- InvestiBrew

- Posts

- 🗞 Real(tor) Talk

🗞 Real(tor) Talk

Will buying $200 billion worth of mortgage bonds help the current housing market?

WHILE YOU POUR THE JOE… ☕️

Trump Orders $200 Billion in Mortgage Purchases, Bloomberg

How does buying $200 billion worth of mortgages affect the U.S. housing market?

As these debt instruments rally, their rates come down by nature, increasing affordability for homes in a cycle where almost nobody can afford to buy a new home.

However,

It’s going to take a lot more than this to kickstart the housing market, and that’s something we should begin looking into before everyone else prices it in. 👀

Today, we’ll go over a few things that matter for this theme, such as:

Construction Spending

Employment trends

Building Permits

And of course, a quick screen for stock selection in this entire theme rotation.

Speaking of housing, let’s get on with today’s email 📧…

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

MONOPOLY MONEY

Ceiling Room

Construction & Real Estate PMI Trends, InvestiBrew

For 8 out of 12 months, both the construction and real estate industries have been in contraction according to the PMI trends.

This is not a momentum play, but rather a massive turnaround for the space as a theme in 2026. 📈

Spotting this turnaround is going to be tricky, but I’ll do my best to provide you with a few indicators and catalysts to look forward to.

Starting with ⬇️

United States Building Permits, InvestiBrew

Building permits, which are now below a long-term balance, are considered a leading indicator for future construction spending and hiring.

The current compression in activity signals a slowdown in spending and hiring, as indicated by the PMI trends noted above.

But,

This also leaves room for a significant expansion to come in, and that’s what I’d be betting on for this space specifically.

