- InvestiBrew

- Posts

- 🗞 The Best a Trader Can Get

🗞 The Best a Trader Can Get

A 10 minute breakdown of how Goldman Sachs traders reign in the big bucks, all in one idea.

WHILE YOU POUR THE JOE… ☕️

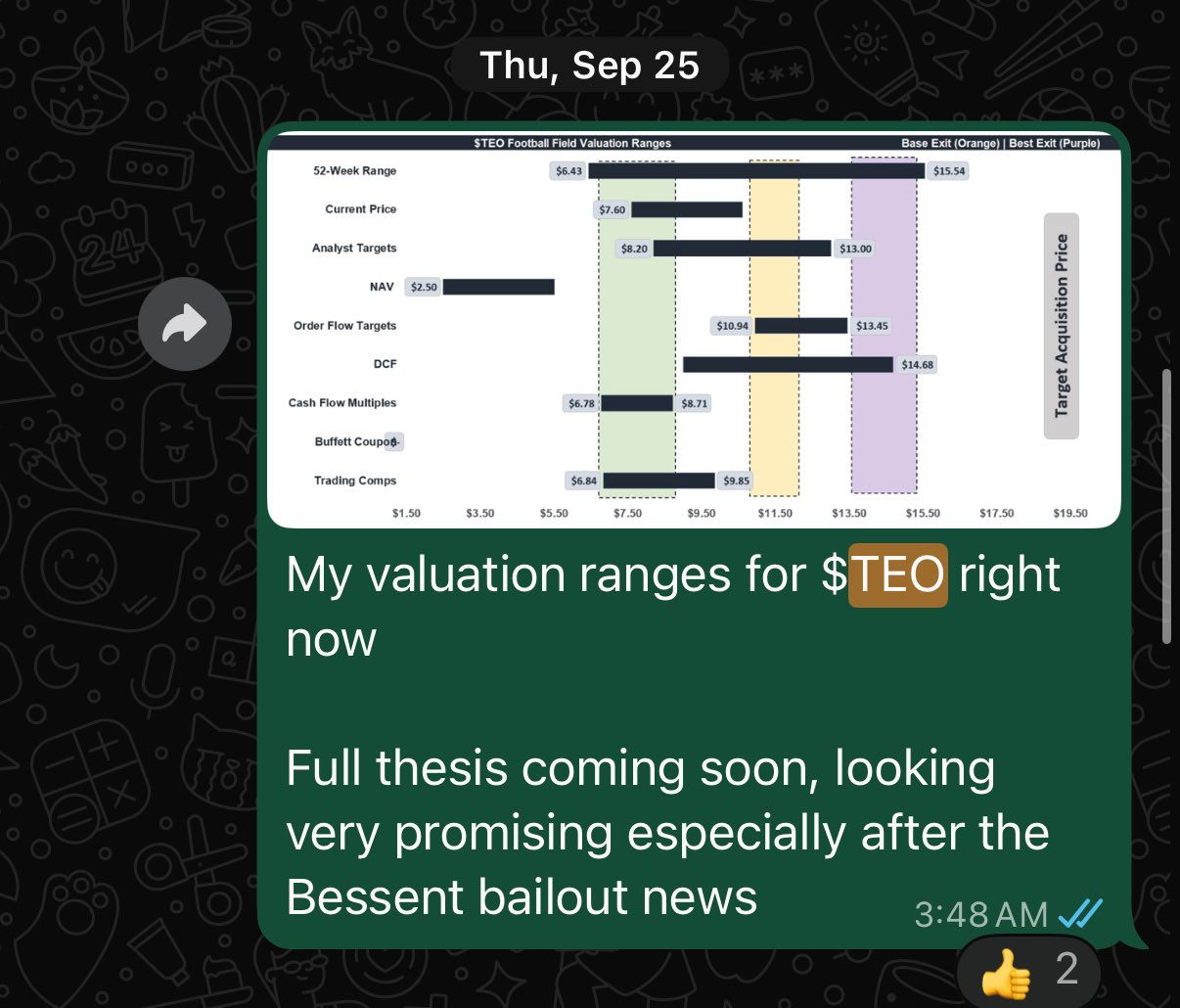

Conversation posted from the WhatsApp Deal Room

A couple of weeks ago, shares of Telecom Argentina ($TEO) rose by over 40% in a single day. 📈

Did we expect a payout this quick? Hell no.

