- InvestiBrew

- Posts

- 🗞 How to Generate Ideas That Win: This Week in Nuclear

🗞 How to Generate Ideas That Win: This Week in Nuclear

Your idea generation process got you this far, but you might be missing a key factor keeping you from reaching your true potential. Let's fix that.

WHILE YOU POUR THE JOE… ☕️

Still Waiting On a Housing Crash? You Might NOT Get It

Are you willing to pay an average $512,000 for a home?

If we had interest rates below 2%, that might be a reasonable ask, but with mortgages still above 6%, no one can deny homes are liabilities, not assets, today. 📉

However, a crash may not be coming, at least not the one we all dream of.

There are a few real estate investment trusts (REITs) that trade at cyclically high dividend yields, which serve as a proxy for the cap rates in their underlying property portfolios.

What this means is that these properties are undervalued even after the massive runs seen in 2020-2025. So the question is, why is property income shooting so high to keep cap rates so attractive still?

The answer is AI.

And that’s what we’ll cover today ⬇️

Your idea generation process got you here, but you might be missing a few key ingredients that could unlock your true potential.

Over five days, I want to help you make an additional 8% per year on your money without taking any additional risk. 📈

Sounds too good to be true? Yeah, that’s what they all say…

They also say this is the best educational experience they’ve ever gone through, despite being so short in length.

Check out our free 5-day email crash course here and find out for yourself. ✅

Then, when you realize (as most do) this is exactly what you’ve been missing, I’ll welcome you into our flagship program, The Sovereign Trader.

Where you will:

Copy and paste everything I learned at Goldman Sachs

Be coached through the entire process and still be part of a community afterwards

Tap into our investor network and ongoing coaching/portfolio, and idea reviews

In six months, you will either be scrolling X for new ideas based on worthless technical analysis

Or

You will make an average of 12% a quarter (as we’ve shown time and time again) or $500 on average per idea after we buy it off you.

$6,499 and six months for six figures in return, show me a Uni degree that can get you that.

Speaking of ideas, let’s get on with today’s email 📧…

PRESS WHERE IT HURTS

With Great Power Comes Great… Bills?

Now You Know Why Bills Have Gone Up

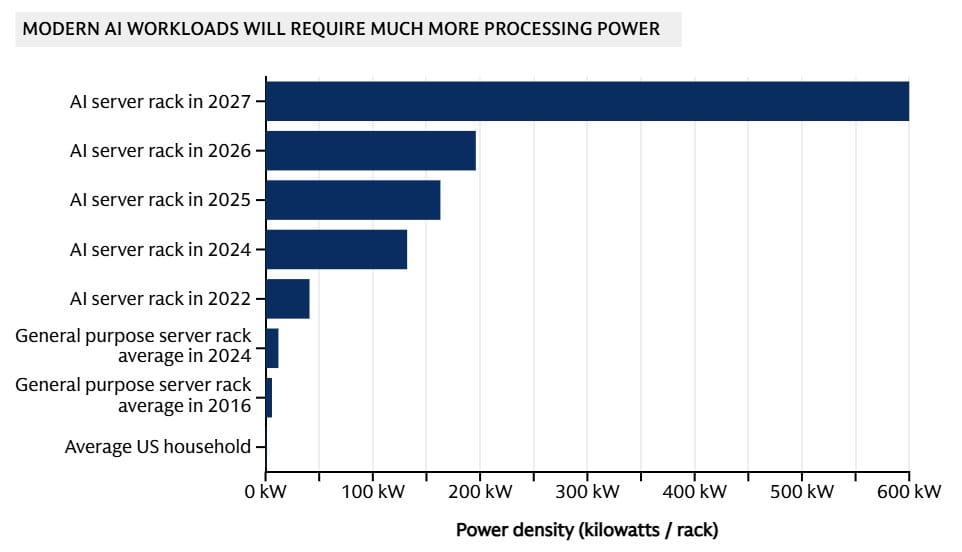

An AI server rack (data center) in 2025 consumes the same energy as roughly 125 homes in the US.

By 2027 the average will be about 500 homes. 🙃

Those suckers ain’t quiet, nor cool, and running massive data training and scraping facilities isn’t something that’s synonymous with cheap either.

