- InvestiBrew

- Posts

- 🗞 Why I'm Buying China

🗞 Why I'm Buying China

I love doing the opposite of what most people do, but this one goes deeper than that.

WHILE YOU POUR THE JOE… ☕️

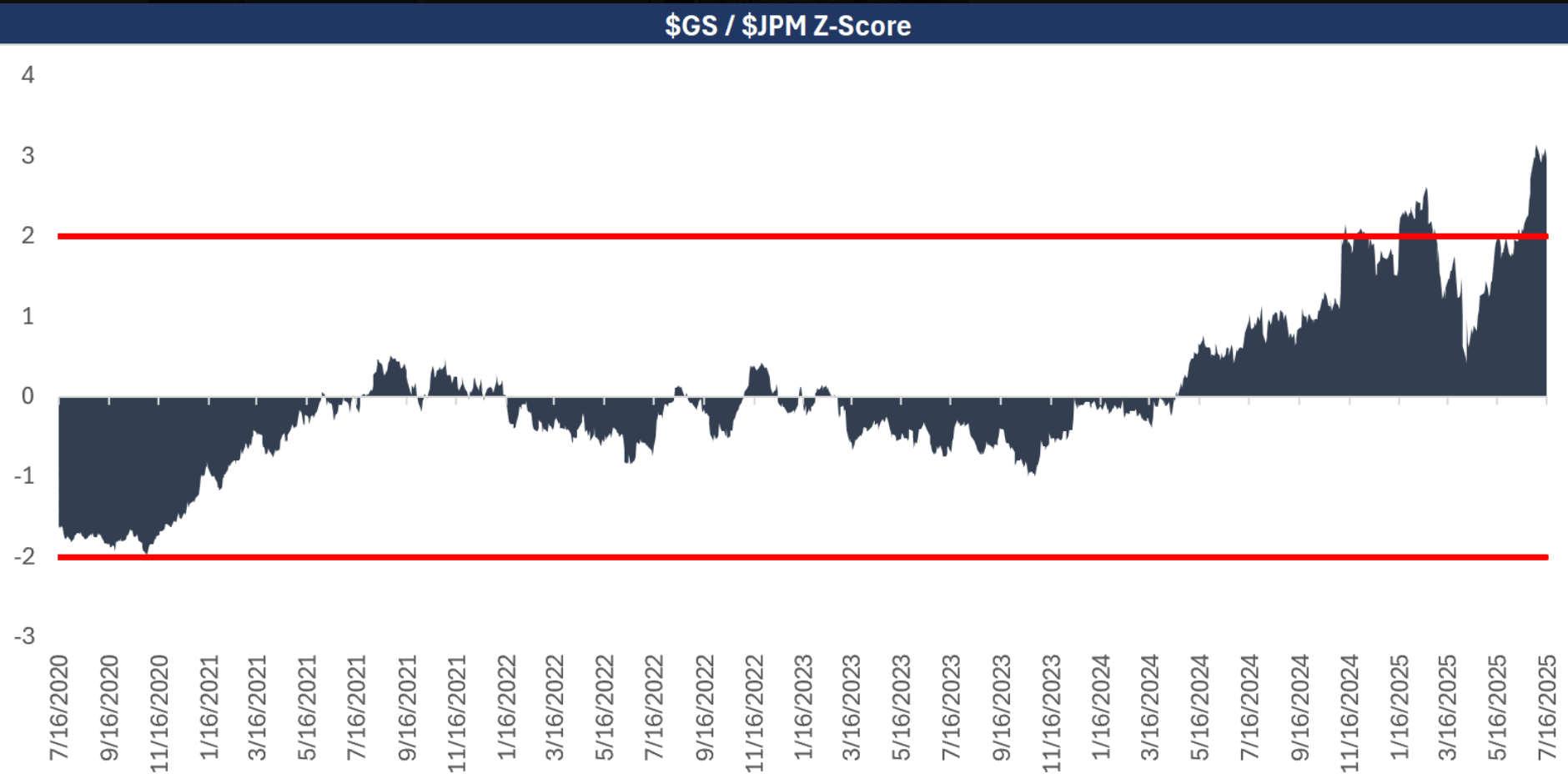

For another day’s post, but pay attention to this spread above here…

This is the $GS / $JPM Z-Score time series, a classic gauge of financial conditions and sentiment on the broader US economy. 👀

Right now Goldman is leaving J.P. Morgan in the dust, which typically signals more confidence in the financial system and business cycle.

But

That spreads is now reaching (and extending) normal limits, meaning something is not quite catching up the way it should be.

Which is fine, because when this becomes a hedger’s market, you will be glad you stuck around and learned from our long/short equity posts and video series.