But,

We knew that this was a company that promised this sort of upside based on how cheap it traded compared to its asset base and profitability.

That said, our full valuation model was sent out to our WhatsApp Deal Room members at $7.00 per share.

Anyway,

You can grab 7 days free right here to get access to our past deals as well as what we’re buying and selling inside the InvestiBrew portfolio.

Speaking of what we’re buying and selling, let’s get into today’s email 📧…

IDEA GENERATION 101

Let’s Start Drilling

Manufacturing PMI Commentary Segment

How does a Goldman Sachs trader think about idea generation?

Knowing that this is the most important part of the job, it’s something you guys are missing out on most of the time, because you either:

Rely on someone else’s idea

Or

Use systems that aren’t scalable or reliable (such as technical analysis)

While others look at the past and hope it repeats, here’s how professionals make money by betting on the future. 💵

OEM Breakout

From the commentary section above, we can see that the aerospace and automotive industries are the primary drivers of demand exceeding budget and capacity for the Fabricated Metal Products business.

So, that’s one signal you can take away into your drill-down to find a potential long or short idea.

Let’s do that ⬇️

Retail Sales Data, U.S. Compiled by InvestiBrew

Examining how these OEM dynamics may be affecting specific companies, retail sales data proves useful in identifying this trend.

Specifically:

Motor Vehicle & Parts Dealers reporting a consecutive quarterly expansion in sales

This healthy demand trend can be due to a few things, but most importantly tariffs on new vehicles (as most are still assembled outside the United States).

So, if new cars aren’t being sold as much, what happens to the average used vehicle owner? 🤷♂️

They need to step up their care and maintenance, don’t they, and that is exactly where we can connect the dots on this bullish theme in the OEM and car parts space.

PMI Industry Data, Compiled by InvestiBrew

When you drill down to industry dynamics, it’s clear that the transportation equipment and fabricated metal products are the ones delivering on both sustained growth and breakouts in expansion readings.

This is always a good trigger for major buyers to enter the market. Remember, the pros ALWAYS deal with these sorts of signals. 👀

Monthly Miles Driven U.S, FRED Data

Another example of where the care/maintenance demand can come back into the industry is a healthy rebound in miles driven per month in the United States.

More miles = More maintenance demand (obviously).

Let’s go a bit deeper into what’s happening in the space, now that we can justify a bullish bias on it:

Comps Data for Automotive Stocks, Compiled by InvestiBrew

Finding the outliers on a factor driver basis is the next step in your idea generation, and probably one of the most important ones.

Why?

Most of you are taught this the wrong way:

Don’t buy “expensive stocks”

Don’t short “cheap stocks”

And that’s just not how the business works if you’re a trader.

So, let me show you how Goldman Sachs traders look at this common misconception in the stock market.

On Day #4 of this free 5-day email crash course, you will be armed with all the tools needed to come up with professional trade ideas like this one.

If you’ve been through it already, feel free to email us back your latest idea, we’d be happy to give you some feedback.

Anyway, these are my bullish outliers:

Modine Manufacturing ($MOD)

Advance Auto Parts ($AAP)

Valvoline ($VVV)

But only one really caught my attention here, and that’s Valvoline. ✅

Valvoline Wall St. Estimates, Data by Koyfin.com

Valvoline trades at a forward P/E premium for a reason, and it’s because markets expect it to deliver above-average growth rates compared to its peer group.

Even then, a forward PEG ratio of 0.6x suggests up to 40% of future EPS growth is not yet priced into the stock.

Some fundamental points I’d like you to note:

Valvoline just expanded into fleet services for transportation trucks and buses

And as you know from this newsletter, trucking is one industry we turned bullish on last quarter.

