- InvestiBrew

- Posts

- 🗞 Duolingo Multi-Bagger: Day 3

🗞 Duolingo Multi-Bagger: Day 3

It's day 3, the most important one for those serious traders in the audience. Let's go over how you can properly hedge this multi-bagger.

WHILE YOU POUR THE JOE… ☕️

Duolingo Return Probabilities, InvestiBrew

It’s Day 3,

Yesterday, we went over the fundamental case for Duolingo and its valuation. Hopefully, you now have a pretty good idea as to why I think this business is still a deep value play. 📈

However, the price action has yet to settle.

Last week, Duolingo presented two major signals for those who know where (and how) to look:

January 12th: Stock dropped by 8.4%

January 14th: Stock dropped by 5.7%

As you can see in the distribution probabilities above, these two are outside of the normal returns for Duolingo.

Again, low-probability events, where professional traders love to take action on their views.

Today, we will build from these two low-probability events and go over how you can protect your capital once it’s deployed.

Through a little-known strategy called Long/Short Equity.

** Make sure to sign up for a 7 Day Free Trial to the Deal Room, you’ll be able to access the entire Excel model (hedge included) and follow along in today’s deep dive.

Speaking of protecting your Duolingo investment, let’s get on with today’s email 📧…

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

NO MORE GAMBLING

Screening For Protection

Once you place a trade, your instincts kick in, and you begin wondering how much you stand to make if you’re successful.

At Goldman Sachs, I learned that just the opposite is true.

You have to start by thinking about how to protect yourself in case the idea turns out to be wrong.

No, stop losses are not enough. In fact, stop losses are one of the worst ways to manage risk since they are fixed outcomes, markets are flexible, and your positions have to be as well.

This is where a hedge comes into play:

Business - Software Services Comps, InvestiBrew

Spreading across different verticals in the industry is where you should start hedging.

Even if your overall bias on the industry is bullish, not all stocks are made (or treated) equally.

Pay attention to Salesforce Inc. (CRM):

Forward EPS Growth 10.5% below the 13.25% average

Forward P/E multiple of 17.5x below the 21.9x average

Forward PEG of 1.7x in line with overall comps

These discounts and below-average drivers make Salesforce a potential short hedge in my view.

Here’s another great candidate.

Intuit Inc. (INTU):

Despite an in-line Forward EPS growth forecast

The stock trades at a Forward P/E discount to the average

A $151 billion market cap with this growth rate is definitely a tail risk to watch out for

Modeling The Hedge

A Long/Short equity strategy begins at the quantitative level, which you can start to break down after the short candidates have been identified.

Again, make sure you sign up for this 7 Day Free Trial to access the fully-built model and follow along these instructions.

Starting with a correlation check, this is what the DUOL / CRM trade looks like:

DUOL / CRM Rolling Correlations, InvestiBrew

The average correlation between them is negative, so there is really no use for us to continue modeling under a CRM short hedge.

Following the same test, a short in INTU as a hedge looks a whole lot better ⬇️

DUOL / INTU Rolling Correlations, InvestiBrew

While these aren’t the highest correlations, they’ve moved higher since June 2025.

Which is exactly when the “AI will kill Saas” narrative was born and accelerated.

Sounds like both these stocks are holding hands in their pain; only Intuit trades at 67% of its 52-week high, while Duolingo is less than 30%.

Lots of ground to cover in terms of Intuit falling relative to Duolingo.

Market-Neutral DUOL / INTU Spread, InvestiBrew

Here comes some math, so bear with me.

Spreading these two stocks requires you to compute a “hedge ratio”, a mathematical formula that guarantees (or nearly guarantees) a market-neutral position.

In other words,

A synthetic that is not exposed to what the S&P 500 does on any given day.

You can chart this in your charting platform as:

DUOL - 1.643 * INTU

Why is this a net benefit for you? Look at the P-Value of 0.0612.

Statistically, this answers the question of mean reversion, of whether we can buy the market-neutral spread at a deviation and ride it back to the mean.

