- InvestiBrew

- Posts

- 🗞 This Week's PMI Tell: Why We're Buying Energy Stocks

🗞 This Week's PMI Tell: Why We're Buying Energy Stocks

Here's what nobody will tell you about the PMI numbers we got on Manufacturing, and how this insight can lock in new profits for you.

WHILE YOU POUR THE JOE… ☕️

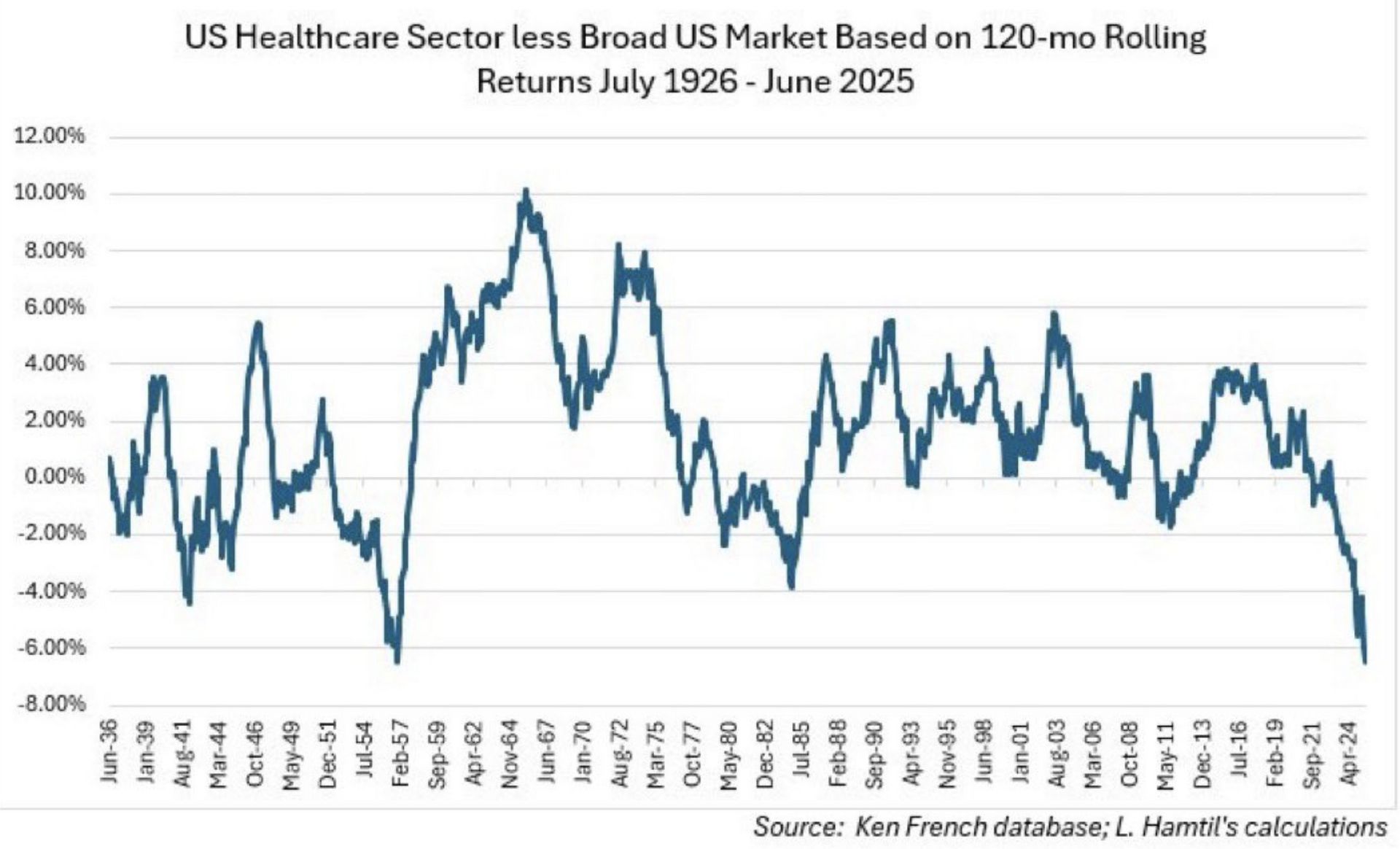

Healthcare stocks have collectively fallen behind by a margin not seen since 1957.

