- InvestiBrew

- Posts

- 🗞 What Your Financial Advisor Doesn't Want You to Know

🗞 What Your Financial Advisor Doesn't Want You to Know

The old buy-and-hold approach may not be as useful in this current market, when you zoom out on the real data, here's why that becomes a painful truth.

WHILE YOU POUR THE JOE… ☕️

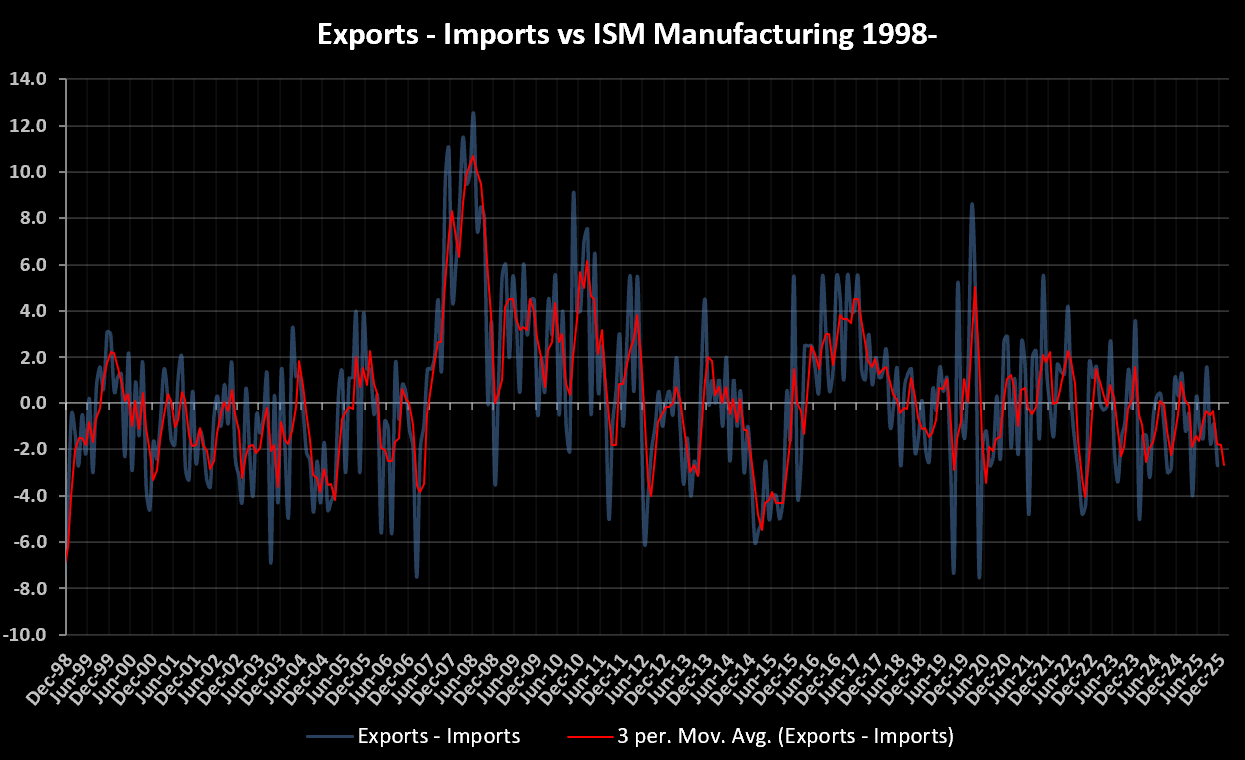

Manufacturing Exports vs Imports Balance Declining

We just got last month’s PMI data read. 👀

This is where 80% of our trade ideas come from, and where most hedge fund/investment bank analysts get theirs as well.

So look, we have a terrible decline in trade here, as you can see above, exports are falling off a cliff, and I guess we can all blame this on two main themes:

Tariff uncertainty is keeping foreign buyers at bay when it comes to dealing with the US

A strengthening Dollar index is going to make it more expensive for foreign buyers to acquire American products

Recall from this newsletter the handful of reasons why we’re bullish on the Dollar, and why this may accelerate the trends that are now obvious in the PMI index. 📈

But,

Manufacturing is <20% of the economy, so today we’re going to focus on the Services PMI (>80% of the economy) for future ideas.

All of which will be pitched inside our WhatsApp Deal Room (whose members are up over 70% cumulative over the past month) 🔥

Speaking of trade ideas, let’s get on with today’s email 📧…

TODAY’S MARKET FOOTING

Once in a Cycle Type of Market

S&P 500 vs Services PMI Correlations (Monthly)

You can chart this however you like, but here’s the truth:

80% of the time, the quarterly returns for the S&P 500 trail the quarterly changes in the Services PMI index

This relationship is stronger than ever today, as companies like NVIDIA, Meta Platforms, Microsoft, and Amazon make up for the bulk of the index as well as major investments in the United States economy.

