- InvestiBrew

- Posts

- 🗞 The Big 3 Bull Horns

🗞 The Big 3 Bull Horns

Bulls have 3 tricks up their sleeves this summer, don't leave any more money on the table.

WHILE YOU POUR THE JOE… ☕️

Most of you are focused on the biggest stories in today’s market, and I can’t blame you.

While there is a lot of excitement in the technology space, be it AI or else, I think there is one little corner being too forgotten for its own good. 📈

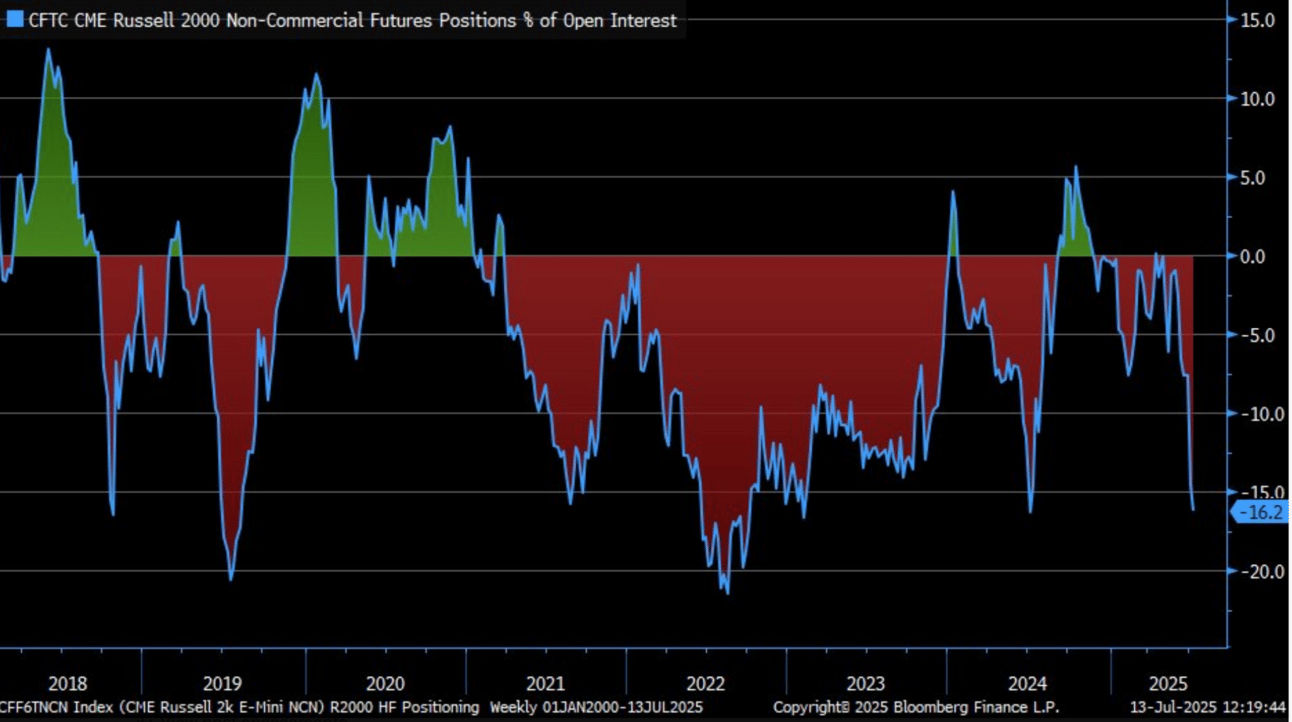

As you can see, the current level of short positions in the Russell 2000 (small caps) has reached a deviation typically warning of a big turnaround in the future.

If history repeats itself, I will become a happy camper, since most of my long ideas are focused on small to mid-cap companies with the right components of a breakout.

Zooming out, there are a few narratives in the market that may make this rotation a reality. 👀

Speaking of where I focus my trade ideas, feel free to join this free 5-day email experience where I walk you through how (and why) I developed this approach.