I think I know why this is:

The GLP-1 weight loss fiasco is affecting most in the industry

However, not all healthcare stocks are created equal, as they are not all affected by this bearish theme. 📉

To which I want to say, buckle up, because we've just found a company that could deliver returns anywhere from 50-150% above its current trading value. 🔥

I just pitched the entire deal (financial models and all) to our Deal Room members in WhatsApp. By the way, the stock is already up near 5% since it was sent.

Don’t miss the next deal, join the InvestiBrew Deal Room today ✅

In other news, I seriously think you should be exposed to some energy names right now before it becomes obvious to everyone else.

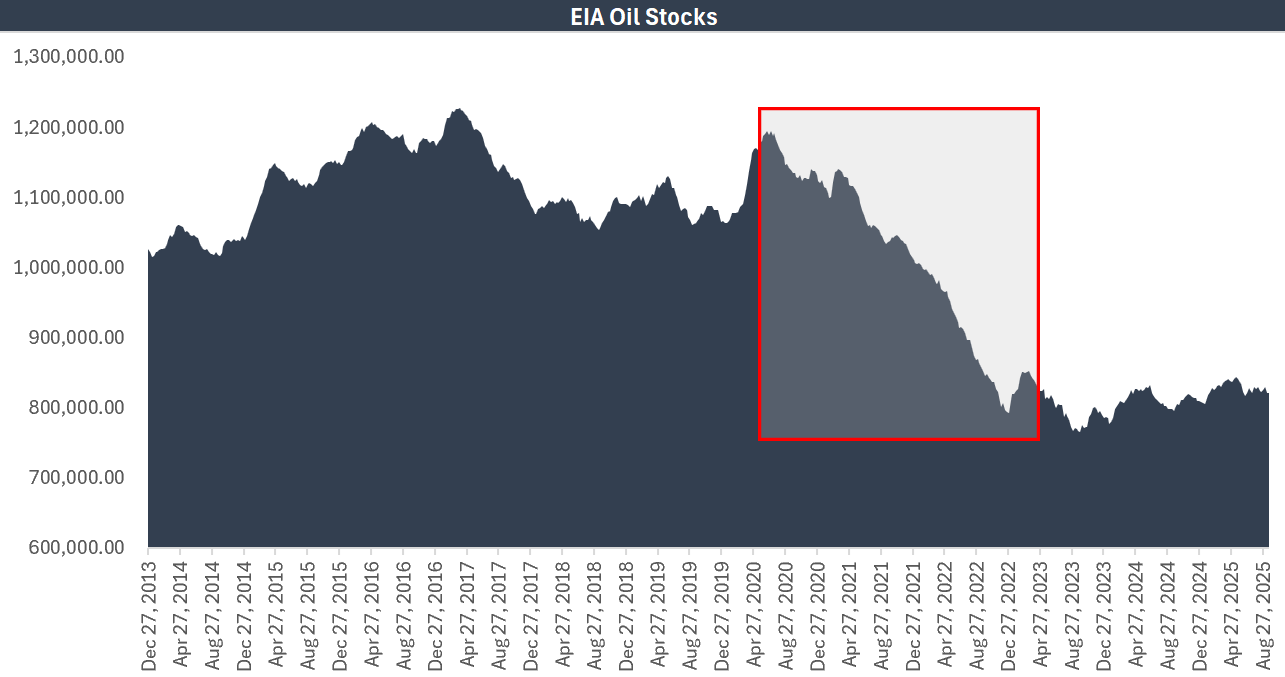

You see EIA crude oil stocks being drawn to the lowest level in over a decade, and yet oil prices refuse to break above $70 per barrel. 📈

With the “One Big Beautiful Bill” now in effect, and a lot of other tailwinds in the materials and commodity spaces,

Not to mention inflation,

This bottleneck could very quickly turn oil back to $100+, where picking the right stocks will be your saving grace.

Don’t wait until we pitch those individual names. By Day 3 of our free 5-day email crash course, you will have enough information (and resources) to come up with these ideas yourself.

Speaking of oil stocks, let’s get on with today’s email 📧…

ZOOM IN

Suddenly, You Wake Up in Trader Heaven

Watching charts and prices fluctuate all day can be time-consuming.

But breaking down the real data and what it means in terms of opportunity, well, that’s just time well-spent.

