- InvestiBrew

- Posts

- 🗞 A 28% IRR Deal (Just for You)

🗞 A 28% IRR Deal (Just for You)

Here's another look at this GDP growth story, and a deal overseas that can double your investment on a whiff.

WHILE YOU POUR THE JOE… ☕️

Something really interesting happened in the markets last week…

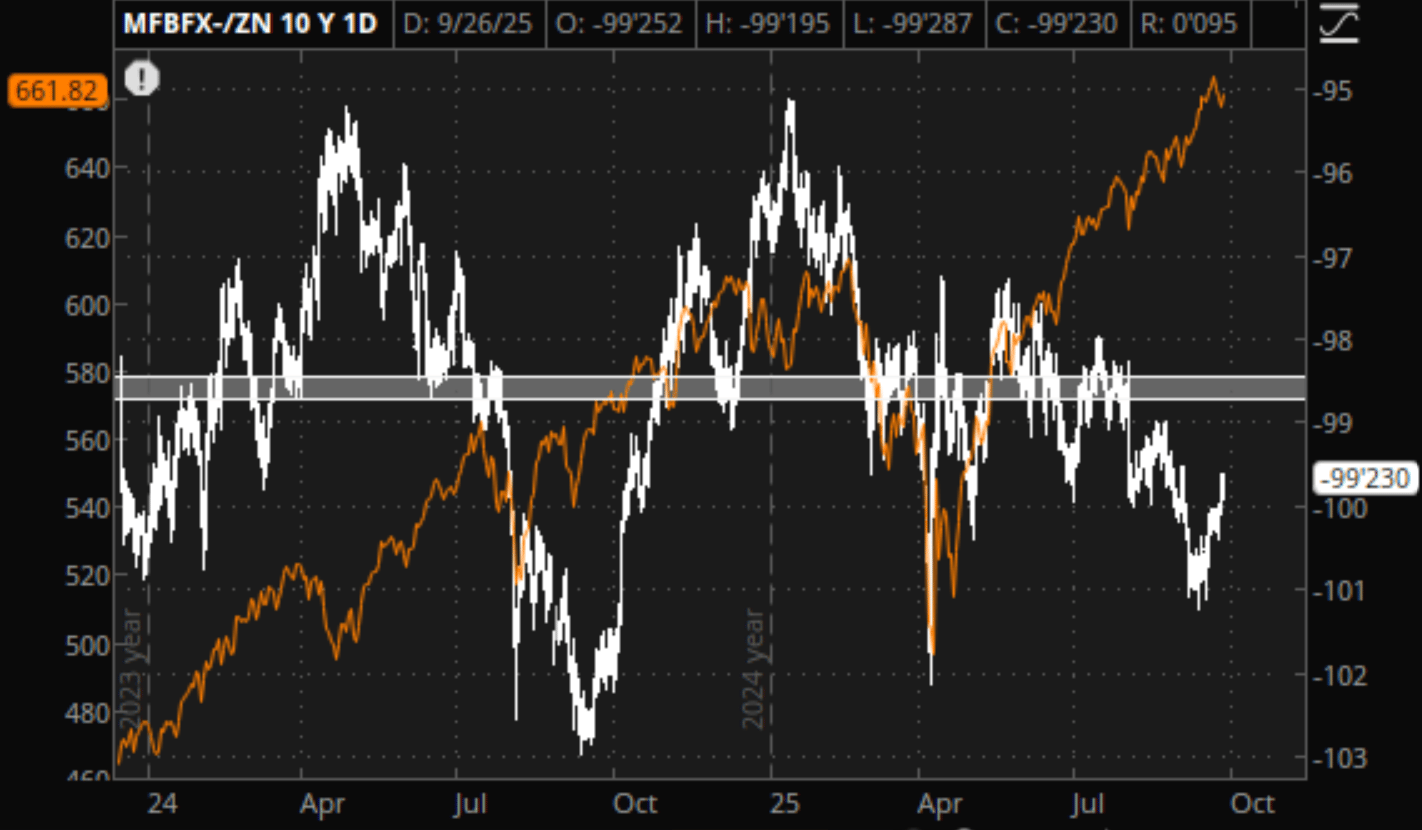

You see that white line? That’s the spread between corporate bond yields and treasury yields (also known as equity risk premiums)

