- InvestiBrew

- Posts

- 🗞 S&P 500 to $7,000+?

🗞 S&P 500 to $7,000+?

Going against my better judgement here, but we may have a bull market on our hands.

WHILE YOU POUR THE JOE… ☕️

POTUS Every Time Powell Says “We Need More Data”

President Trump just fired the head of the Bureau of Labor Statistics (BLS)…

Why?

Well, ever since August 2024, revisions have been coming in wider and wider for the Nonfarm Payrolls report. I don’t know who they got there running as a quant, but I think a high-school freshman can do better than that…

If anything, it all feels very political, though I have a pretty good idea of why these revisions occurred in the first place:

A widening gap between part-time and full-time jobs.

When seasonal work ends, and those government jobs start to feel shaky, that’s when these revisions start to get worse (we warned about this back in January 2025). 📆

Anyway, I still stand on our last newsletter post about a potential S&P 500 melt-up, only now I have landed on a few other datapoints to support that view.

Speaking of views, let’s get on with today’s email 📧…

P.S.

2025 is probably the last year you will see such easy money being made, and most other furus will disappear as they do every cycle. 👻

The next decade will look a lot different for you, we are entering into a market which can actually fight back.

This is where knowing how to hedge comes in, here’s how I learned the game (a skill that got me into Goldman Sachs) ⬇️

START YOUR ENGINES

We’re 🤏 This Close

Most of you are aware of how obscene some of the valuations in the top S&P 500 holdings have become. 📈

Yet,

You have absolutely no idea what to do about it or how to hedge away from a potential pullback.

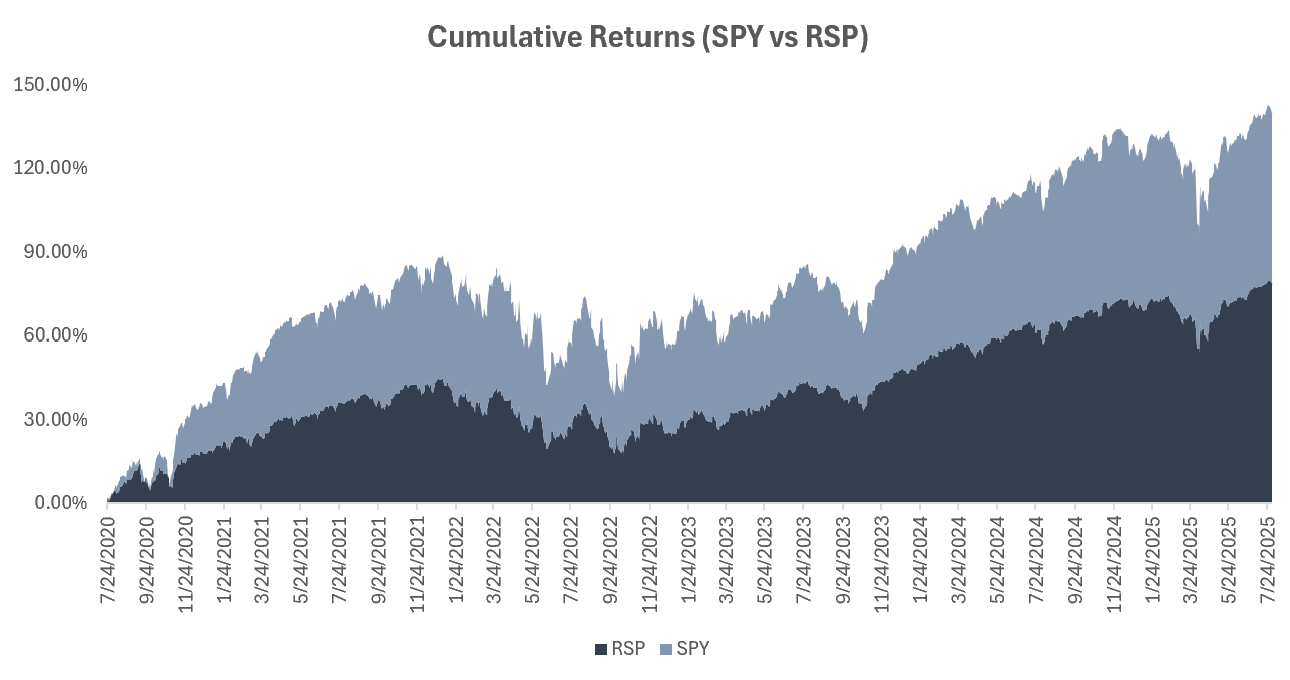

Well, here’s an interesting gap (image above):

The Equal-Weight S&P 500 ($RSP) is now roughly 17% below the S&P 500 over a 5-year cumulative basis

What this means to you is that, if the $RSP starts to break out into new all-time highs, it will likely also push names like $NVDA higher along with the S&P 500. 🔼

But get this…

The outsized returns will actually come from the companies with the not-so-great breadth out there, and those are inside the small to mid-cap areas of the market.

What You Can Do About This

If you’ve been part of our flagship program The Sovereign Trader, then you know what this means as far as spreads and mean reversion goes.

The gap between the $SPY and $RSP is now past a second standard deviation, meaning you can expect some mean reversion to take place here. 👀

Specifically:

Either $SPY needs to pull back harder than $RSP could

Or

$RSP will rally much more aggressively and start to outperform $SPY altogether (over 20% potential returns here)

But that’s vanilla level stuff, you’re here to catch those life-changing plays in the market, and those don’t typically come from just buying into an ETF (no matter how attractive it looks).

Which is perfect, because that’s where our stock-picking process comes in 👀. When I say ours, I really mean what I took from Goldman Sachs and adjusted for a retail trader like myself.

Finding the Underwater Volleyballs

With the exception of that recent pullback, the dollar index has been on a tear since mid-July 2025, and that has a few implications.

If you read our last newsletter, then you are aware of the massive amount of short positions centered around the dollar right now.

And that could quickly turn this into a short squeeze event.

However…

I’m not interested in a currency trade here per say, but rather the effects that a higher dollar could have on this one area of the market: ⬇️

The Services PMI of the United States economy is extremely tied to where the Dollar Index goes, so of course, we will be landing on lots of ideas there. 🧠

Not to mention a couple of honorable areas such as:

Consumer Discretionary

Retail (Focus on Apparel)

By the way there is an entire YouTube video dedicated to how we have picked a Long/Short equity trade within Apparel, goes to show you we’re not your average furu here.

Why retail and apparel again? Well it seems trade tariffs have been pretty much priced in, and not as severe for the space as they once seemed, giving us a shot at profiting there. 💰️

More than that, there is also another major rebound I’m waiting on:

The Manufacturing PMI has been extremely soft for over 24 months now, and I think the dollar + $RSP strength could point us in the direction of some multi-bagger mid-caps inside of it. 🔥

This is where knowing exactly how to break down the data comes into play for you.

If it feels like trading is getting harder…

It’s not just you; everyone is on the same boat

The next decade will chew up traders who only rely on charts and momentum

Genuinely, I believe this is what can help: A real hedging + idea generation system built for markets that actually fight back

Also known as market-neutral Long/Short Equity

(Reserved for hedge funds, until now)

To your success,

G 🫰

GO AND MAKE IT HAPPEN

Keep the Ball Rolling

Do you really think I got into Goldman Sachs by pitching them ICT patterns and other nonsense?

Honestly…

Everything I do stems from years of education for them to even look at me, and then I polished it all in my years working there.

This is part 2 of how you can build a long/short equity idea

Thank me later ⬇️

To your success,

G. 🥃