- InvestiBrew

- Posts

- 🗞 Value Investing is Great, But We're Faster (50% Upside Inside)

🗞 Value Investing is Great, But We're Faster (50% Upside Inside)

You got the wood products breakdown last time; today, I will give you the trade to bring home the bacon.

WHILE YOU POUR THE JOE… ☕️

Bloom Energy ($BE) up 26% on 10/13/2025

There are three things that make a great trade:

It delivers on your view fast

There is little to no drawdown from the moment you put it on

I know I said three, but I can’t put the best one in one single bullet point, so let me explain… ⬇️

When I mentioned in last week's newsletter that Bloom Energy was flagged as a buy, I didn’t provide a specific reason (other than its role in the AI energy revolution).

That’s because I didn’t know why it was a buy, nor did I need to.

Actually, all I needed to know was that the market saw it as a premium stock, and a brief financial analysis was enough to take this idea home.

The result? 26% returns in a single day. 🔥

As you will see today, there’s a bit more that goes into stock selection and portfolio construction.

But you just got our basic premise: Why is the stock a premium one, and is the market right?

If you can answer that, you will be a very rich trader.

And that’s exactly what I aim to show you in Day 4 of our free 5-day email crash course on Long/Short Equity methods. ✅

Speaking of Long/Short ideas, let’s get on with today’s email 📧…

WHERE WAS I?

Right, Wood Products

Ratio Spreads in the Building Products Industry

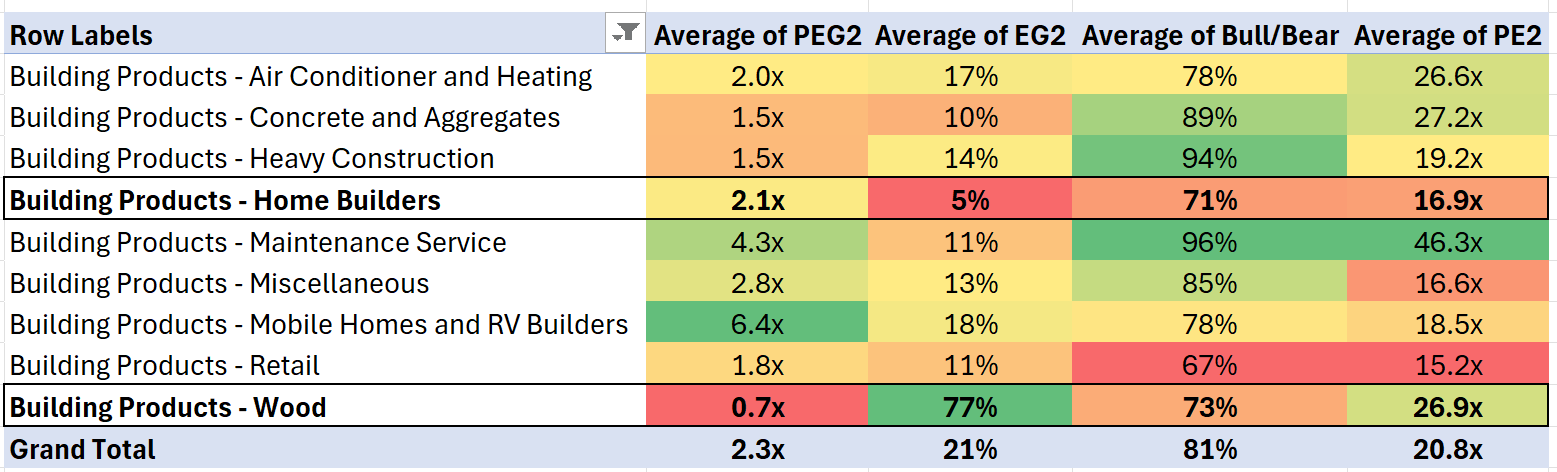

Recall that, despite home builders' anemic projections for future EPS growth and their call for a discounted valuation, there is still an opportunity in the wood products sector.

Especially as tariffs on wood imports have been applied today, October 14th, 2025.

But,

These tariffs can very well create a more favorable environment for domestic lumber prices and demand, especially as imports start to eat into margins.

Keep that in mind as we go through our stock selection. ⬇️

Universe selection on Construction - Wood Products

Apples to apples, this is the best gauge I could get for North American companies exposed to wood products.

Picking the long candidates was easy:

Weyerhaeuser ($WY)

West Fraswer Timber ($WFG)

We already have positions on $WFG against a $DD hedge on the short side, that trade is up single percentage points since, so I guess we are left with $WY.

Here are a couple of reasons I like this name:

Weyerhaeuser ($WY) 2022-2025

First, look at the price action; it’s shaking out anyone and everyone at this point.