That tightening suggests stocks are seen as less risky now. 👀

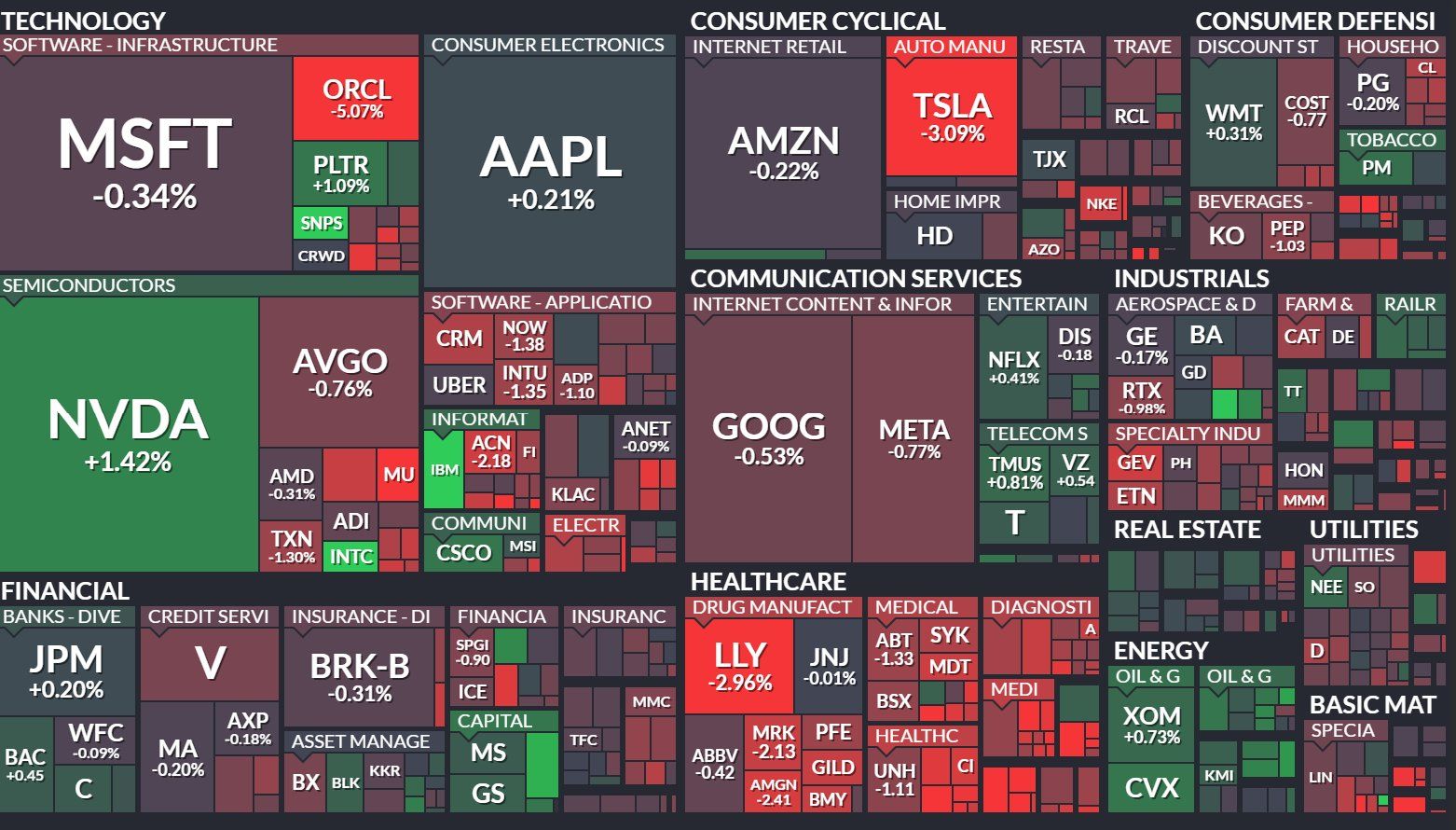

All because two sectors started to outperform while two others declined heavily:

The big tech names, such as $TSLA, $ORCL, and $MSFT, fell, while Utilities and Energy rallied. 📈

So why did the markets like this?