This is why a few cities in the United States have seen their electricity bills rise by over 20% in a single quarter.

What do you think prices will look like if this 2027 forecast is right?

I don’t even want to know…

A Practical Solution

Short-term fixes are found in areas like solar energy, despite the issue of energy storage solutions when it gets cloudy.

But that’s only a band-aid on a cut that most likely will need stitches.

The Mag 7 Printer Goes Brrrrrr

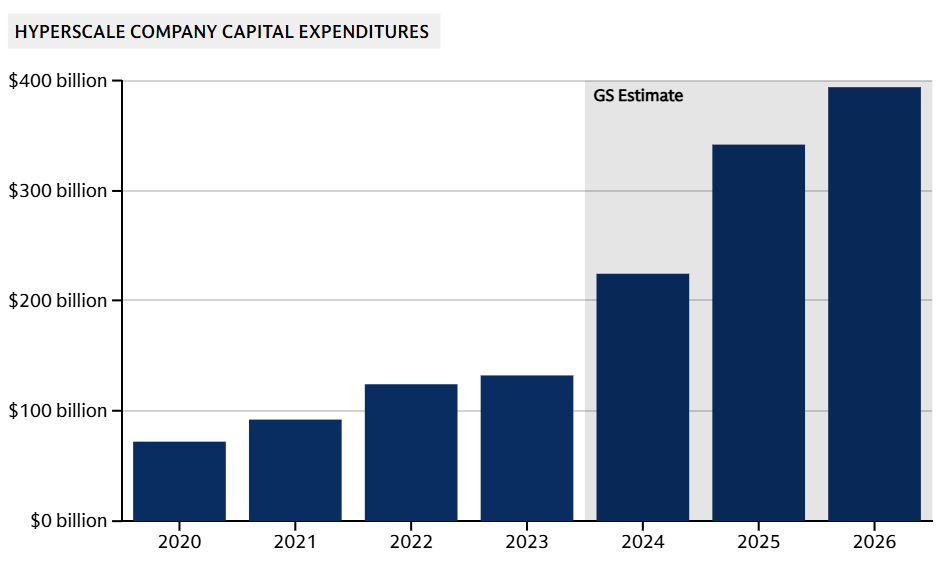

Goldman Sachs expects CapEx spending from the hyperscalers to keep rising through as well.

Most of this money is likely going to land on some form of infrastructure for AI data centers or energy facilities.

The problem is that neither the current grid nor solar can sustain this level of output consistently without someone picking up a very large tab.

With the Fed now cutting into 3% inflation and all-time high asset values, as I’ve said before, we are surely set up for a mix between 1974 and 2019 here.

A scenario that likely ends up in stagflation, which is amazing for real assets and not so much for financial ones.

That could drive the Gold rally further, and spike a real estate boom (again) as property income rises as a function of utility and construction costs with data center footprints.

So if you live in the following cities:

Dallas

Atlanta

Phoenix

Chicago

Then expect to see both higher property prices and higher electricity bills.

Why? ⬇️

These cities already operate at 80%+ capacity in terms of electric output, and these are also where some of the biggest data centers are being built.

So the math isn’t mathing there.

What I Plan to Do About This

First of all, let’s look at the real estate side of things as this NOI is set to rise for most multi-family and apartment complex properties. 📈