I’d say 71% of its 52-week highs is a bit overdone, wouldn’t you?

Anyway, here’s another angle.

$WY is mainly exposed to domestic wood sales and production, not subject to tariffs, and completely attached to domestic spending trends.

These trends could rebound from here, especially as the Dollar index begins to break out of its monthly range.

More than that, as you recall from our last newsletter, U.S. Building Permits are now in a depressed state, so the downside is pretty much priced in and limited for $WY. 📉

This is why the stock is set to deliver 178% EPS growth, and a 0.3x PEG ratio suggests this growth trades at a 70% discount right now.

We’ll come back to this later. For now, let’s look at why $JCI is a short. ⬇️

Johnson Controls International ($JCI) 2022-2025

You may look at this and think, Why would I short this stock? It’s gone nowhere but up and to the right!

Here are a couple of reasons why the market might be wrong here:

$JCI is heavily dependent on capital expenditures for its manufacturing operations, where inflation and tariffs significantly squeeze margins.

Most of its revenue comes from government projects, and with the shutdown expected to last up to 35 days, some of these may be delayed or outright cancelled.

Shutdown = No contracts.

This is why the stock’s forward EPS growth rate is only set at 18.1%, and even then, a 1.3x PEG suggests that this below-average growth is still 30% overvalued today.

Correlating the Trade

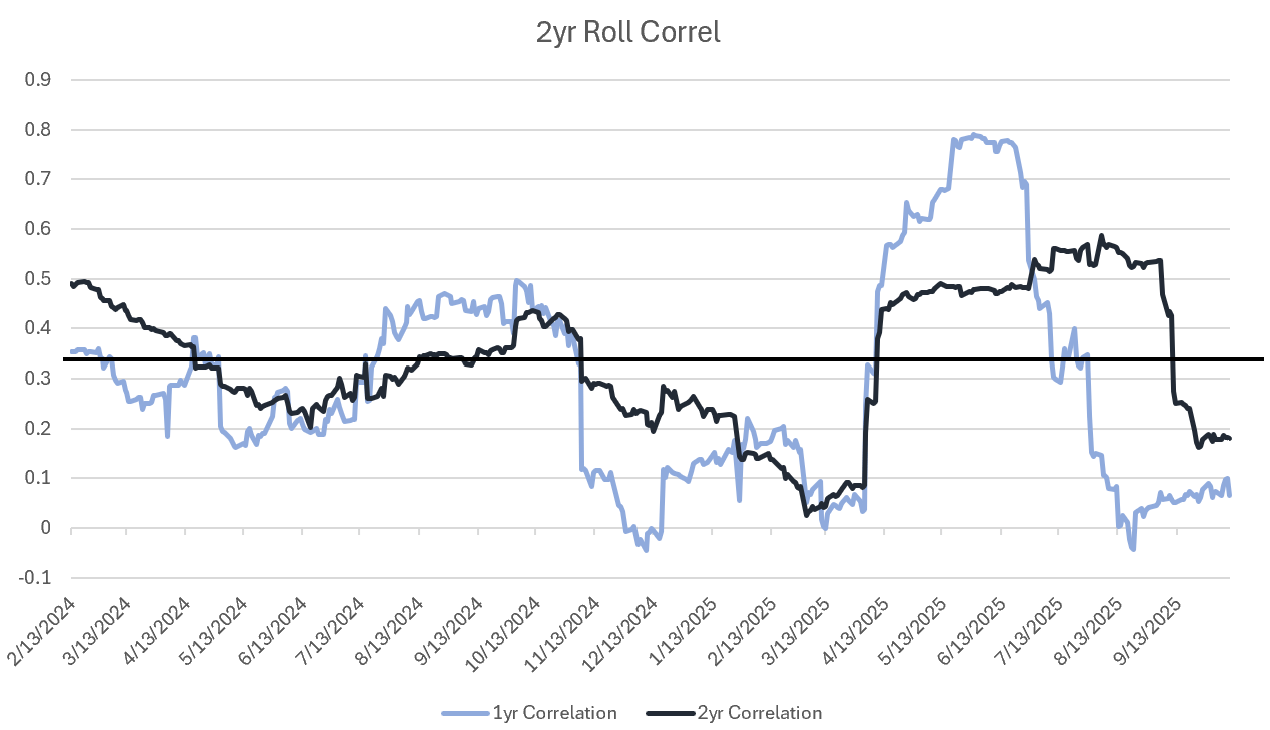

$WY - $JCI rolling correlations

These two stocks are overdue for a correlation upswing, according to historical data.

