turbulent time.

Which is why:

It’s assigned a 21.2x forward P/E above the industry average

Analysts expect to see 29.5% EPS growth (also above average)

Markets are paying a premium for its book value relative to peers, and a PEG ratio suggests growth isn’t priced in yet.

In our next newsletter, we’ll cover a bit more of the financials behind this company, and why we think it’s a buying opportunity here. 👀

But,

Our bread and butter strategy, long/short equity, needs to assume that we are terribly wrong in our thinking.

Which is exactly where our hedge comes in through a short position.

Now, picking shorts is that much harder than the longs, but hopefully you’ll have a pretty good idea of how to do this by Day 5 of our free 5-day email experience breaking down our entire flagship strategy for you. 📖

Our short pick this time is Canadian National Railway, here’s why:

Tariffs are hitting Canada real bad, we all know that

Hence the market is discounting the company’s future earnings

EPS is going ex-growth for next year, which makes sense

Its PEG suggests this below-average growth is now 40% overvalued

Looks like we got our setup ready to be modeled up! ✅

So stay tuned for our next post, where the entire model and trade setup will be posted for you, along with a brief financial analysis of these two names to justify our positioning.

Here’s a hint: We’re almost ready to buy into this spread ⬇️

Want to stop relying on us to feed you ideas, which can often come at inconvenient times?

The solution is actually very simple.

In six months, you will either be:

Scrolling X for ideas based on chart patterns that even a kid in Guatemala can access

Or

You’ll be putting together institutional-grade trade ideas for yourself, and even have the chance to sell them to boutique financial advisors

Your choice my friend..

To your success,

G 🫰

GO AND MAKE IT HAPPEN

Together With Astoria

We tripled the S&P 500 index (again) last month. 🔥

In a post pitching the $XRT ETF over the S&P, you would’ve made nearly 10% since then, while the rest of the market only went up by barely 3%.

But you know who else beat the market?

Astoria’s very own ETF, the $ROE

Its picks are based on a very similar method compared to ours, which you already know works.

Give it a look, and consider shifting some of your weighting to this space. ⬇️

To your success,

G. 🥃