If you read this newsletter, we broke down why the concentration in tech for the S&P 500 is not an actual bubble, but rather the other 493 stocks in the market are.

Simply because they are not pulling their weight.

Now, with energy and utilities on the rise, I can confidently say that markets are pricing in inflation returning above 3% soon, justifying more rotations like the one we saw last week.

Stay with me.

If risk premiums liked this (which they did), then chances are the choppiness in stocks is right around the corner.

Which is why you NEED to uncorrelate your money from the indexes and keep your volatility in check right away.

That’s the premise of our long/short equity strategy, which can take months to break down.

But,

We boiled it all down into this free 5-day email crash course you can sign up for now. ✅

And for those of you who are really serious about this opportunity, then our flagship program, The Sovereign Trader, is just the thing for you.

Give me six months, and I will put you on a path to 10x your trading account (responsibly)

Speaking of rotations, let’s get on with today’s email 📧…

MACRO COMPASS

Broken Relationships

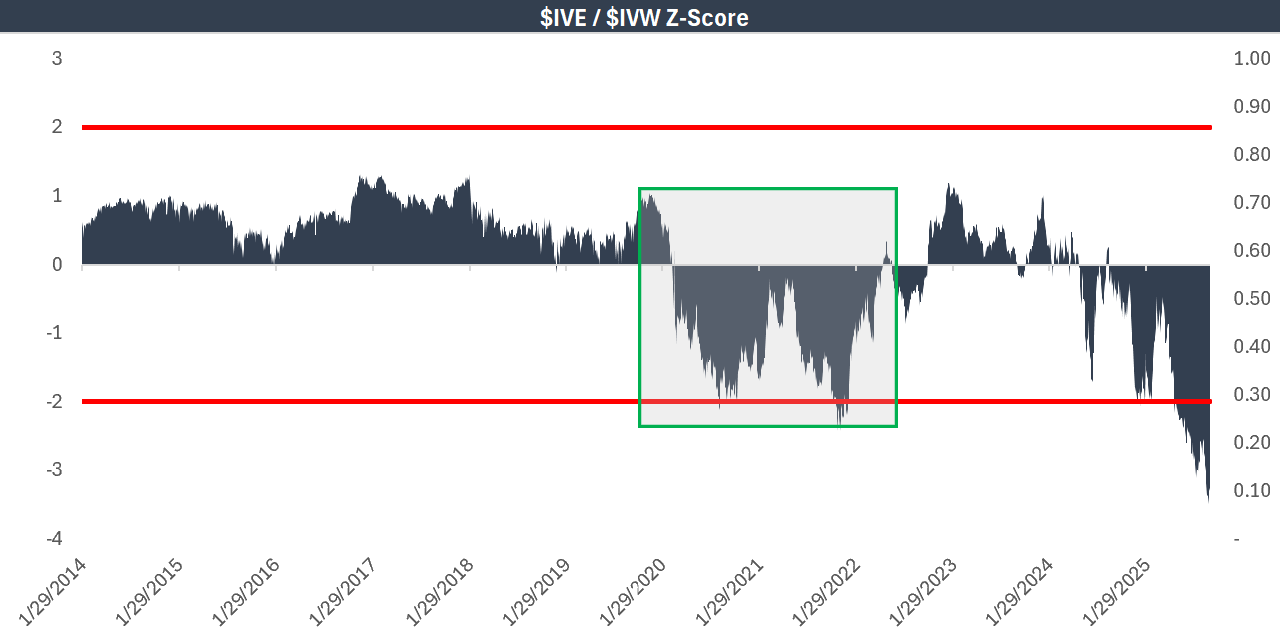

Not the first time I bring up the $IVE / $IVW spreads,

Nor will it be the last time.

