- InvestiBrew

- Posts

- 🗞 There's Always More Than One Cockroach

🗞 There's Always More Than One Cockroach

Not my words, J.P. Morgan's CEO Jamie Dimon mentioned the credit markets could be filled with cockroaches, and I have to say I don't disagree.

WHILE YOU POUR THE JOE… ☕️

Jamie Dimon’s commentaries. CEO, J.P. Morgan Chase

Something weird just happened in the market last week..

Earnings season is beginning, and as always, it is the banking stocks that lead the way in, giving us mortals a glimpse of what these “masters of the universe “ are up to.

I want to focus on Goldman Sachs, not because I was chewed up and spit out by it, but because it seems to have a better pulse of the business and consumer cycle.

Here’s what I saw:

Underwriting and advisory revenues jumped by 42% on the year

Credit-loss provisions are lower compared to last year

Wealth management fees show some signs of complacency around large caps

Overall, it was a very good quarter.

Yet,

The stock fell to 10% off its 52-week high (full correction territory). 📉

And they’re not the only ones in the financial sector showing some warning signs. So maybe Dimon is right after all…

Banker’s Work

Adobe’s Discounted Cash Flows Valuation Model

Long/Short Equity trading is only part of what we do here at InvestiBrew.

The other part is taking some of those cheap stocks people love to talk about on Twitter and digging into whether they are actually good buys or just dead companies grabbing attention.

In the case of Adobe, I think the retail crowd could be right.

You’ll find my assumptions above for Adobe’s projections and my exit scenario, which puts the stock at an ideal valuation of $700 to $742 per share. 👀

Now it’s probably going to be a lot higher, considering my assumptions do fall below the Wall Street consensus until 2027 when they begin to catch up.

There are about three other live deals already pitched and modeled up for you inside our WhatsApp Deal Room. ⬇️

Click here for 7 days free, then $50/month afterwards (cancel any time)

Speaking of credit markets and tough cycles, let’s get on with today’s email 📧…

MACRO SANITY CHECK

Do We Need Pest Control?

Secured Overnight Financing Rate (SOFR) Call Options Interest

Liquidity drives all cycles and market valuations, there’s no doubt about it.

And the SOFR rate is one of the best gauges you can have in terms of where this liquidity premium is at today, giving you an idea of whether we’re tightening or loosening.

As it stands today, we are definitely tightening, and it seems more and more traders are catching up to this fact.

But, how can this be?

SOFR and Overnight Index Swap Index

Remember in 2022 when people were saying the economy was headed into recession and the S&P 500 started falling off the highs?

This event coincided perfectly with a steady rise in SOFR rates and the overnight index swaps rate (OIS), meaning liquidity was tightening and drying out back then.

The problem is, none of this has changed, and all other drivers have gotten worse since.

PMI indexes are softening on the Services side, with Manufacturing in contraction for over 3 years now (save for a couple of weakly positive months)

Consumer spending and confidence (ex. affluent spenders) is not there either

I could point you to a lot more data that is looking bearish, but I digress. ⬇️

Margin debt in brokerage accounts, US

We are now at an all-time high for margin debt carried in brokerage accounts across the United States.

And I would like to remind you this is exactly what brought on the depression of 1929.

Only today is much worse as we have leveraged ETFs betting on single names like $NVDA, $AMD, and others.

So not only do we have a 1929 problem, we are also headed very quickly into a stagflation scenario as GDP growth rates have nothing to back them outside affluent spending and AI investment.

Also,

Inflation figures are headed higher toward 3% and above, so we’re back to a 1974 scenario. 🐻

On the other hand,

Everything else in terms of rates, yields, and liquidity is looking a lot like 2019.

None of these years ended up well for the S&P 500.