However,

We can’t just buy Valvoline and call it a day, what if we’re wrong on November 19th when the company releases earnings?

Here’s a great way to hedge this buy in a major steel company going ex-growth (just another way to play the tariff environment). ⬇️

Comps Data for Steel Makers, Compiled by InvestiBrew

Following a strong run in Cleveland-Cliffs ($CLF), I believe there’s now a great opportunity to screen for steel shorts that may be nearing ex-growth.

Such as ArcelorMittal ($MT).

Below-average EPS growth

Forward P/E discount justified

2.6x forward PEG suggests overvalued

The reason why this stock is below average is simple: They are heavily exposed to both EU and China, so tariffs are going to wreck their margins potentially.

They actually already have: ⬇️

Financial Comps Data, Compiled by InvestiBrew

Notice $MT has the lowest EBITDA margin in its group at only 8%.

This is not favorable for an asset-heavy company like ArcelorMittal, which may explain the -8% consensus view among Wall Street targets.

When it comes to discounts, this stock is also discounted on an EV/EBITDA basis as well, so I think this short candidate makes sense so far.

Now for Valvoline:

75% capacity utilization, more than enough room to ramp up as miles driven come back and maintenance demand spikes

Highest EBITDA margin, making for EPS upward surprises coming up

P/FCF has a massive premium based on these high margins and future growth expectations

Setting Up The Trade

Rolling Correlation Matrix, VVV vs MT

Surprisingly, these two stocks are correlated enough to create a convergence expectation.

Fundamentally, this could be because of the relationship between steel demand slowdowns (from car manufacturing) and the increase in care/maintenance demand (as used vehicles make up a larger share).

VVV - hedge ratio * MT, InvestiBrew Proprietary

Considering how far away these two stocks are right now, this correlation shift is going to come in handy for a convergence back to the mean.

You can spread this trade on Thinkorswim as follows:

VVV - 0.72 * MT

That decimal is the hedge ratio for this trade, and it’s the key ingredient to putting on market-neutral portfolios that aren’t affected by what the S&P 500 chooses to do on a given week.

By the way, we show you how to come up with that number and model up your trades by the end of our free 5-day email crash course, so make sure you grab a copy.

We are looking to enter this spread at the $2 level (just hit in yesterday’s session), and a reasonable exit at the $15 mean value.

That’s a multi-bagger in the making in case you haven’t noticed. 🔥

Valvoline Volatility Analysis, Compiled by InvestiBrew

This is our version of technical analysis, which is mainly focused on timing tools like volatility.

Currently, Valvoline’s volatility has contracted enough to provide a breakout setup, and this breakout is expected to occur by November 19th, which is the company's earnings date.

Valvoline Volume Profile, Thinkorswim

One last check before we go…

Valvoline now trades at a major volume cutoff for the year, meaning traders have little interest in conducting business at these levels.

So, chances are we’ll see prices rotate back to a point of control, which is $35 first.

Break that, and we've got ourselves a $42 per share level, which is exactly where Wall Street analysts see the stock going. 📈

Coincidence? Not at all.

You can get to where analysts are getting to before they even think about it, but only with the right tools at your disposal.

So let’s take the weekend to hop on a call together and discuss our flagship program, The Sovereign Trader.

If we’re a fit for each other, you’ll be an unrecognizable money machine in six months.

See you in the next issue!

To your success,

G 🫰

GO AND MAKE IT HAPPEN

Welcome to Brazil

In our last newsletter, we mentioned that Goldman Sachs had turned bullish on Brazilian stocks.

So I pitched my favorite pick in energy there, and it’s up 15% since (our WhatsApp Deal Room members can attest). 🔥

But if there’s one trade that keeps me up at night, it’s my AI short through Taiwan Semiconductor. 🐻

So, I made an entire video for you to really understand what’s behind this trade, and how you can get a better night’s sleep if you went short with me ⬇️

To your success,

G. 🥃