Historically, when value stocks ($IVE) underperform growth stocks ($IVW), it means markets are becoming bullish on the economic growth story.

This should come along with a rally in oil prices, as long as this growth is happening in the real economy.

In that shaded area, 2020-2022, growth was happening in the real economy, no doubt about it. 🤷♂️

Low inflation + rock-bottom interest rates resulted in ⬇️

Oil stocks drew down at the most aggressive rate in history, partly due to lockdowns creating massive bottlenecks, and also due to huge demand coming in.

However,

As growth stocks start to outperform to the greatest extent in history, there is ZERO reaction in oil stocks and oil prices.

Why?

The Fed just cut interest rates to 3% inflation, while the services economy is firing on all cylinders.

All the while, the real economy remains in a deep recession, which is why the $IVE / $IVW relationship to oil has been broken since the beginning of 2025.

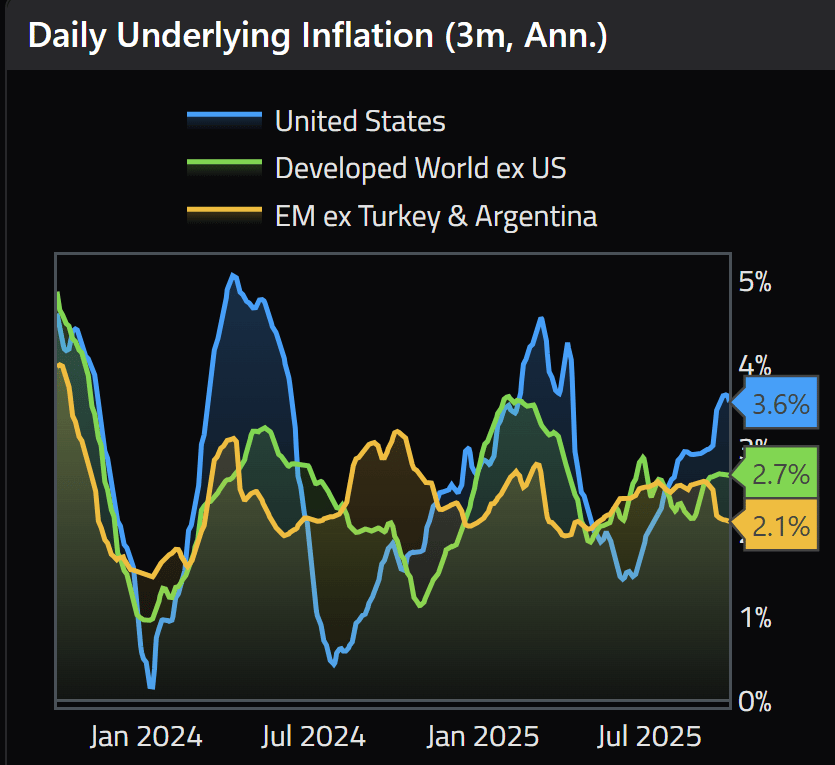

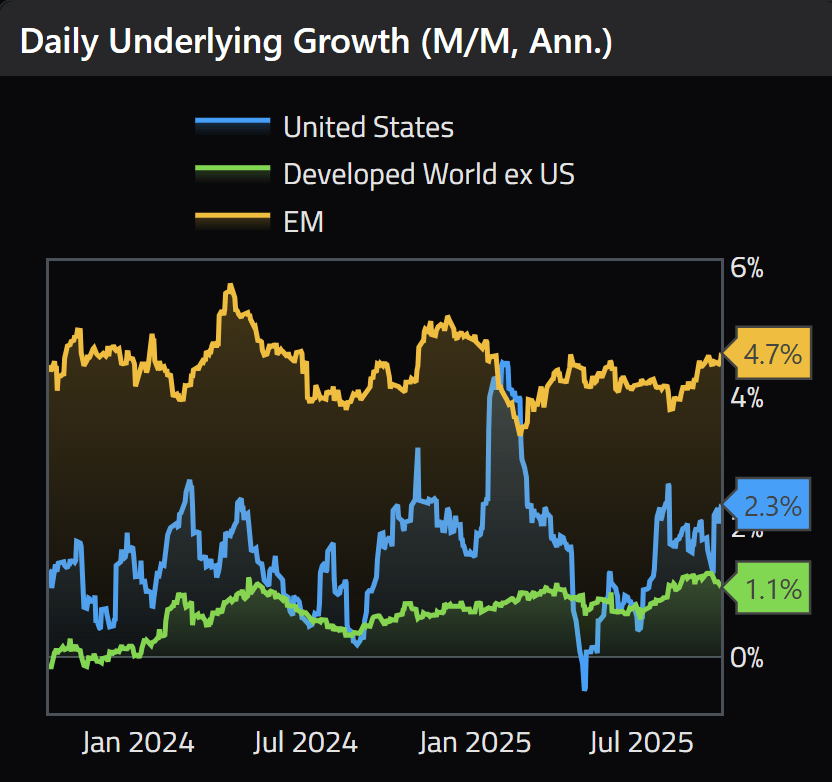

I mean, look, out of all the developed and emerging economies (ex, Argentina), the US is the one leading in inflation readings + expectations. 🔥

This should be attached to growth, but it isn’t for the reasons I just showed you above.

But in case you’re still doubting ⬇️

Emerging markets are the ones knocking it out of the park.

You’ve seen it: China’s tech rally has been insane lately, especially with $BABA breaking past $170 after we recommended it in the $80s in previous newsletters.

But now the question is: Where is the next big swing?

Enter Your New Deal

I am a bull on Argentina’s future.

President Milei is implementing a five-step plan, and we are now in step two, characterized by a depressive state, which will be followed by bailouts and foreign investments aimed at privatizing core sectors.

With Bessent investing $20 billion in this second step, what follows will be a massive swing in corporate profits for these sectors.