So where are we today?

Not within that 80%, that’s for sure.

Ever since March 2025, correlations between the quarterly S&P 500 action and the PMI fell to -40% and below, driven by events like:

April’s Liberation Day selloff

Services activity rebounded as tariff uncertainty turned the world’s attention to American services

Again, that rebound in services activity was responsible for the bulk of the market’s recovery after the big selloff. 🐂

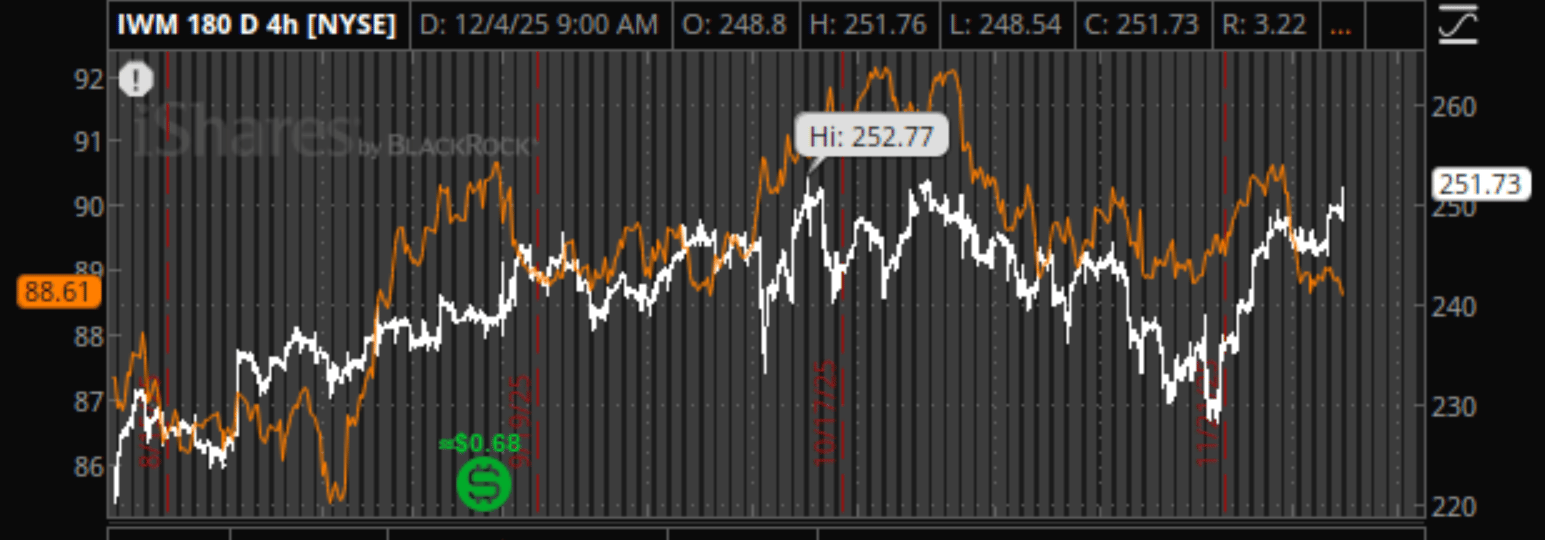

TLT Bond ETF (Orange) vs IWM Small Cap ETF (White)

Here’s a small confirmation of what might happen next, given this overdue convergence between the S&P 500 and the Services PMI.

We see the TLT bond ETF (orange) beginning to fall while the IWM small-cap ETF breaks out of a monthly range.

If the market is attempting to price something in, it’s probably this:

Inflation is going to stick around and be above 3%

Rate cuts, if more are coming, have probably been priced in already at this point

That’s all bullish for the Dollar index, considering how weak it has been as markets bet (and overbet) on these cuts coming indefinitely.

A stronger Dollar also means more consumer buying power, and that’s good for small businesses.

Commercial Positioning on S&P 500 Futures

What’s good for small businesses is bad for large ones in general.

As a stronger Dollar hurts international sales for these large companies, EPS growth lags, and so do valuations. 📉

And we all know where valuations are right now for most of the stock market.

All-time highs.

Which is why dealers have been buying into S&P 500 futures to make a makret for the leveraged money managers (hedge funds and other commercial traders) who have been selling since March 2025.

Do you think it’s a coincidence that “smart” money has gone deep into short positions for the market, just as the divergence between the Services PMI and the S&P 500 went deep into negative as well?

It’s not.

Equity Risk Premiums (white) vs SPY ETF (orange)

Last but not least, we can see this sentiment shift in real time through equity risk premiums.

These are widening to levels only seen during major crises (or right before them).

All while the S&P 500 flirts with a new all-time high.

