- InvestiBrew

- Posts

- 🗞 Re: Your Withdrawal Request Has Been Approved

🗞 Re: Your Withdrawal Request Has Been Approved

For traders who like their money to work for them, here's a quick rundwon on sourcing the best stocks can offer.

WHILE YOU POUR THE JOE… ☕️

Equity Risk Premiums Levels

Grab your balls (and ovaries), are they made of steel?

If they aren’t, then you should know equity risk premiums are reaching pre-crisis levels on stocks, and even that is not an accurate reading. 🐻

I say this because bond yields have yet to reflect the fact that we’re in a recession, a shadow one at that, but inflation and a debt super cycle is keeping bonds at bay.

For now.

But what happens next? Well, history has taught us that markets will shift from the comfortable “buy and hold” environment we’ve had from 2020-2025 into a “hit and run” type of market.

Most of you can hit, but running is where it gets hard. 👀

You start with a stock you like, set a timeframe, and end up keeping it for your retirement when the initial idea doesn’t pan out.

Which is why I’m opening my WhatsApp Deal Room to everyone, in a 7 Day Free Trial.

I’m confident 7 days are enough for you to not only 5X your initial membership investment before it’s even due, but also to learn that markets are much deeper than you think. 📈

The AI trade is unwinding in real time, we have an impossible housing market, and the average consumer is quietly depressed.

Join now, and see how deep the rabbit hole goes. 🐰

Speaking of hit and run, let’s get on with today’s email 📧…

LISTEN TO THE MARKET’S TALK

The Customer is Always Right

Fed Consumer Sentiment Data & Driving Concerns

Consumer sentiment is at a cyclical low, we all know that.

But,

The main concern behind most consumers is driven by lower incomes, not necessarily prices.

Which means our bullish take on consumer discretionary stocks depends on one single factor:

Value delivery

If you recall from our last newsletter, the discount retail industry is one of the premium outliers where we’d like to source more opportunities coming up, and it makes sense since most of the space fits this value delivery narrative.

Though not all stocks are created equally, some are just better than others.

Such as Dutch Bros (BROS) ⬇️

Dutch Bros Stock

This underperformer is quickly turning into a gem for our portfolio.

It was given out to our WhatsApp Deal Room members at just under $50 a share, with a very clear price target of $75 on average for 50% upside potential. 🔥

Combining this setup with a stronger $DXY dollar index, a recent coffee tariff removal announcement from President Trump, and a clear value delivery…

I wouldn’t be surprised if Dutch Bros surpasses that valuation target on good volume.

Dutch Bros Valuation Ranges

In fact, Dutch Bros is a premium stock on a P/FCF basis, solidifying my view on this being a fantastic setup for a quicker payout than most.

Again, we are entering a hit-and-run market, and you must shift accordingly.

You see, we are all taught to look for stocks which are discounted as part of a value strategy, but the problem is you will be exposed to long holding periods before you ever find out if you’re right or wrong.

Premium setups pay quickly, and allow you to exit within 20-30 days on average.

Sourcing these ideas is not rocket science, but it isn’t simple either.

Which is why I made an entirely free 5-Day Email Crash Course for you to learn how to do this.

Now that Dutch Bros is up 15%+ and proving my discretionary thesis right, it’s time to expand on this theme in a much more efficient way. ⬇️

Enter Long/Short Equity

Hedging your bets is a key part of being a professional trader, and also a survival guide in this new market environment.

So, here’s an example you can take home (and you might not even be too late to trade it as well).

Retail/Wholesale Home Furnishing Comps Spread

Finding some more outliers in the home furnishing industry, there are two clear plays we can make here:

Long FND with an above-average EPS growth rate and a premium Forward P/E

Short WSM going ex-growth and an overextended forward PEG ratio

There’s a reason why markets are pricing these stocks in this way, and it’s because FND sources most of its materials within the United States (tariff-free), and delivers on the value issue consumers are most concerned about today.

On the other hand, WSM is heavily exposed to tariffs and its price tag is much higher, so consumers may want to pull back as they don’t see the value as of right now.