That means they need to come closer to each other. Considering one trades at 71% of its 52-week high, while the other is at 94%, there’s enough room for this convergence to take place.

So let’s chart that, shall we?

Spreading the Trade

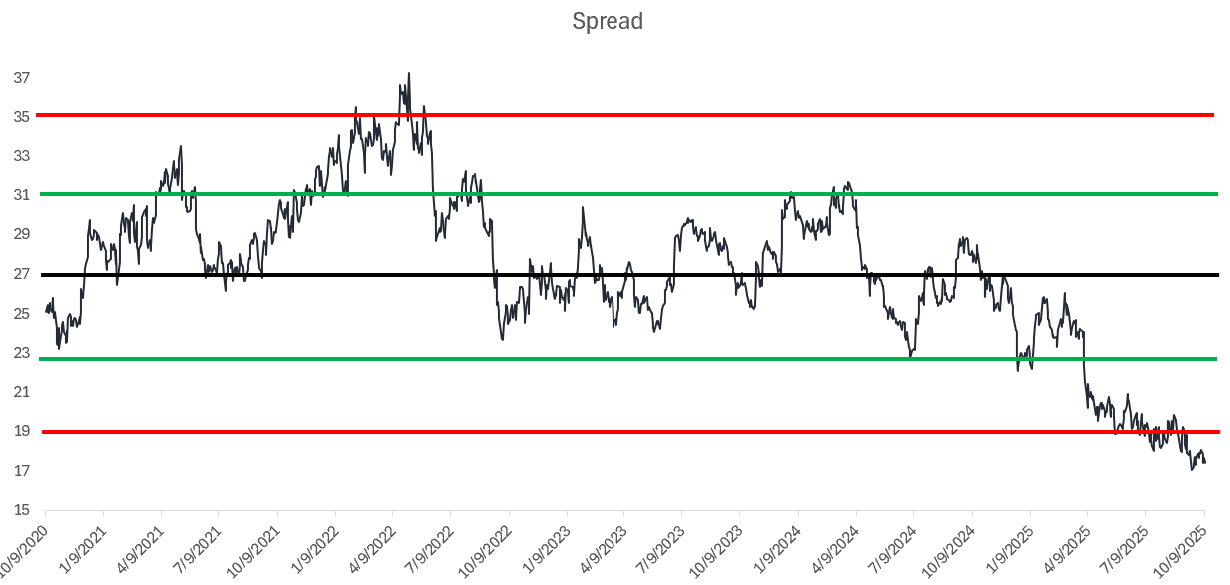

Spread of $WY - 0.06448 * $JCI

We can compute the market-neutral spread as $WY - 0.06448 * $JCI on most brokerage charting software as such.

That big decimal number? That’s the hedge ratio, and it’s key for you to have that as the bridge to reel in the benefits of a Long/Short Equity Strategy.

There’s a whole bunch of math that goes behind this ratio, and even then, there are two ways to compute it for different situations.

Which is something we have pre-packaged for your use right after you complete the Long/Short Concepts module within our flagship program, The Sovereign Trader.

In six months, I aim to distill everything I learned at Goldman Sachs & Citigroup into this, so you can come up with ideas just like this one.

What’s more, after graduation, you will make it to our investor network, where you can sell these ideas for a fee.

$6,499 and six months, in exchang,e you can make insane returns and six figures in cash flow?

Show me a Uni degree that can do that. 👀

Anyway,

That spread is now trading at a second standard deviation on the downside, meaning there’s a real chance for converging here (recall the correlation upswing as well).

However, we need to make sure this convergence is statistically significant.

With a P-value of 0.03, we can pretty much say it is (with 95% confidence). ✅

Financial Comps data for Weyerhaeuser

Now the cherry on top.

Look at capacity rates for $WY vs $JCI …

It’s 2.3x and 1.9x, and I think we can all agree on why one is oversubscribed while the other one is undersubscribed as far as demand goes.

Think government contracts & tariffs. 💡

$WY - 0.06448 * $JCI spread

Entry point is set at $17 on this trade.

Initial exit is $24 with best case set for $27.

That’s 41% to 58% returns in a single quarter time horizon. 🔥

$WY - $JCI Z-score

And the Z-score (a zoomed-in, more accurate version of the spread) agrees,

This trade is ready to be put on right now. ✅

So good luck!

To your success,

G 🫰

GO AND MAKE IT HAPPEN

Reinforce Your Skills

This exact breakdown just got a lot better.

If you’re a more visual learner or would like to see me build this idea step by step live, I would 100% recommend watching this YouTube video.

Hopefully, both angles help you reinforce the long/short equity skillset here 📽️

To your success,

G. 🥃