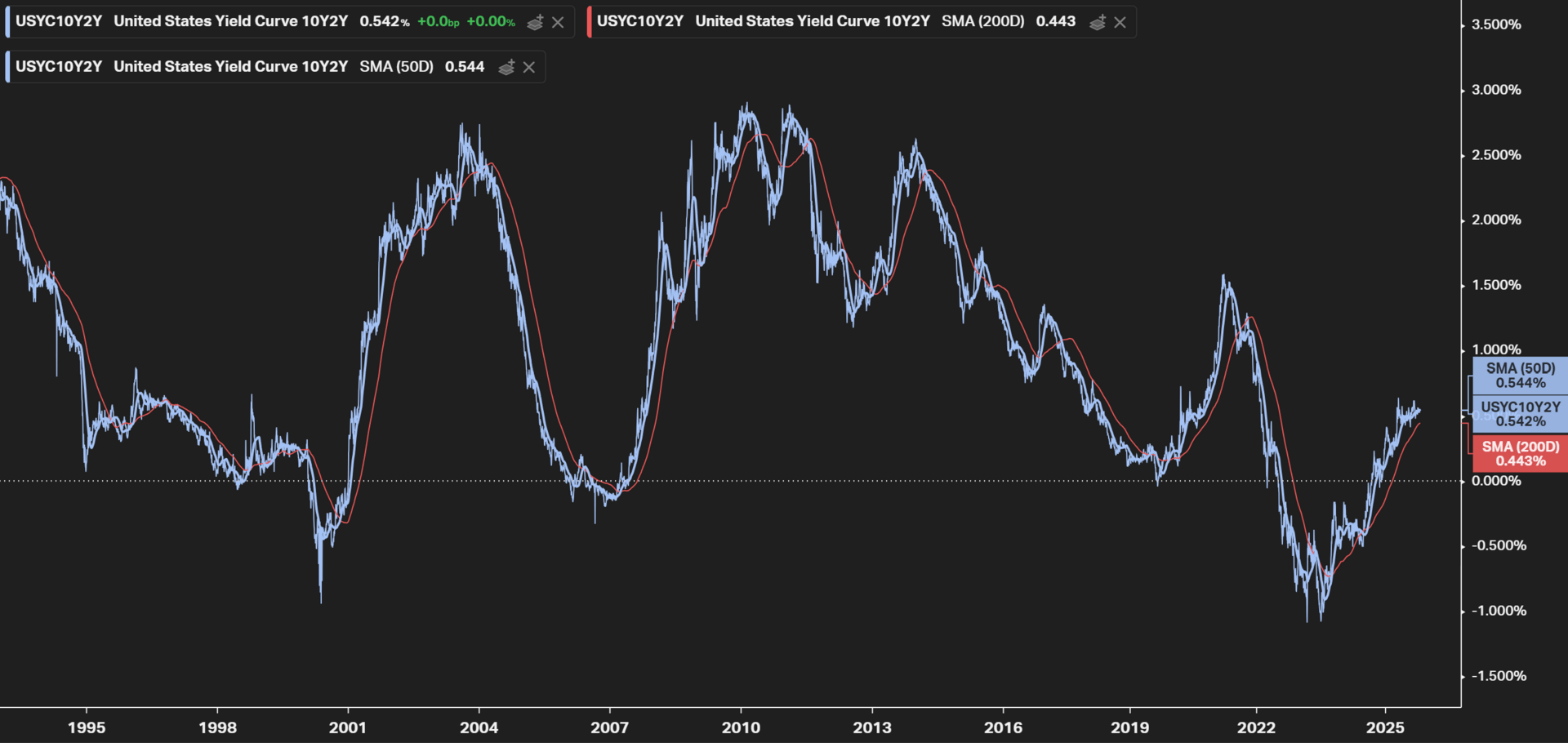

Yield Curve, 10Y - 2Y Bonds

Then we have a live view on credit markets, the yield curve.

A steepening driven by the long-end of the curve supports the idea of liquidity tightening, and we’re not even halfway to normal ranges.

Meaning a further steepening could be had, a direct threat to further economic growth and earnings in the S&P 500.

Yet people are as complacent as ever in a “stocks only go up” narrative, hence the record margin debts we have today.

Record dip-buying week for single stocks this week, BofA

After the S&P 500 sold off on the Trump tweet for China tariffs, people ran to buy the dip at record levels.

But not just any buying, this was single stock buying driven by institutional volume.

In other words, ETF allocation as people started buying more of these leveraged single-name ETFs betting on the continuation of the AI rally.

It’s a classic hot potato game.

$KRE ETF, Regional Banking Exposure

Financial stocks always lead the way in terms of economic outlooks, which again are driven by liquidity conditions.

After three years of tightening, markets are finally beginning to react, as the $KRE ETF is now well into correction territory.

And It’s not just the ETF. ⤵️

Biggest investment banks in the US, comps spread

Some of the biggest and most powerful banks in the United States are also falling into correction territory. 📉

Recall what I mentioned for Goldman Sachs and its quarter at the top, it’s all showing signs of classic late-cycle behavior.

And there is one player (highly exposed to US debt) already preparing for a doomsday scenario:

Chinese gold stock levels

With China holding trillions in US bonds, they know a sneeze overseas can bring them a severe case of bronchitis. 😷

Which is why they’ve been stacking up so much gold this year, as they can sustain their economy even with the bond losses they currently have, as well as keep their currency validated in case a peg to the dollar needs to be broken.

I also think it can be a bet on inflation (which we know is coming back) which can further deepen their bond losses.

What This All Means

Markets can remain complacent (or irrational) longer than you can remain solvent, we’ve all heard that before.

But,

Now you are left with the current setup:

Gold all-time high

Dollar is rallying

Stocks atll-time high

Oil on life support

You can’t go to cash, not in this inflationary environment.

So what do you do?

Exactly what the biggest hedge funds (the outperforming ones) are doing!

Uncorrelate yourself to everything, remain agnostic to S&P 500 exposure and volatility with a market neutral book, and you will be fine.

Not only fine, but you will keep generating returns even in a potential turmoil.

If you’re the value investing type, and like deals with a huge margin of safety to protect your downside, then listen up:

Here’s our WhatsApp Deal Room, where we drop financial models and valautions on deals that fit this mandate

Now for those who are more active traders, and are comfortable on both buying and shorting stocks.

You have two choices to make, before it’s too late and your lunch is stolen from you.

You can figure out if trading (real trading) is for you, no strings attached, in this free 5-day email crash course. ✅

If it turns out Long/Short trading is the thing for your current account size and stage in your career, then let’s take you a step further in door #2.

Apply to be part of our flagship program The Sovereign Trader. ✅

I’ll be honest with you, it requires a big investment ($6,499).

But you get that back and much more in terms of value, here’s how:

You will understand how to spot macro economic trends and biases

Industry selection frameworks will line you up in areas driving this economic activity

Stock selection places the odds in your favor to catch big EPS swings

Hedging frameworks will protect you against big market moves

But here’s the best part…

After your graduation, you will now enter a database, where your ideas will be measured in terms of quality and performance.

The best of you will then be hired as analysts to generate ideas for us and our investor network.

And that’s how you can 10X your investmtent in this program (plus whatever money you make trading).

With that, I will catch you in our next post discussing some opportunities in what we think can be a multi-bagger play altogether. 💰️

Until then.

To your success,

G 🫰

GO AND MAKE IT HAPPEN

A Taste of Greatness

I can talk about Long/Short equity all day.

But,

Why don’t I just give you this 15-minute YouTube video showing you exactly how the sauce is made. 📹️

To your success,

G. 🥃