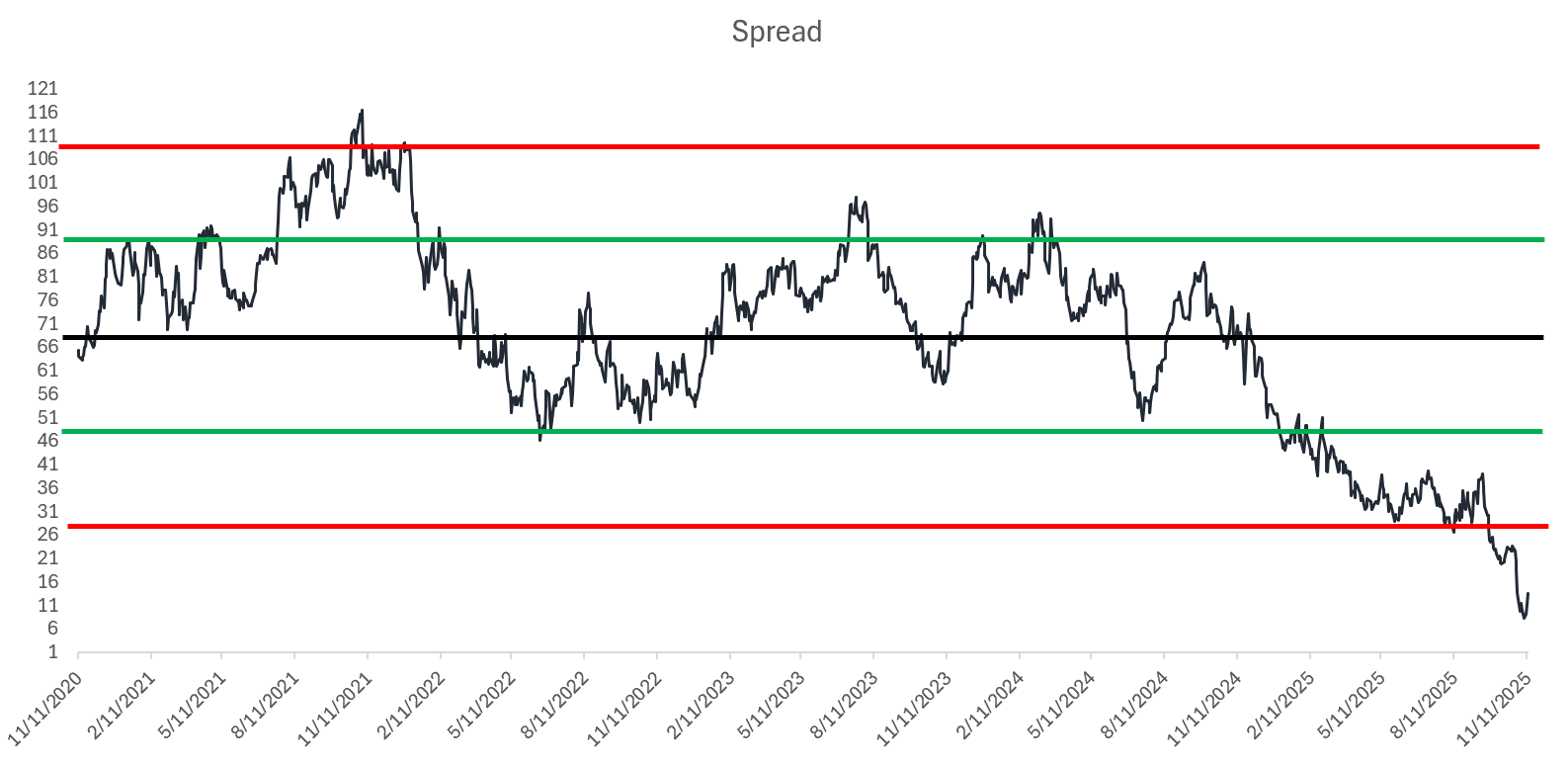

FND - WSM Correlations

Correlations on these two stocks are high on average, though right now they have fallen to a cyclical low, leading us to expect an upswing in the coming weeks and months.

That swing means the two have to converge, given that they are trading at beyond average deviations compared to each other.

And it turns out they are:

Hedge Ratio Spread Between FND - WSM

When we pitched this trade inside our Deal Room, the spread was trading at roughly $12.

Right now it has just crossed $18 for a 50% return within a week. 🔥

A reasonable target, which favors mean-reversion, is of $70-$72 on the spread, so you are still on time to take this idea home.

You can chart it in your brokerage platform as such:

FND - 0.259 * WSM

That will give you a market-neutral position in your portfolio and keep you mostly agnostic to all these VIX events coming into the S&P 500.

There you have it,

Two other ways to keep playing on this consumer discretionary recovery, especially as our main drivers keep playing out in the market:

$DXY dollar strength

Tax refunds coming soon

$60 billion in stimulus coming in the first half of 2026

For first dibs on our next deals delivering double-digit upside in the coming weeks, don’t forget to grab your 7-day free trial to our WhatsApp Deal Room.

To your success,

G 🫰

GO AND MAKE IT HAPPEN

Growth Beyond GLP-1s

Everyone was saying dump and even short shares of Hims & Hers (HIMS).

I’ve always liked this company for its fundamentals, but it recently hit a price I just couldn’t say no to.

If you’re worried that the weight loss segment in this business is going to be an ongoing headache in the future.

I’ve got news for you, Hims & Hers is becoming a national pharmacy right in the palm of your hand.

Here’s my price target and financial breakdown for this thesis ⬇️

To your success,

G. 🥃