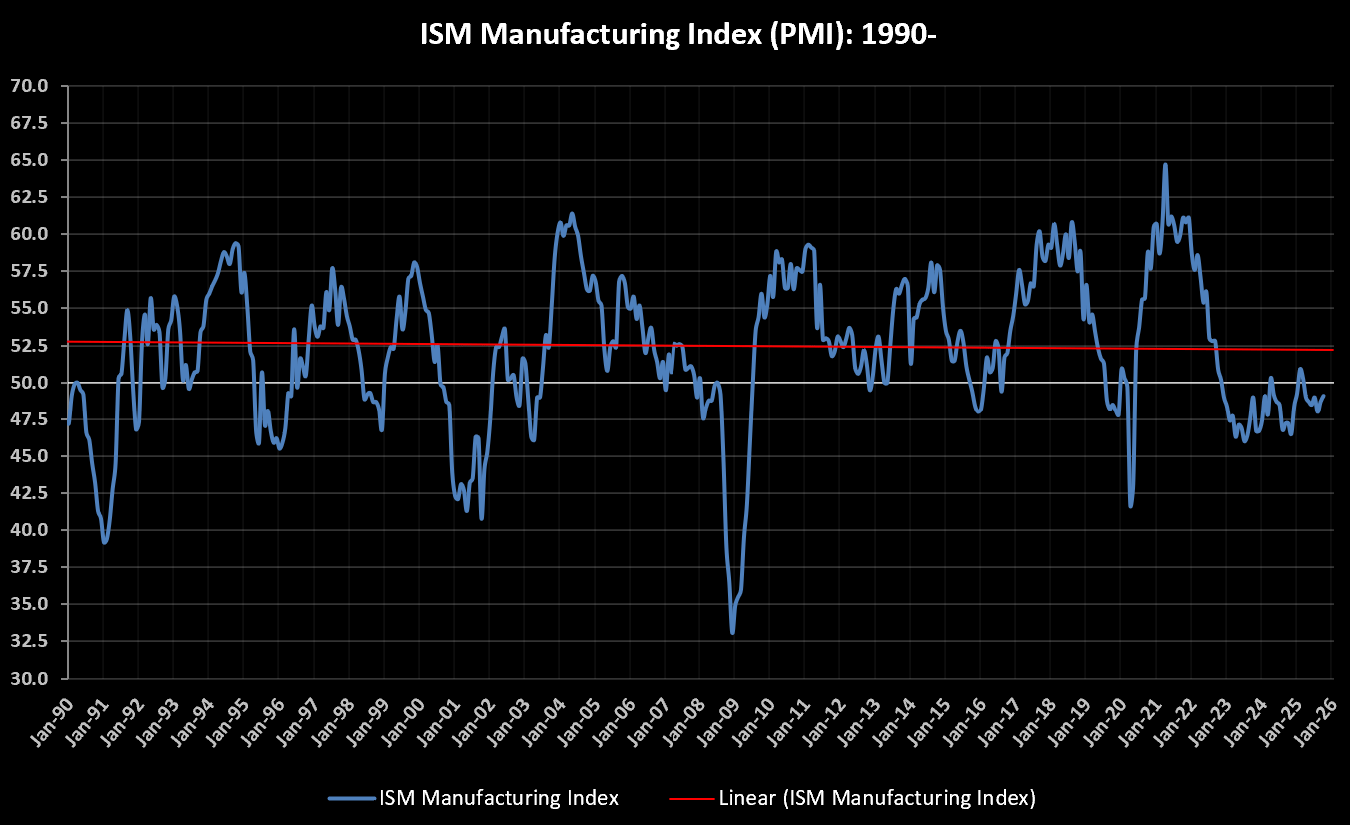

We received the Manufacturing PMI report on Wednesday, and most traders would likely focus on the headline reading of 49.1% and call it a day.

“PMI contracted, I guess I will short $SPY”

I’ve been there, but I have also come a long way from that dark place.

That being said, let me show you how a Goldman Sachs analyst breaks down one of the most important macro series in the stock market. ⬇️

“Your Best Bet This Year”

This marked the 8th consecutive month of contraction in the manufacturing sector. 📉

If it weren’t such a small (18-25%) player in US GDP, that would be extremely bad news, but hey, this doesn’t mean we can’t use it to find great ideas.

With a 49.1% reading, it’s definitely not expanding.