On that rotation note, let’s get on with today’s email 📧…

SPREAD THE MARKET

The Real Cheesecake

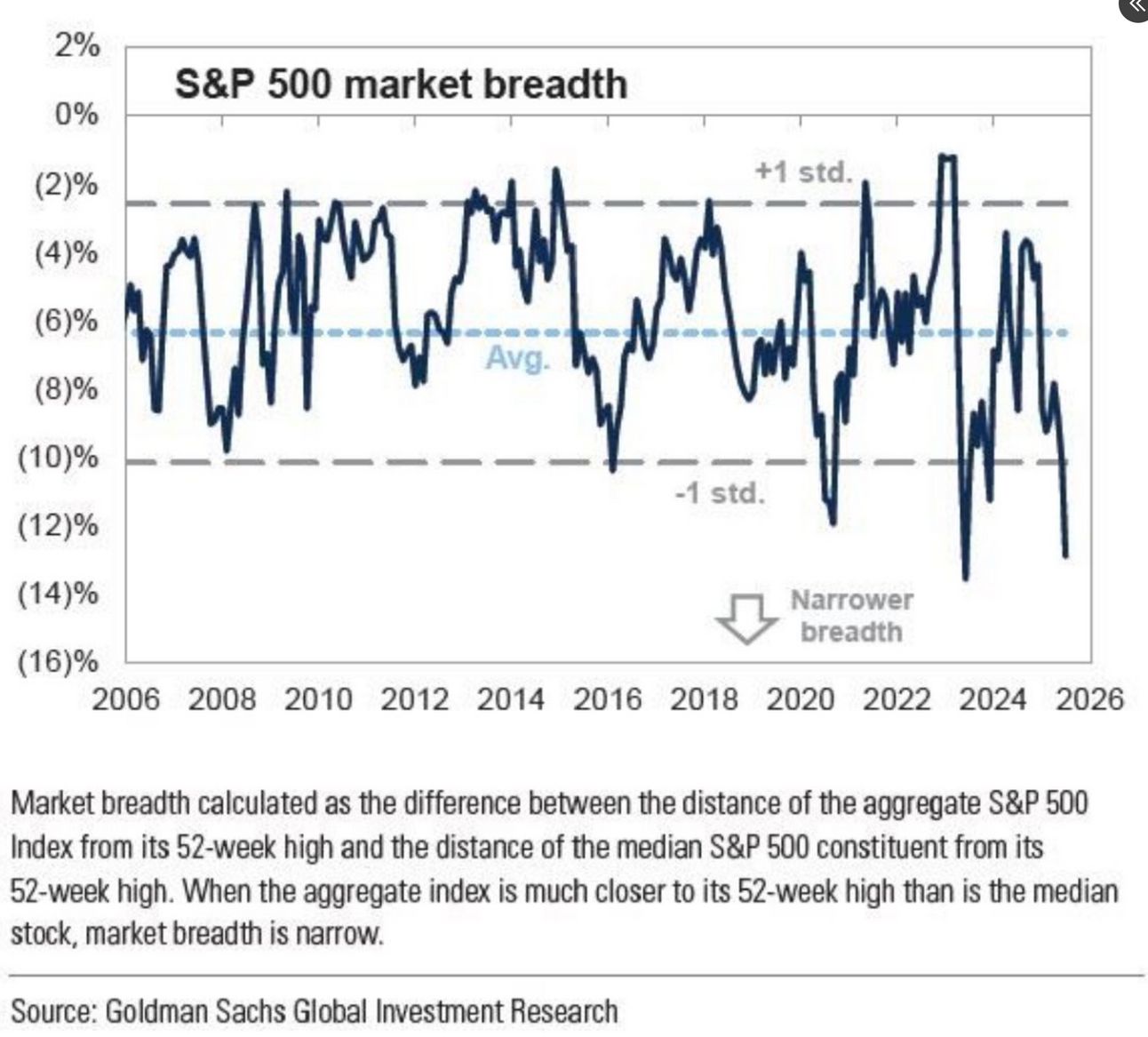

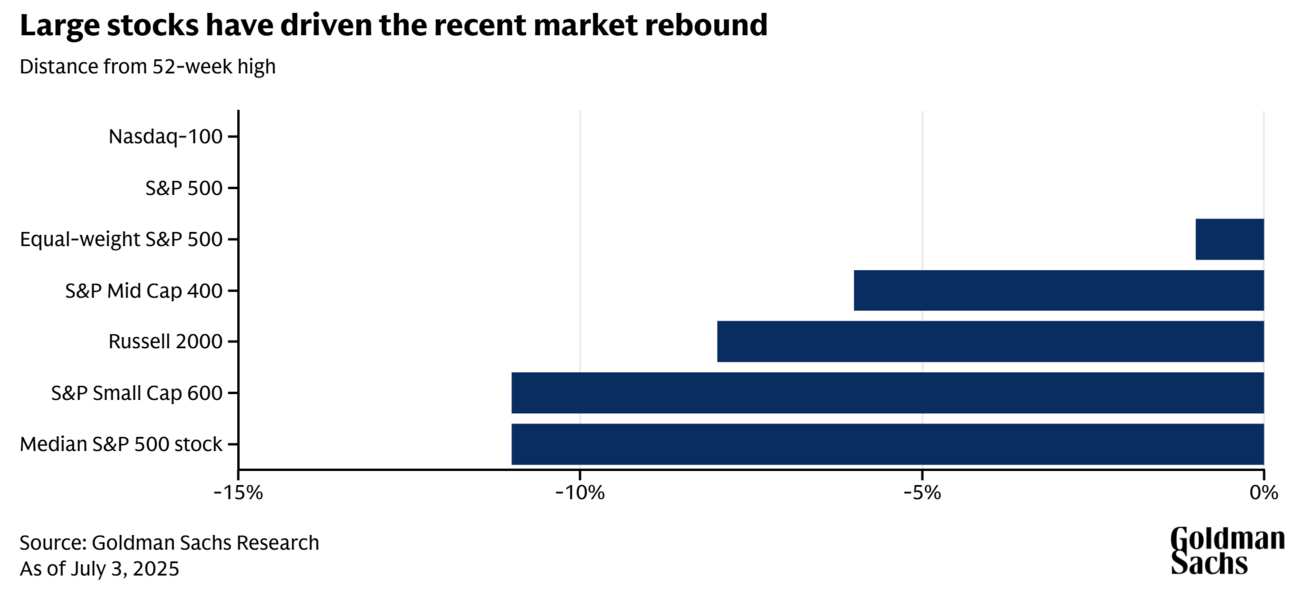

Here’s a gentle reminder of just how overextended the S&P 500 has become recently.

According to Goldman Sachs, the stock market doesn’t really reflect the overall performance of its constituents, which makes sense since we are now at the most overconcentrated market we’ve been in the cycle. 👀

In other words.

While the S&P 500 is making new highs, it is likely due to the mega cap names, while everyone else keeps struggling to catch up.

Enter Narrative #1

The market is now betting that the Fed could implement up to three rate cuts this year (Goldman Sachs is leading this bet).

The reason is that inflation, while still a risk according to Powell, likely isn’t going to be enough to keep rates as high as they are.

Think about it. ⬇️

We’ve had pretty much three whole months of tariffs and have yet to see the effects of the catastrophic inflation the media told us to expect.

And yet, consumers are spending way less. 📉

Just look at how badly Amazon’s Prime Day event did, and you will see just how depressed the US consumer really is today.

Now here’s what I think will happen if the Fed ends up cutting interest rates this year.

No, it’s not bonds, we’ve been over it and some of you are looking for something a bit more aggressive and medium term, so here we go.

Narrative #2

You have seen Bitcoin get to a new all-time high price over the weekend, and if there is any gauge to show you where risk assets are headed, Bitcoin is the best one. 🪙

However, why would risk assets start to rally when the US consumer and the economy itself are in the toilet?