In fact, here’s one to get you started while part 2 comes out ⬇️

Speaking of limits, let’s get on with today’s email 📧…

GAMBLING NATION

24/7 Casino Runs

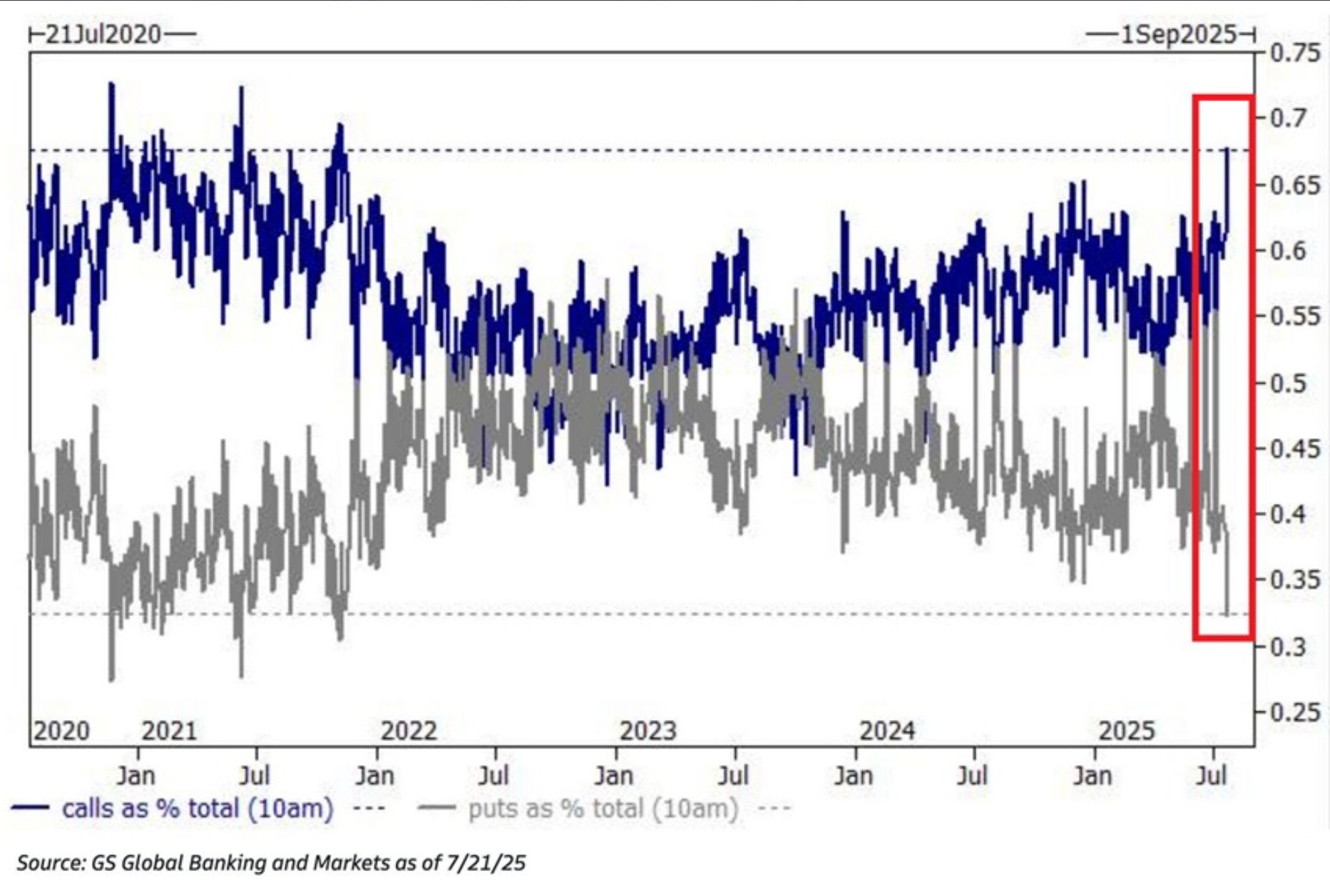

In case you missed it, the level of call options trading is now at a similar level to where it was back in the 2020-2021 mania. 🌀

The market is trading risk like money is being printed and cheap as it was back then, yet it isn’t.

What this tells me is that a large amount of today’s market participants are squeezing the most leverage they can to make money in very tiny moves, after all the VIX and S&P 500 ranges have been asleep for the past 3 weeks.

When volatility wakes up again (inevitably), I will be ready to eat the market up with my long/short portfolios and then getting back to short-term trading in /ES futures.

I got my start the same way most traders did, losing money and jumping from strategy to strategy (and I documented it). What finally turned things around was knowing how to implement everything I learned inside Goldman Sachs. ✅

Which is exactly what I’ve put inside this free 5-day email experience.