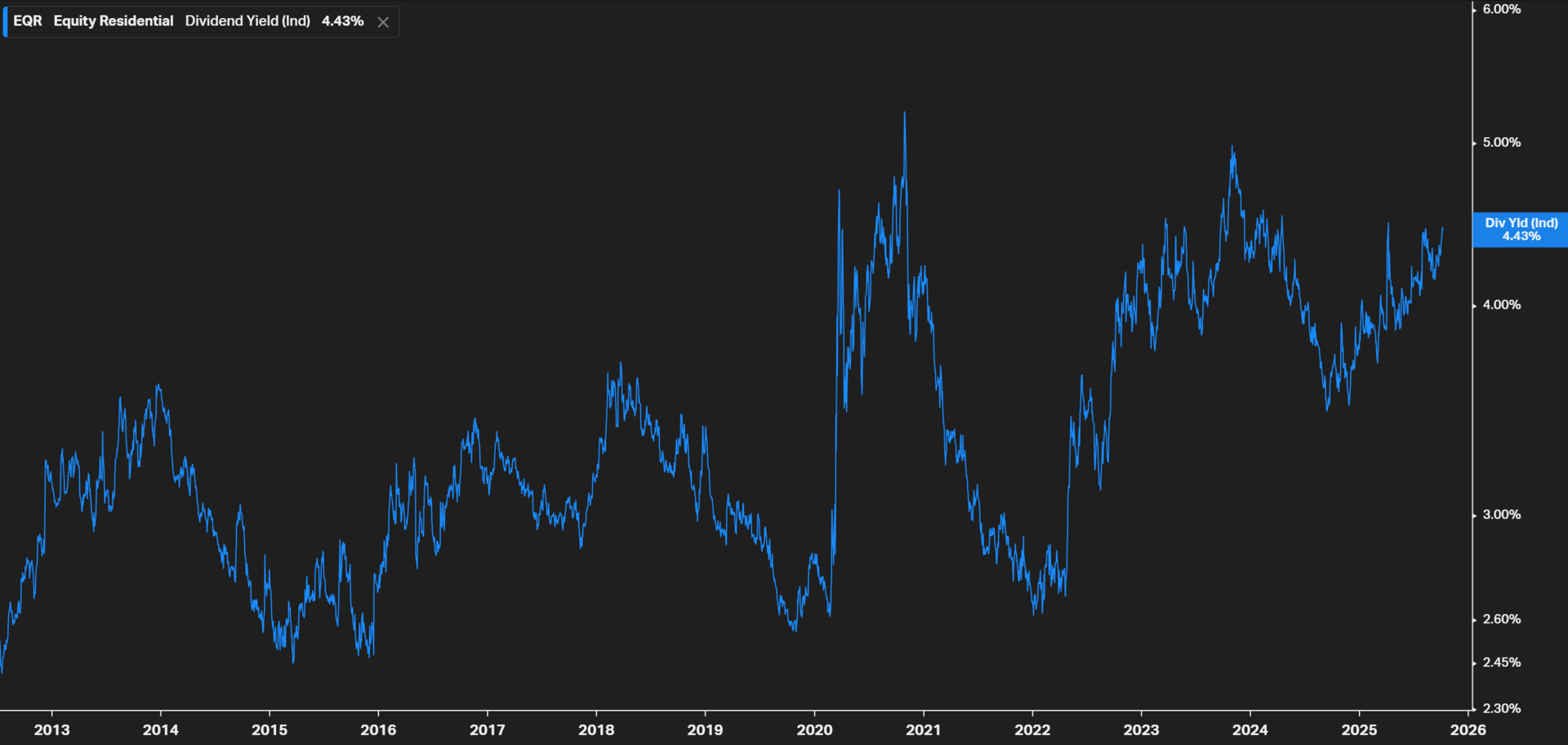

Equity Residential

4.4% yield

Good liquidity to keep buying more properties at 4-6% caps

Well positioned for low rate environment

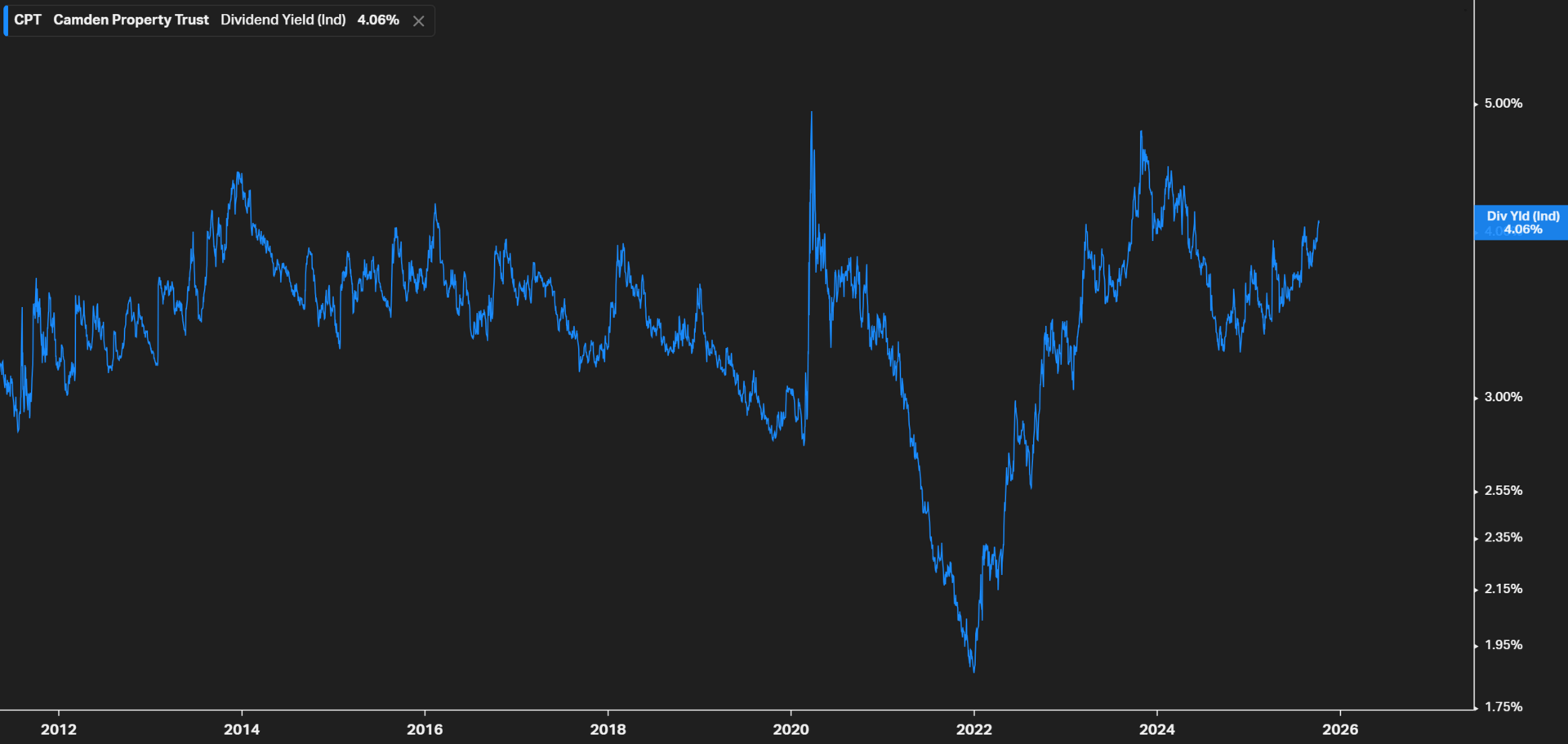

Camden Property Trust

4.1% yield

More concentrated along the Sunbelt Region

High growth in NOI exposure, though more cyclical and a tight acquisition pipeline

While there are a few worthy mentions, I like these two the most for double-digit upside and a decent dividend yield.

If you are into REITs, these are great choices in this real asset super cycle thanks to the Fed’s out-of-touch decision-making.