But,

There are a few exceptions to this:

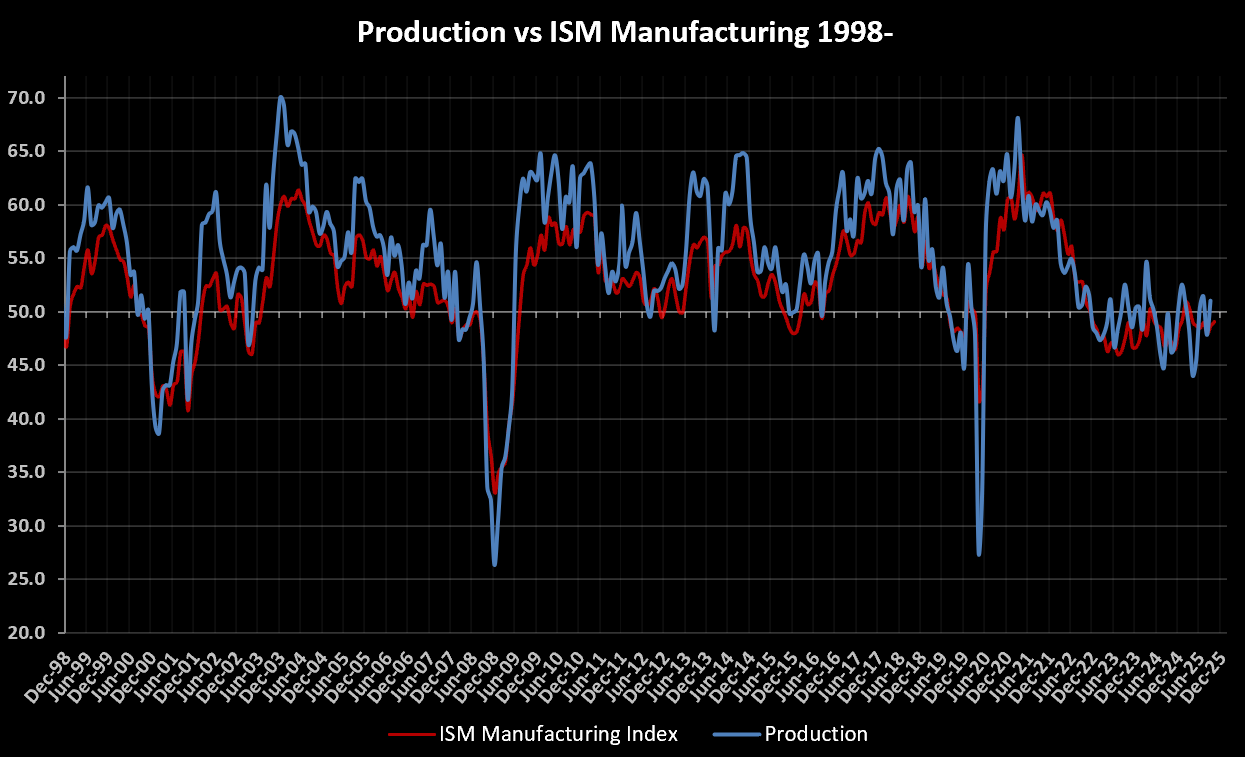

Production did expand unexpectedly to 51% from 47.8% last month, and while it isn’t the biggest delta, it still signals something is happening behind the scenes.

Something like end-of-year restocking, or simply a reaction to tariffs or rate cuts.

However,

When you look at what happened next, I think this is all happening to get businesses and consumers out of being completely choked out on costs ⬇️