For now though, I need a place to redeploy my capital before the market wakes up, my so-called foundation segment of my portfolio.

Queue China In

There are many reasons I am a China bull. Demographics, economic indicators and positioning, the sort of technology and business that is spurring up there, and a lot more.

But, to keep things simple and to the point, I’ll just focus on the Chinese stock market’s valuation.

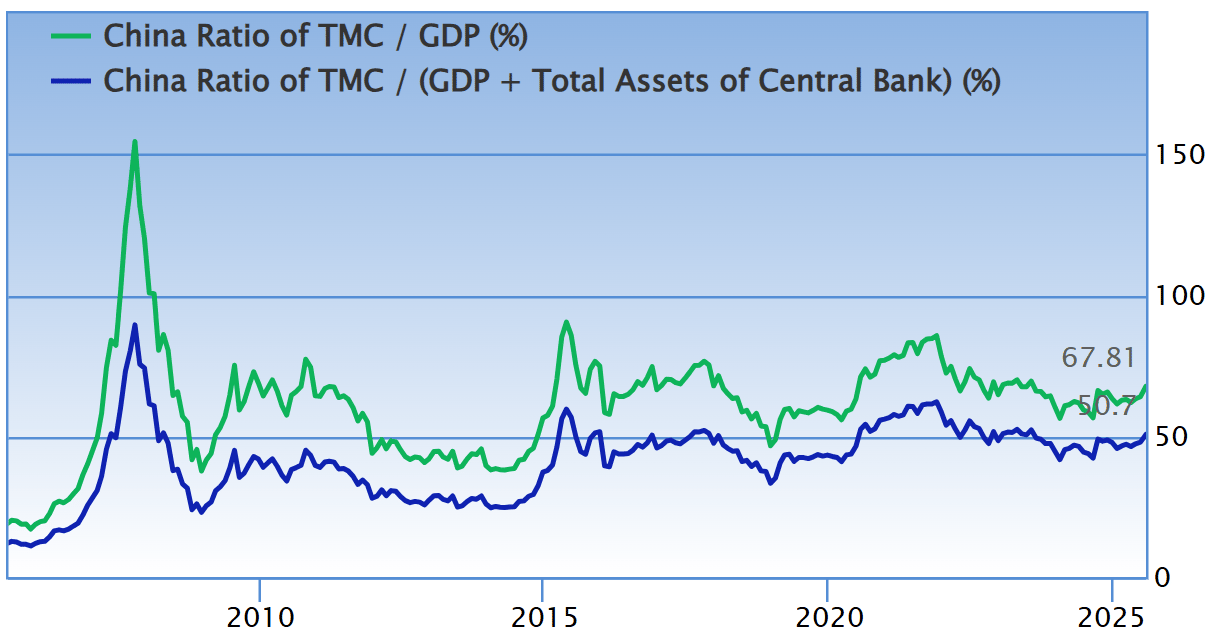

Roughly 67.8% on a Buffett indicator (Stock Market / GDP) basis

14.4x P/E on the $MCHI ETF

This looks a lot different than what you could find for the S&P 500 index in the United States, which should be concerning if you are a long-only investor or rely on technical analysis.

Remember, this is about to become a hedger’s market.