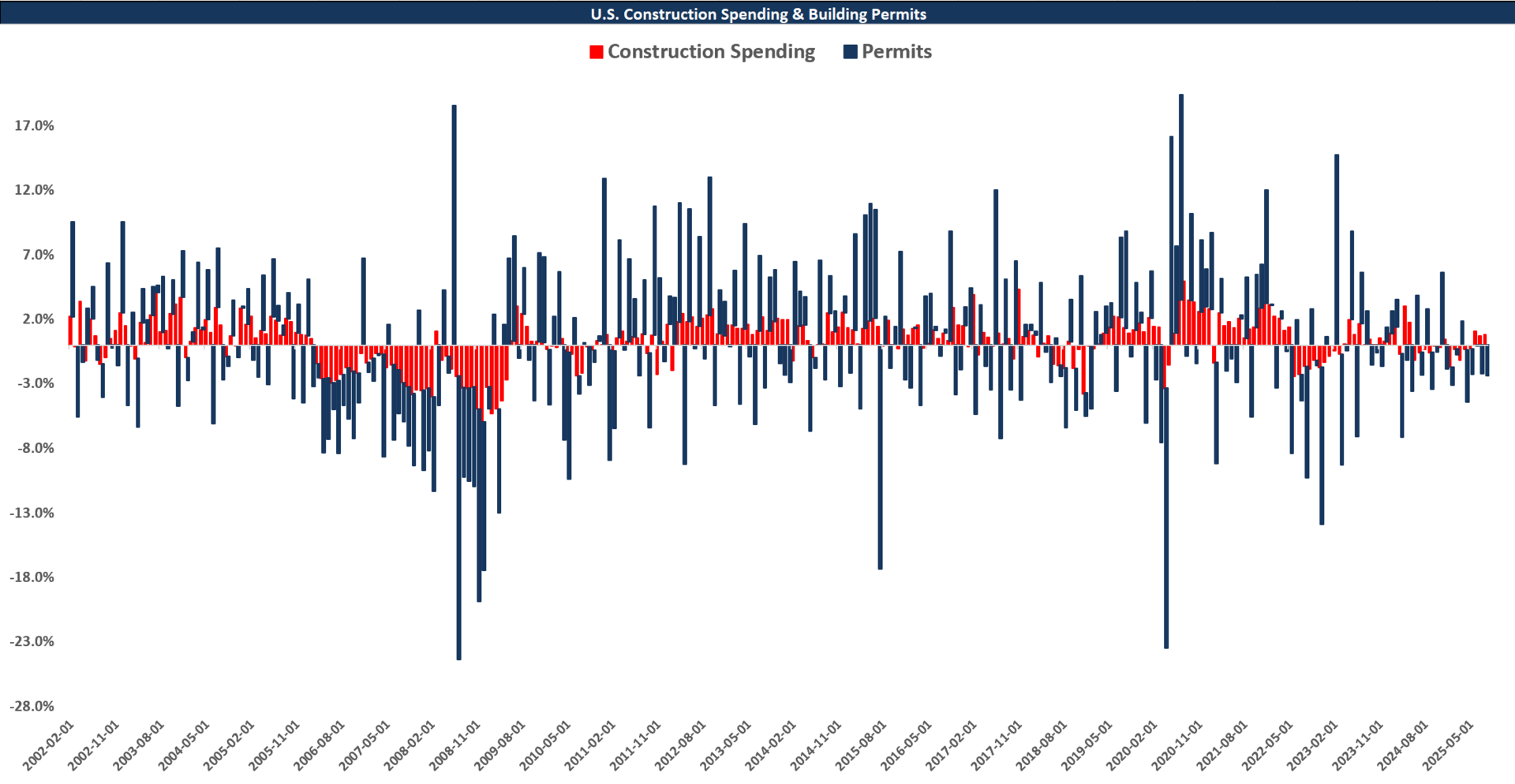

Construction Spending & Building Permits, InvestiBrew

You can see the strong correlation between the two, making the connection a clear line of reasoning.

So, what can turn permits on their head moving forward?

Surely, we need the overall inventory availability to tighten, especially now that we have 50% more housing inventory compared to last year.

If mortgage bonds keep rallying on this $200 billion purchase, lower rates can help us get there.