In other words, the market is not liking this setup whatsoever, so I guess we’re down to two options right now:

Services PMI improves along with business conditions

Or

Markets have to sell off in order to normalize their spread to the PMI and reflect the currently soft economic data

Now for the big deal, or at least the beginning of it…

Idea generation is the most important aspect of being a successful trader, as going through this repeatable process can yield dozens of actionable ideas each month.

And if you can structure them correctly, it can change your financial future forever.

Sample of Client Managed Account

Here’s one example during the past month alone, a client-managed account that is up nearly 10% since we signed together. 💰️

Can 10% in a month move the needle for you?

If so, imagine being a part of:

$ONON up over 40% in a month

$CSAN up over 30%

$LZB up over 40%

$BROS up over 25%

And many other deals we’re putting on for the InvestiBrew portfolio RIGHT NOW.

Screenshot Taken From The Deal Room

This is the type of research you can expect from me, every single week.

Real banker’s work.

And the best part?

You can get 7 Days Free access right now (most 10X their monthly membership before the first payment is even due).

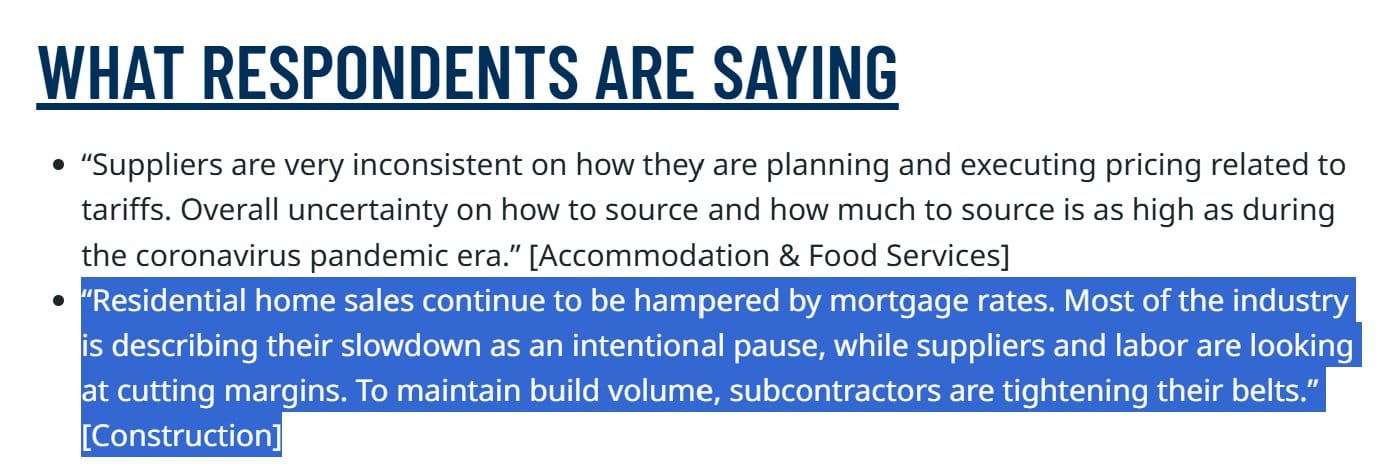

Commentary Section From Services PMI

Within the Services PMI respondent section, there’s a clear trend showing us weakness in the construction industry.

But that’s old news as you’ve been seeing from our content, we have a mess of a housing market with lots of potential opportunities to bet on its further contraction.

Maybe there’ll be some upside to digging through laterals like building materials.

But for now:

Industry Themes Inside Services

I am turning bullish on the Finance & Insurance industry 📈, as you can see, it landed in the top half of expansion readings this month after being pretty much flattish.

XLF Financials ETF

Looking at some of the price action in the financials space (XLF ETF), we can confirm that bullish sentiment is present as the ETF is now closing in for a new all-time high.

So that’s one area I’d like to dig further into for our next newsletter, giving you some potential deals to take on and profit from.

Industry Themes Inside Services

On the short side, here are some areas I’d like to screen for in a hedging nature:

Construction

Real Estate

Expanding on the weak fundamentals theme mentioned in the housing market already.

$XHB Homebuilders ETF

On the other hand, the $XHB Homebuilders ETF is showing us bearish price action sentiment, now trading at 12% off its 52-week highs and being in official correction territory. 🐻

Keep these in mind as we move forward into our next issue, where a few portfolio opportunities and stock selection will come through for you.

Until then.

To your success,

G 🫰

GO AND MAKE IT HAPPEN

Better Coffee, Better Profits

Everyone knows and loves Starbucks and its coffee.

Well, not so much lately, and there’s one brand lookign to take the crown in the United States.

It’s not Dunkin’…

Dutch Bros (BROS) is now up over 20% since our entry point, and still worth another 15-point rally from here.

Our WhatsApp Deal Room Members got the stock at $49 per share before the big move.

But in case you don’t want your 7 Days Free Trial…

Here’s a Seeking Alpha post breaking it all down for you ⬇️

To your success,

G 🥃