Well, I think I figured out why…

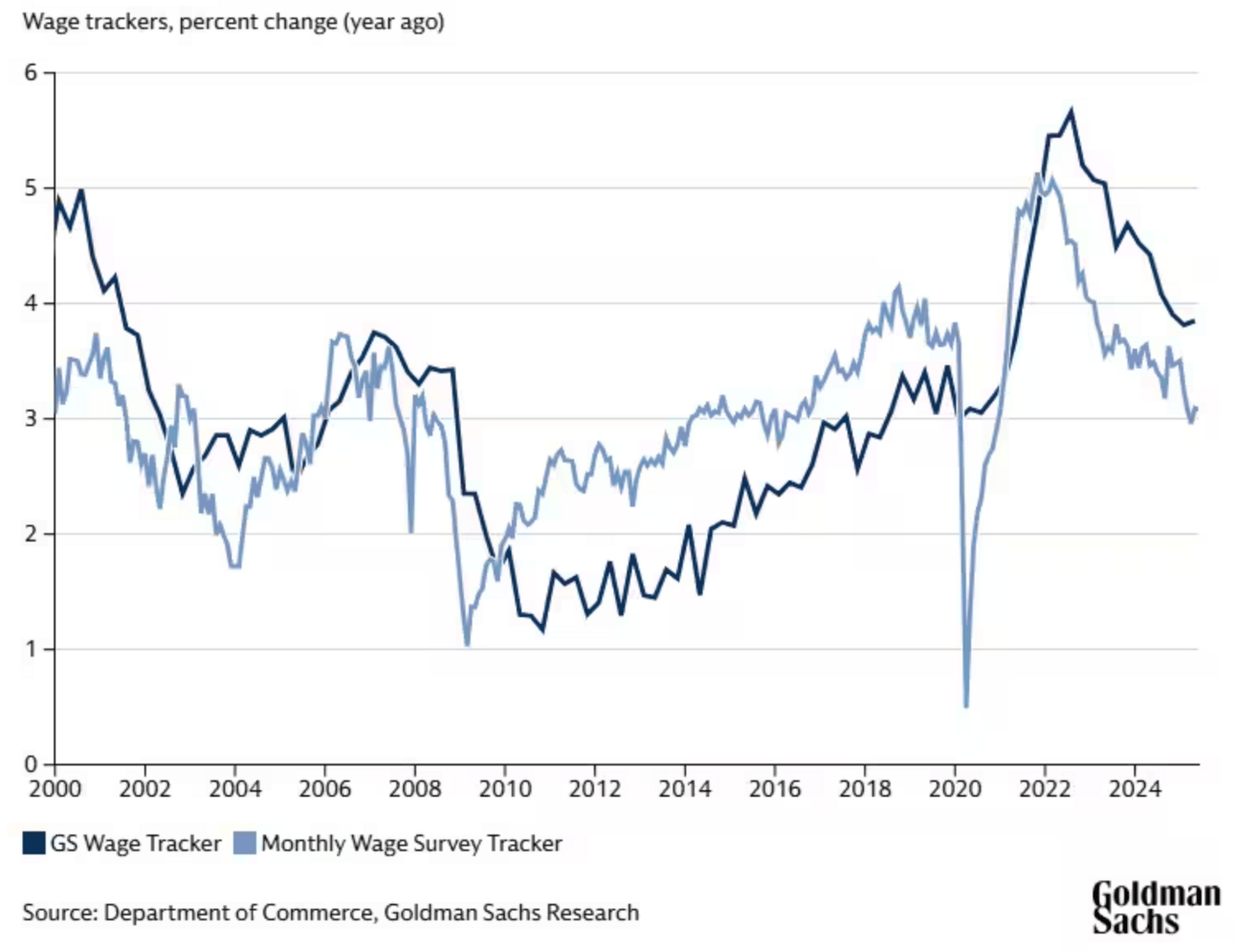

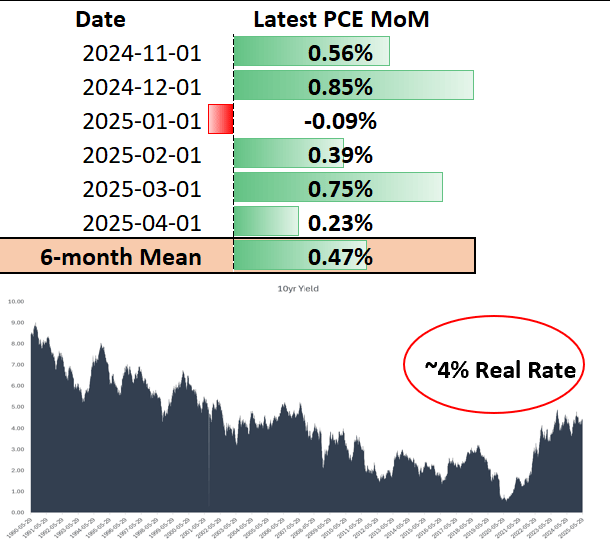

Real rates are going up, by this I mean where the ten-year bond yield is minus the inflation averages.

Now if we take the past 6 months of PCE data, our average is 0.47%, meaning we could get roughly 5.6% inflation for the year.

However.

When we take the recent data into account, this 0.23% reading, we could see the median rate of inflation come down faster than expected, bringing real rates high enough for the Fed to truly justify a cut.

In this sense, risk assets are excused to make a new bull run, maybe why Bitcoin is already taking the lead.

Now here’s what I think will happen for the broader small cap sector when and if these real rates give the Fed the room it needs.

Narrative #3

Where could a rebound from mid to small caps come from?

Debt. 💵

That’s right, companies in this size bracket typically carry more debt than your average large or mega cap company. Which means they are now carrying the burden of higher interest payments due to where rates are today.

But, that also means they will be paying less (a lot less) in interest expenses when and if the Fed decides to cut. 📉

This is huge.

It can open up a massive margin expansion in the right sectors.

That leads to significantly more EPS.

Stonks go up.

Now this is where it gets tricky.

You don’t want to simply spread your bets at random within the mid to small cap space, you need a system to drill down to where the volatility is.

Which is exactly what we teach our analysts inside The Sovereign Trader Program.

And that is where we’ll meet next time, picking the right place to begin searching for high-debt companies with tons of upsdie. 🎯

Past Winners

Remember our pitch for Advance Auto Parts?

Yep, this was part of a whole tariff breakout trade in a high-debt mid cap company like this one.

Guess what?

Over 100% returns in a quarter, that’s on top of all the other gains we’ve given you in our long/short picks as well. 🔥

To your success,

G. 🫰

GO AND MAKE IT HAPPEN

No Shortcuts

I understand most of you are skeptical about our program, and that’s fine.

But, as you will 100% find out, we are the only ones training you on this type of information, there are truly no alternatives unless you actually go work at a bank or hedge fund.

However.

Some books, such as today’s book recommendation 📖 can give you a high level exposure into what it is that we do here.

To your success,

G. 🥃