We’ve picked one for you, and landed on a company with the following metrics:

74% market share

8% FCF yield

75% gross margins

And the best part, our valuation case (in line with Wall Street’s base case) suggests the stock can deliver up to 28% IRR over the next 5 years.

That’s a total return of over 140%. 🔥

The link to access this deal is below. We will be pitching other private deals like this one in the coming weeks.

So do yourself a favor and don’t miss out. ⬇️

In other news and opportunities..

You now understand that the markets are at risk of becoming choppier, and that’s where long/short equity outperforms the most.

So it’s time to pull the trigger on this deal right here:

Long $LSTR / short $CNI with a hedge ratio of 0.52489.

If you want the full breakdown and thesis behind this trade, I made a couple of resources for you:

Watch the full video on this idea

Read our newsletter pitch for it

The target exit is still $100-$105, yielding 38-45% returns while maintaining market neutrality. 🎯

I’ll catch you next time for another macro breakdown and a potential value play in the making.

To your success,

G 🫰

GO AND MAKE IT HAPPEN

See You at 5pm

Remember that $INTC rally we called back at $19?

The stock has now broken $35 per share.

Called it without using charts or any of the BS advice that gets shoved down your screen every single day.

A single spreadsheet and the knowledge of how to interpret market dynamics were enough to secure this opportunity.

You can do the same thing after completing our flagship program, The Sovereign Trader, within 6 months.

If this is your first rodeo with long/short equity, don’t forget there’s that free 5-day email crash course.

Anyway,

A YouTube video will be released today at 5 pm, covering that trade with more visuals than I can fit in one newsletter.

Hope to see you there (subscribe & keep the bell on so you don’t miss it). ⬇️

To your success,

G. 🥃