Energy Pick

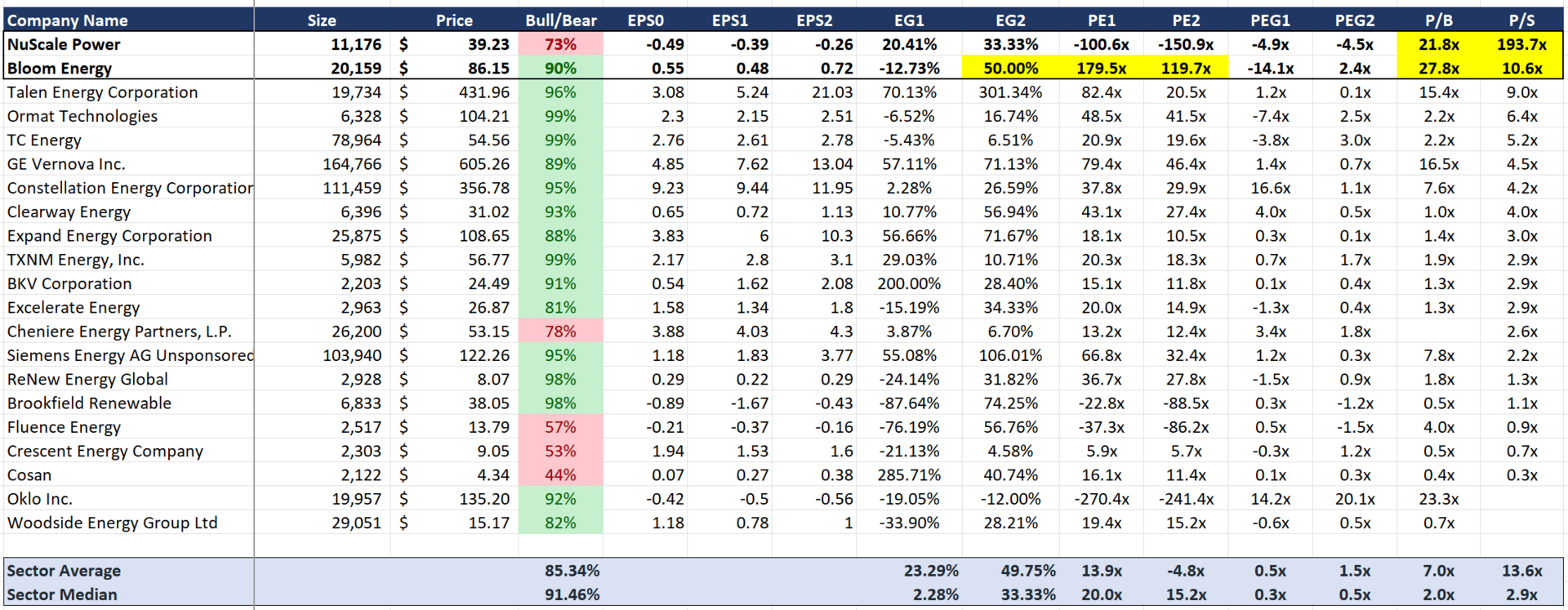

After screening for a few stocks in the alternative energy space, I came across two that immediately caught my attention.

NuScale Energy

Bloom Energy

I’ve highlighted the ratios that I believe will drive their price action in the coming quarters, especially as the U.S. seeks to resolve this electricity issue while maintaining its leadership position in data center buildouts.

With that, I invite you to join the next step of this idea-generation process, where:

We will do a further selection screen and dig into the business models that best fit this narrative

Build entire financial and valuation models for you to keep handy

Arrive at a full thesis plus entry and exit strategies on our top choice

Last pitch we made in healthcare ended up rallying by 10% just a week after we sent it, and we still expect an additional 50% return to end the quarter. 🔥

At the end of the day, it might not be nuclear.

If you read our last newsletter, we are (as Buffett is) turning bullish on oil stocks.

Our top picks are being sent to our WhatsApp Deal Room (join now to get 7 days free) after our healthcare pick was still hot.

Now, whatever nuclear play comes in, it will be sent there as well.

But here’s the reality for you:

As long as you depend on people like me, you will never be truly rich

Once again, I invite you to join our free 5-day email crash course to start decoupling yourself and become an independent thinker in these challenging markets.

And if you’re ready to 10x your $6,499 investment, The Sovereign Trader Program waits for you.

Good luck on your REITs if you take them,

I look forward to seeing you next time for our discussion on the long-term and short-term ideas stemming from last week’s PMI indexes.

To your success,

G 🫰

GO AND MAKE IT HAPPEN

Now for Visual Learners

This whole thing is simple, but not easy.

Most of us fall either into the value investing side of things or the wannabe trader relying on chart patterns and some day trading adrenaline.

But,

There is a sweet spot in between not many know about.

It’s how guys like Steve Cohen build billions in wealth in only a fraction of the time it took someone like Warren Buffett.

This is how Long/Short Equity concepts landed us on $INTC at $19 a share before the big news came out. 🔥

No charts, no illegal info, pure insider experience ⬇️

To your success,

G. 🥃