- InvestiBrew

- Posts

- 🗞 Watch Me Pick Stocks to Buy & Sell

🗞 Watch Me Pick Stocks to Buy & Sell

Part 2 of Wednesday's long/short idea generation process, these stocks are going to be hot.

WHILE YOU POUR THE JOE… ☕️

Mid-cap stocks tend to outperform small and large-cap names over time.

There are a few reasons for this:

They’re usually out of institutional reach due to size limitations

Not often covered by Wall Street analysts on a regular frequency

Outside the speculative radar that’s often found in small-cap stocks

Which is exactly why we always focus our long positions in mid-cap stocks when generating an idea. 💡

Here’s what’s interesting, though, one day after I posted this newsletter calling for a bullish view on mid-cap stocks, Goldman Sachs posted that YouTube video expressing a similar view.

Coincidence?

Nope, just good old skills, which are the same ones you can acquire inside The Sovereign Trader Program ✅

Speaking of trade ideas, let’s get on with today’s email 📧…

WHAT’S ON THE MENU

Finding Outliers

That is the first thing we do once we hone into an industry of interest to trade in, with the expectancy of higher volatility (where profits are made) in the next 20-60 days.

Our last newsletter broke down the data that led us into the Steel, Wood and Plastics industry for a long bias.

If you haven’t read it, give it a look because now we’re going to go into our stock selection process. ⬇️

Churn ‘Em and Burn ‘Em

Being in the right industry with a massive pocket of volatility is half the battle, though you are now where the top 10% of market participants are.

The other 90% is still trading chart patterns on the hottest stocks and ETFs, providing the exit liquidity for the big guys.

We like to do things differently, so let’s get to it:

Out of 33 stocks in this mini universe of Steel, Wood, and Plastics, there are really only four I am willing to look into.

However,

I’ll save you some time and give you my top long and short outlier picks so we can start modeling this trade up further.

Long: $WFG West Fraser

Short: $MT Acerlor Mittal

Those inside our flagship program know this as the Victoria’s Secret analogy, which takes everything you know about valuation multiples and flips that on its head. ⬇️

Anyway, I think $WFG is a long here because:

Mid cap at $7.7 billion

Massive 312% forward EPS growth potential

34.6x forward P/E premium (100% justified)

At today’s price of 71% of its 52-week high, I think this stock is ripe for a boom when the market starts to price in this potential EPS growth (which might come from tariffs with Canada where we get most our wood).

Now here’s why I like $MT as a short:

$26.4 market cap outside of the risk/reward hell for shorts

EPS contraction for the next 12 months expected

Forward P/E discount (100% justified as well)

This stock doesn’t deserve to trade at 93% of its 52-week high one bit, so I think a proper reality check might bring these two together.

Let’s chart that and see what happens:

Correlation regime ✅

We are now at the highest coupling we’ve had in the past two years, which tells me these two are going to have to close down that wide performance gap sooner rather than later.

First math check out the way, now let’s see if this is the right time to take action or not…