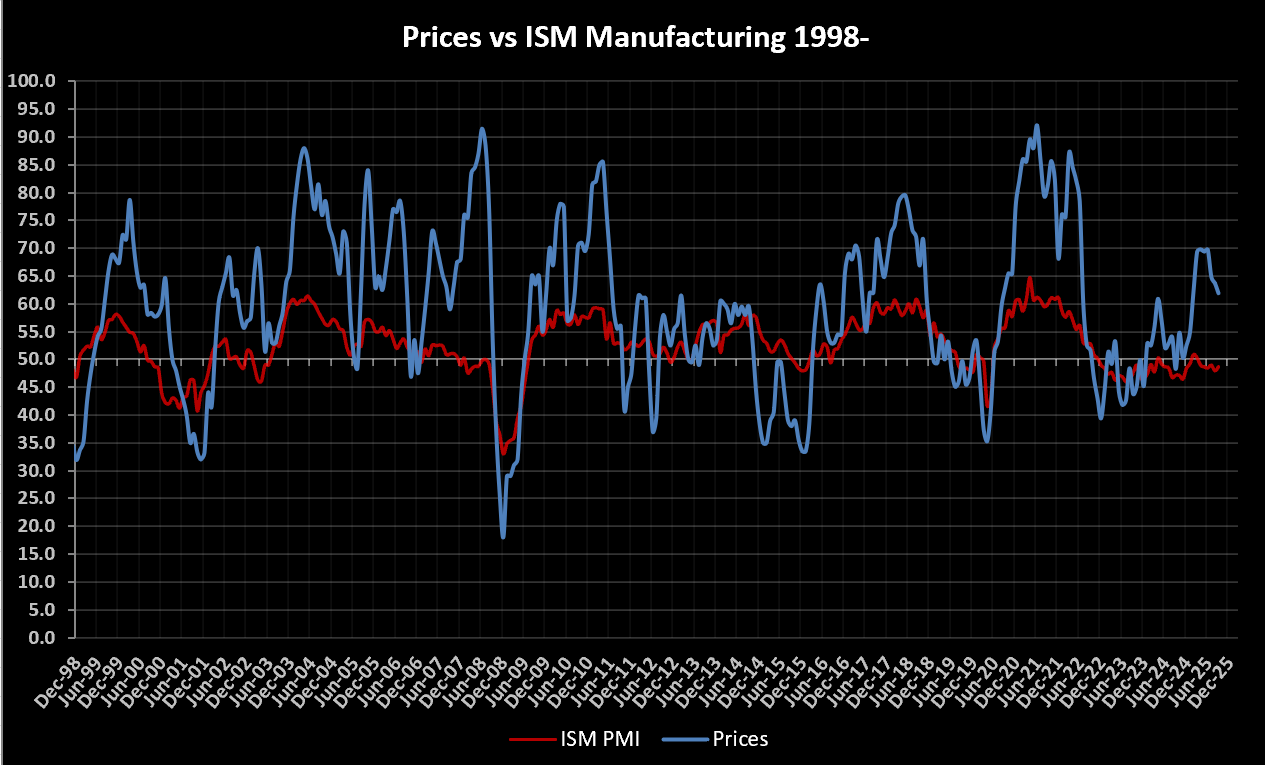

You see, prices are still rising above 60%, which means inflation is definitely not something that’s going away any time soon.

More than that, New Orders also contracted this month, sending the manufacturing sector straight to stagflation territory.

A quick fix would be to see the rising demand in certain industries which aren’t really prepared for it, since high costs have driven inventories lower and lower.

That’s a bottleneck tail risk we spotted in these two industries:

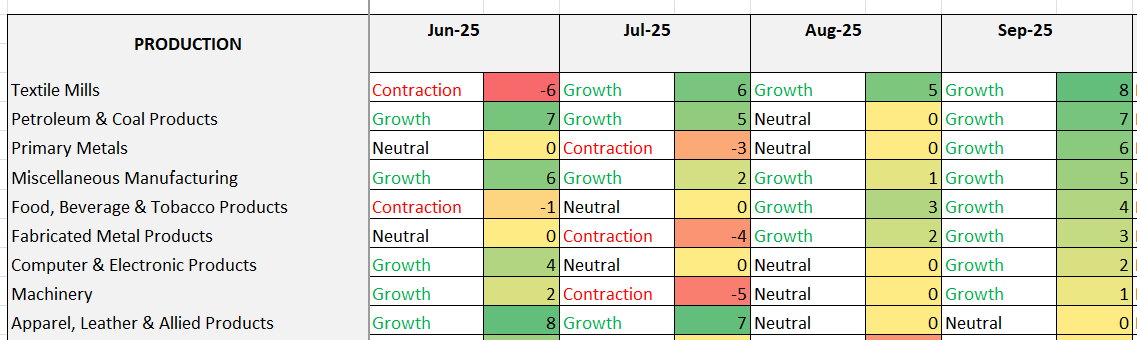

Primary Metals, Petroleum & Coal Products.

These two had the biggest change in production readings month over month, which comes as a welcome surprise. 🎁

By this, I mean we now have a better understanding of where the real business activity is in the sector and where a potential EPS expansion scenario could occur. 📈

That means a profitable opportunity for you and me.

