- InvestiBrew

- Posts

- 🗞 Inflation, The Fed, and AI Reflexivity

🗞 Inflation, The Fed, and AI Reflexivity

Three things are driving markets right now, and I bet nobody has told you what is really going on in each of them, that ends today.

WHILE YOU POUR THE JOE… ☕️

Real Rates (US10Y minus PCE)

The Fed has a tough job ahead in 2026.

Inflation just came in (delayed) at 2.8% for the annual rate, and over the past quarter, it’s been getting hot to get us back near 3% and above.

Here’s what your furu won’t tell you:

Inflation by itself matters very little for Fed rate decisions

It’s more about where real rates are right now in the live markets, where the 10Y bond yield is the better proxy of sentiment.

Adjust that by inflation, and you get a pretty good idea of how much room the Fed actually has.

That’s exactly what we’re going to cover, so let’s get on with today’s email 📧…

MACRO MADE SIMPLE

Recessionary Cuts

There are pretty much three types of rate cuts implemented by the Fed:

Routine cuts

Emergency cuts (COVID, 9/11, etc.)

Recessionary cuts

Right now, real rates are only 1.5% (assuming inflation is actually 2.8%).

Meaning cutting rates when they are already so low has more to do with recessionary cuts than routine cuts; in other words, the Fed has lost control of the market and the economy.

So, where is the recession/emergency nature of these cuts coming from?

AI Stocks Valuation vs Revenue Growth

George Soros gave us a very important piece of advice back in the 1980s.

It was his theory of reflexivity, and I think it applies today more than ever before. By the way, this is always the case when we approach a manic market with no regard for fundamentals…

Most of you think that the value of an investment is the present value of all future cash flows, and while that can make you wealthy in the long run, you first have to be rich.

And getting rich in the financial markets is only achieved by successful speculation.

So in this reflexivity model:

AI names like NVIDIA, Microsoft, OpenAI, Meta are all seeing their valuations fly through what’s reasonable while revenues remain stagnant

This growth is the reflexivity of massive CapEx (in the trillions now)

CapEx is being absorbed by vendor demand (cloud and data center sales)

This feeds further valuations on the expectations that revenue from these vendors will eventually catch up.

That works beautifully, until it doesn’t.

Circular Financing in AI names

The only reason you should expect this to stop working is simple.

Circular Financing must come to an end eventually.

NVIDIA invests in OpenAI, which invests in NVIDIA

OpenAI requires Oracle to develop infrastructure, like data centers

To do this, Oracle needs NVIDIA chips

Reflexivity happens when NVIDIA funds OpenAI’s CapEx, which funds Oracle’s infrastructure buildout demand, which feeds NVIDIA chip sales.

Then it begins again.

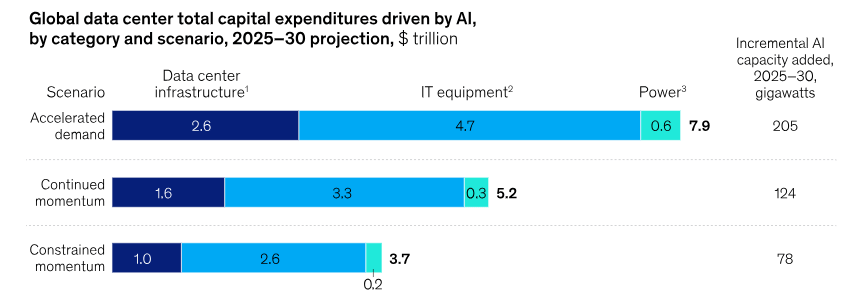

AI Data Center CapEx Forecasts, McKinsey

Going back to reflexivity,

The expectation is that up to $8 trillion will be needed in terms of infrastructure investment to carry out this AI development into fruition.

That CapEx initiates the growth expectations, which are now driving the entire valuation spike in all related names. 📈

So I guess you’re starting to catch onto the trend here…

Should the CapEx growth slow, the Circular Financing theme comes to a halt.

And then we have a multi-trillion-dollar collapse in the system. 🐻

PCE Inflation Trends

Judging by how the Fed is beginning to act, I think this collapse is closer than we all think.

Otherwise, why start cutting into an already low real interest rate environment?

PCE just came out this week (delayed) at 2.8% for the year, which is heating up compared to a six-month trend.

Yet, the real economy feels a lot worse than that; prices are high everywhere and rising much faster than the data seems to suggest.

This is why bonds haven’t rallied, and why the dollar has been channeling for this long despite interest rate moves happening this quarter.

It’s because they’re not routine cuts, they are:

Recessionary / Emergency cuts

If this ends up taking the S&P 500 down with it, then I would agree with the following ⬇️

10-year Equity Market Return Forecast, Goldman Sachs

The market is set up for a lost decade scenario, Goldman Sachs pretty much just said.

Expecting to see 6% returns over the next 10 years, the S&P 500 is barely going to give you anything above inflation.

Which could be trending back above 3% soon.

Anyway, you now have two choices:

Underperform and find yourself short on real gains when it’s all said and done.

Or

Get good at finding alpha in what’s going to become a near-impossible market

$CHWY DCF Valuation Model, InvestiBrew Deal Room

Chewy stock just fell to 68% of its 52-week high, and based on our analysis, it could deliver up to 23% returns on an annualized basis over the next five years. 🔥

However, not at today’s price.

The entry I just gave my Deal Room members is much more attractive, based on order flow levels, and of special interest to some 13-F players out there.

In your 7 Day Free trial, you can access this deal and a dozen others we are putting up this week to help you outperform the S&P 500 in this terrible outlook.

Here’s exactly how this hated stock can make you just a bit richer ⬇️

Subscribe to the Deal Room (or miss this opportunity)

Deal Room members typically end up with 10X their first membership fee, before it's even due

Already a paying subscriber? Sign In.

Subscribing can significantly boost your returns every single month :

- • Access to all my financial / valuation models

- • Trade management with tailored advice to your position and account size

- • Goldman Sachs research quality right in your pocket

- • Access to a live community to discuss and even pitch ideas of interest