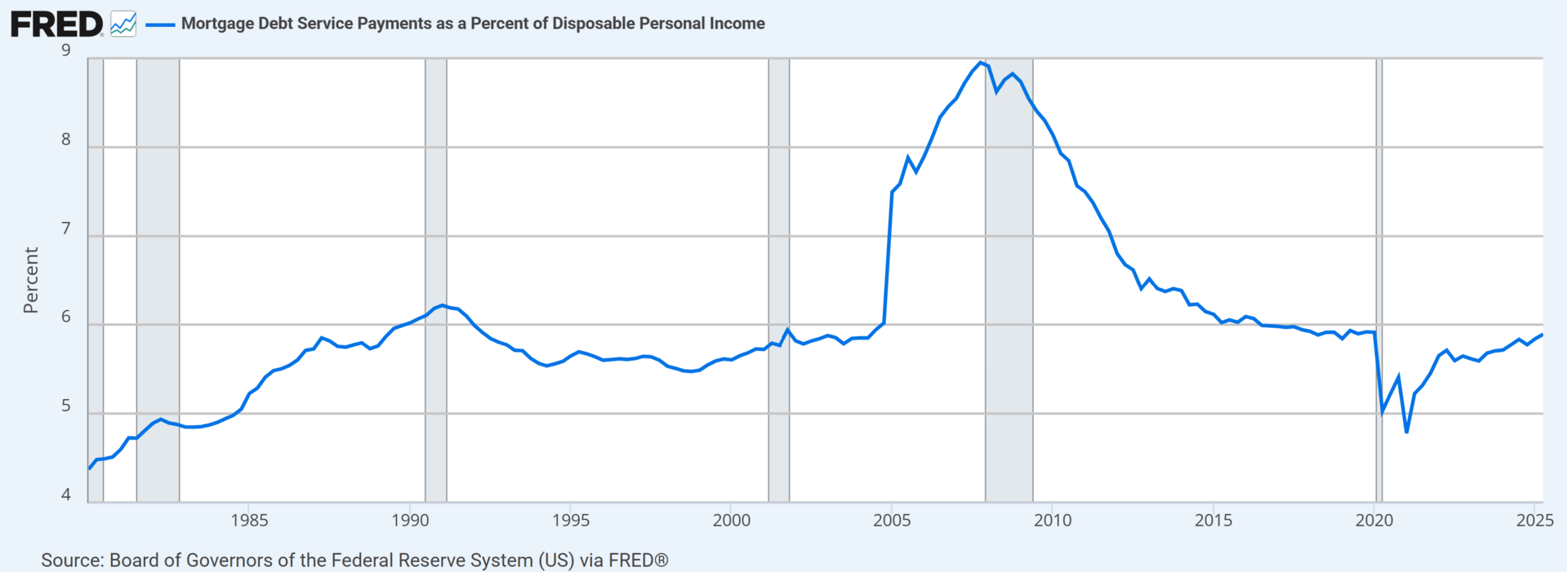

Mortgage Payments as a Percentage of Incomes, FRED

With mortgage payments now making up 5.9% of the average American income, a relatively stable number, the stagnant housing market isn’t so much about payments.

It’s about mortgages being approved, price/income ratios to be precise.

You see, in order to approve a mortgage, lenders in the U.S. typcially need a borrower to make 36% of the loan’s value in annual income.

Let’s do the math here:

The average home price in the U.S. (according to the Fed) is now $512,800

Assuming a 3.5% down payment, the average loan should be of $494,852

Making the required annual income roughly $178,150 per year

Most Americans don’t make this much a year, and the marriage rate in the country is falling off a cliff.

Demographically, we are in an unaffordable market. 🏘️

U.S. Housing Price/Income Ratios, Longtermtrends

Right now, the average home costs 7.0x what the average American makes in a year.

This is the highest ratio in history, meaning homes are no longer considered assets by the traditional sense of the word.

They’re more like debts on the household balance sheet.

So making mortgages cheaper won’t really help.

Not unless prices come down significantly.

Real Estate Industry Comps Spread, InvestiBrew

This is exactly why two industries in real estate are trading the way they are right now.

Development companies call for a premium and an average 66.4% EPS growth rate

Residential REITs have fallen to 84% of their 52-week highs (worst performers) with below-inflation EPS growth rates

The question is, which market is driving these REIT valuations so low, and why is development activity positioned to explode in 2026? 👀

American Homes 4 Rent Footprint, Investor Relations

This REIT, American Homes 4 Rent (AMH), stood out to me in terms of future EPS growth, justifying a forward P/E premium compared to peers.

It’s exactly what I’m looking for in this theme, because:

Generated roughly $1 billion in NOI

Market Cap of property portfolio trades at $13.3 billion

In other words, this portfolio trades at a cap rate of 7.8% (a MASSIVE opportunity).

But,

That’s on the rental side, a perfect way to play this situation in case home-buying activity takes longer to be sparked (considering we still need a significant decline in home values).

Now we know how to make money on the rental side.

How about on the mortgage side?

Blackstone Mortgage Portfolio Exposure, Investor Relations

The Sun Belt region of the United States is experiencing the same issue.

6%+ cap rates.

That makes it a better market for immediate affordability once mortgage rates come down, and exactly why I like the Blackstone Mortgage Trust (BXMT).

It also commands a forward P/E premium, alongside above-average EPS growth in the industry.

Without boring you with financial details, consider the following:

BXMT holds billions in a mortgage loan portfolio

The rally from a $200 billion buying spree will send these up in value

Book value spikes, so does the stock price

Enough said. 🎤

I’ll be sending my deep dives and financial models in a proper portfolio this coming week, giving my Deal Room members a unique advantage over everyone else.

Will you be one of them?

$MELI

$PBF

$TGT

All Deal Room picks up double-digits since our pitch.

7 Days Free, see you inside. ✅

To your success,

G 🫰