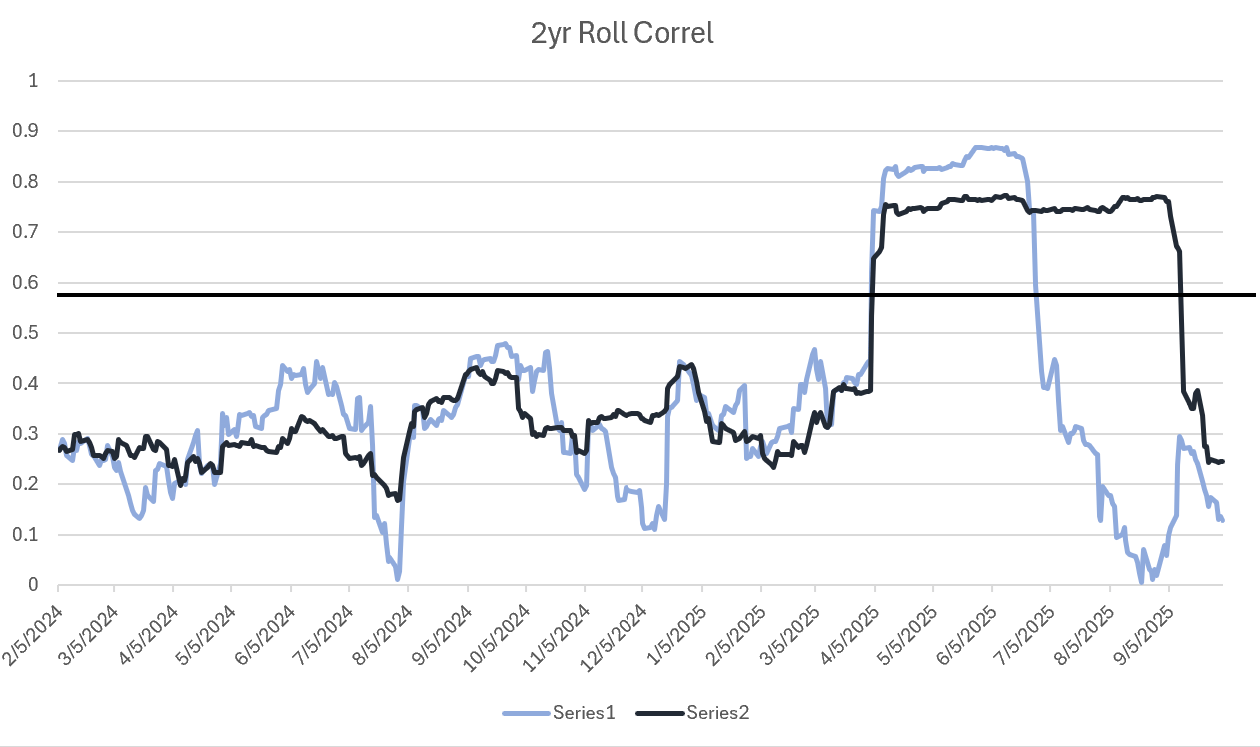

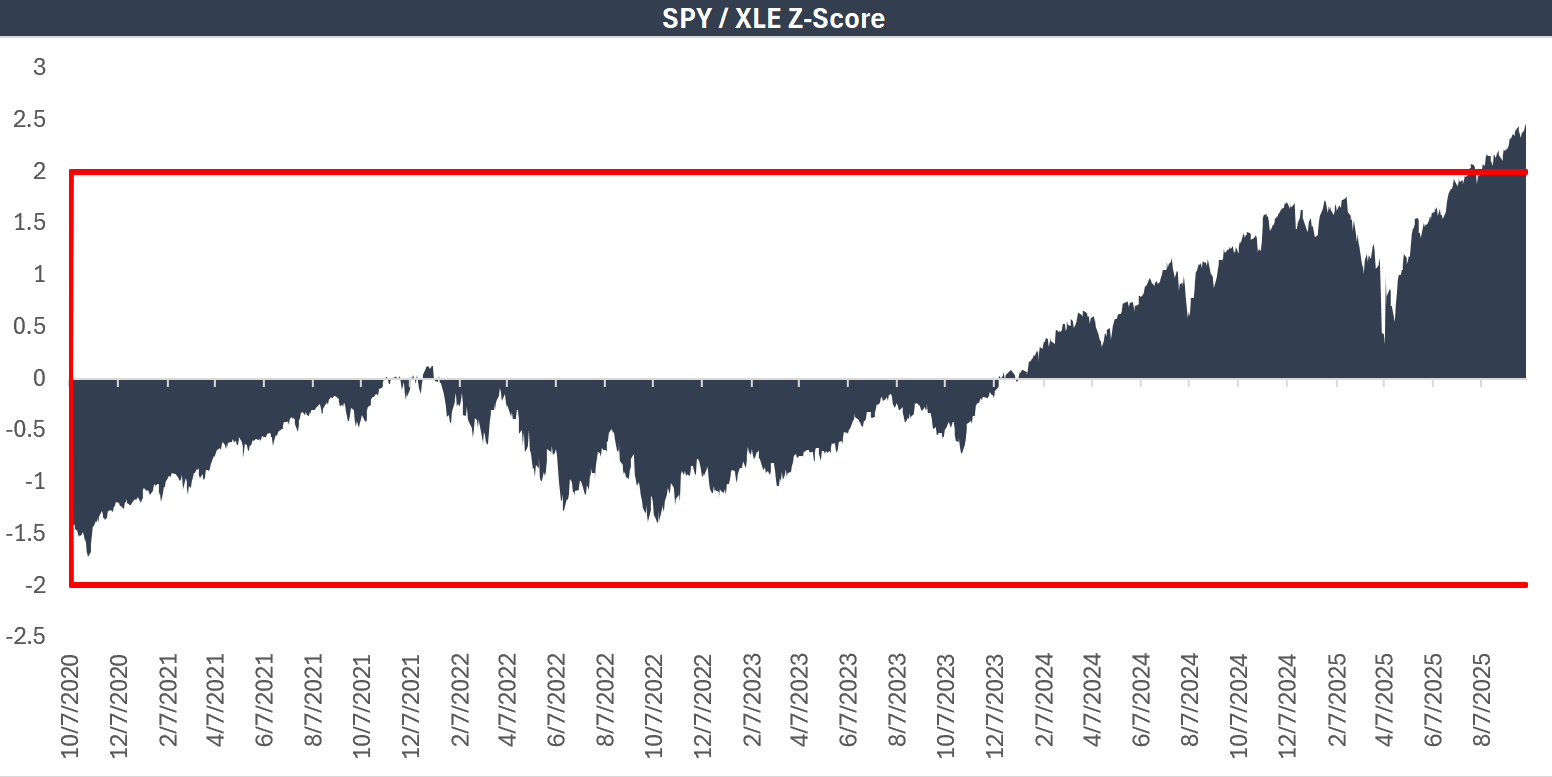

These are the rolling correlations between the S&P 500 and the $XLE energy ETF.

As you can see, we are now falling off a cliff, and the two have created a huge gap between them in recent quarters.

Which makes sense, since energy is underperforming due to no economic growth in the US, all the while the Mag 7 stocks take the S&P higher and higher still.

You can see how far away from “normal” relationships we are through a Z-score measure between the $SPY and $XLE,

Meaning we must return to a balance eventually.

Knowing that EIA stocks are at cyclical lows, and Fed cuts may trigger an economic reset, I believe energy will see enough reactionary demand to drive a bottleneck into higher oil prices. 🛢️

Which also means buying opportunities for a few select stocks.

All of which we will give you in future newsletters.

In the meantime, don’t forget you can access all our live deals inside the InvestiBrew Deal Room. ✅

Also, these ideas could be yours truly to untie any dependency on our content.

We provide you with our entire idea-generation process, condensed into five chapters, for free, inside this 5-day email crash course.

But,

For those looking to make the jump into full-time trading, tapping into the ability to sell your research to a network of investors and more.

Then you are going to love being part of The Sovereign Trader Program.

In six months, you will be just as equipped as an analyst coming up with ideas at a hedge fund or Goldman Sachs.

To your success,

G 🫰

GO AND MAKE IT HAPPEN

Now for Visual Learners

This whole thing is simple, but not easy.

Most of us fall either into the value investing side of things or the wannabe trader relying on chart patterns and some day trading adrenaline.

But,

There is a sweet spot in between not many know about.

It’s how guys like Steve Cohen build billions in wealth in only a fraction of the time it took someone like Warren Buffett.

This is how Long/Short Equity concepts landed us on $INTC at $19 a share before the big news came out. 🔥

No charts, no illegal info, pure insider experience ⬇️

To your success,

G. 🥃