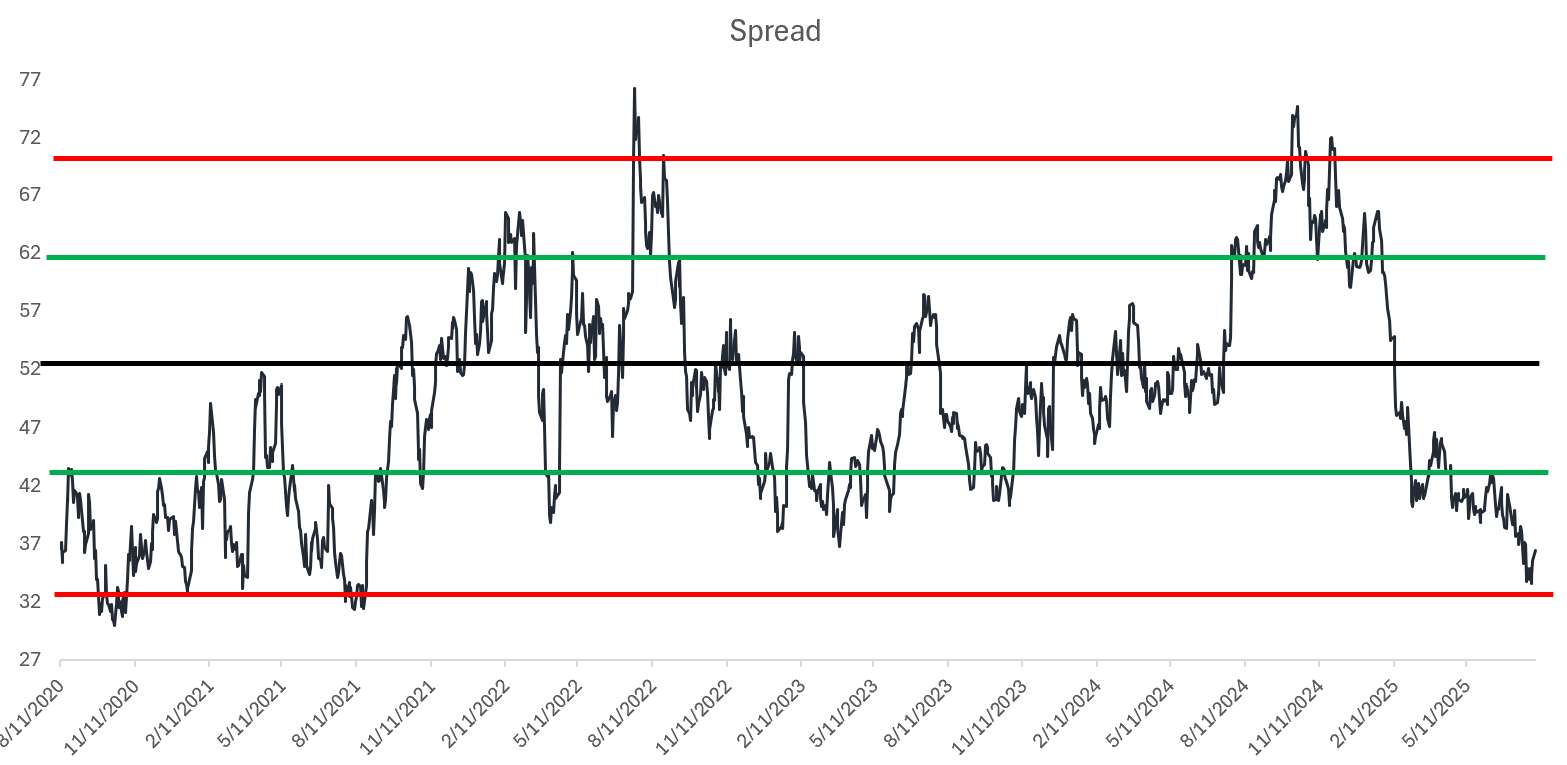

Looks like we are right there, the spread between these two stocks is trading at a negative 2 standard deviation.

I love this, and so should you, because getting back to the mean (black line) is where the real money is made, 💰️

The question now becomes: “How likely is this to move back toward the mean?”

Well, using a hedge ratio of 1.106, we get a P-value of 0.02.

Which is english for 95% certainty of mean reversion ✅

Checking on a normalized Z-Score time series, we can see that we are there but not quite there yet on the deviation for an entry.

Which is fine, at this point we just stick this on a watchlist, set our alerts on our broker, and keep moving onto the financial analysis (for next newsletter’s post).

In the meantime, you can chart this: WFG - 1.106 * MT into your charting platform and place an alert for $30 on this spread, which is where I would like to enter.

Target price? $48.6 🎯 on our mean reversion.

By the way, that’s 62% upside potential on this trade, not bad for a day’s work. 🔥

Look, by the time I put this trade on and take profit on 5 other ideas I have working already..

You’d still be scrolling X for ideas and leaning on other people’s chart breakdown.

I’m offering you a better way, a better life in the financial markets really.

It’s up to you to take it or not ⬇️

GO AND MAKE IT HAPPEN

Shortcut Time

Haven’t recommended a book in a while, and I see there are a few of you that are new.

There aren’t really that many good books on trading, since most are based on the same technical analysis nonsense, and if everyone has access to the same information then I really don’t see how that can make you better in this business.

Which is why today’s book recommendation 📖 is made (again) as the only book I deem worth reading for a more professional view on trading.

You’ll find long/short equity and global macro strategies are typically the best areas to be in ✅

To your success,

G. 🥃