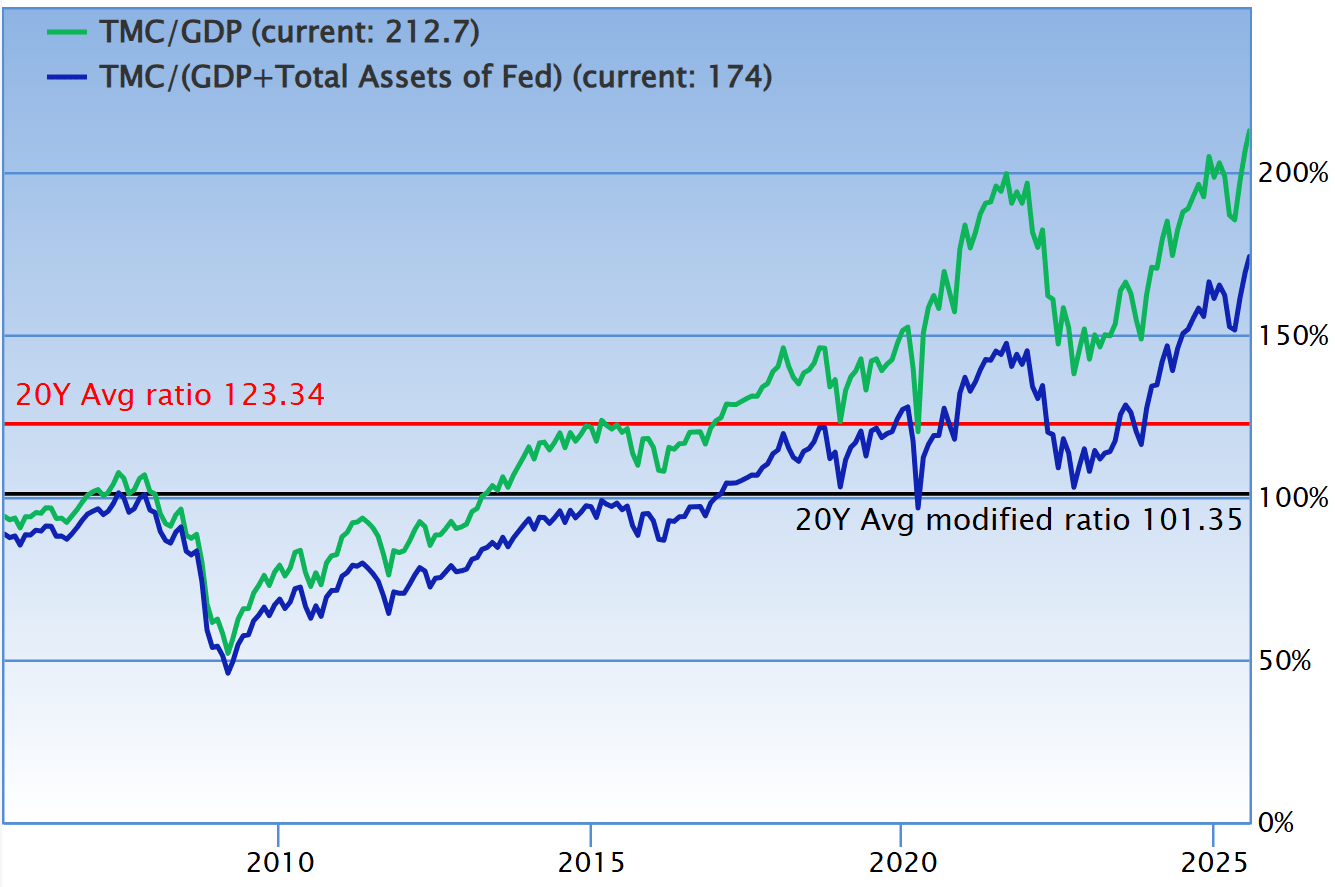

The United States sports a Buffett indicator ratio of just over 212% (the most expensive stock market in history).

Now that the S&P 500 trades at a much higher 25.0x P/E against China’s stock market, you could make an argument for selling US stocks and buying Chinese ones.

However, it’s not that simple.

Underwater Volleyballs

That’s what I called industrial and materials stocks a quarter ago, and so far the $XLI and $XLB have outperformed the S&P 500 according to plan.

I am still a bull on those areas, and some of our stock selections have already gone parabolic since that call, but that’s besides the point.

The point is that we can rinse and repeat this systematic process no matter the country or industry, because it’s rooted in logic and what works in the market, not relying on the past repeating itself (charts).

This one skill will determine whether your portfolio joins the side of greatness, or stays in mediocrity along with 90% of everyone that joins this game.

Not All China is The Same

While you can buy the $MCHI or $FXI ETFs for China exposure and probably do well, I think there are a lot better ways to get your hands on the massive Chinese transformation for cheaper. 👍️

But before we cover that, let me netion one BIG catalyst for these ETFs and other Chinese stocks:

China is soon to adopt the American 401(k) model, creating a guaranteed index buyer every pay cycle.

When this happens, you can be sure that trillions of dollars will flee into Chinese stocks, and that is where my top pick comes into play.

I’ll just cut to it for now, but Alibaba is a $600 stock all day long. 📈

This is coming from someone who’s been buying since 2022, DCA’ing at an average cost of $79.45.

Needless to say I am talking my book here, but the Alibaba story is honestly one of those miracles in the market, but we can cover that in another post so we can do it justice.

For now, at least you can walk with the knowledge that the US market is overvalued, and the gambling risk-on sentiment is now in full swing.

2020-2025 will seem like paradise compared to what’s coming, and if you don’t know how to hedge, I’m sorry for how you will have to find out my friend.

To your success,

G. 🫰

GO AND MAKE IT HAPPEN

Common Success

There is one theme that’s always present in the successful hedge funds of the market, and it’s all in how the secret sauce is made.

That means a global macro & long/short equity strategy, which is exactly what we practice and preach.

Today’s book recommendation 📖 can hopefully serve as an introduction through storytelling on how important these two are in the financial world.

To your success,

G. 🥃