A 0.0612 value indicates 90% confidence in mean reversion. ✅

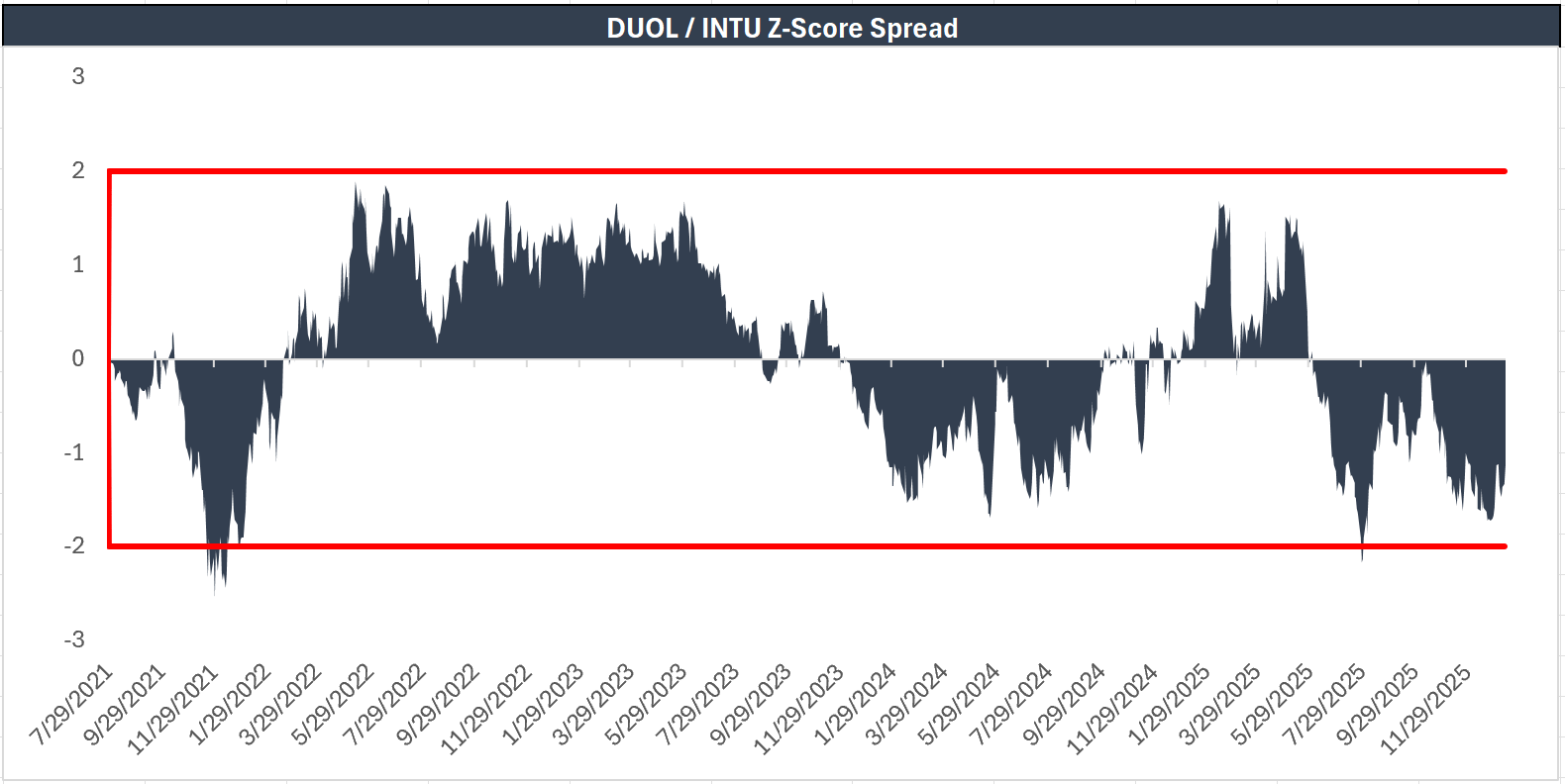

DUOL / INTU Z-Score Spread, InvestiBrew

Now that we know the spread is mean-reverting, it all comes down to execution timing.

The Z-Score smoothes out the spread, giving us a clear picture of +2 and -2 standard deviations, or the buy/sell targets.

Currently, we are roughly at a -2 deviation, confirming both entries: DUOL long and INTU short.

However,

That was last week, when Deal Room Members got the signal.

Here’s what the spread looks like today:

DUOL / INTU Spread, InvestiBrew

Massive rally after INTU dropped by 10 points.

Absolute beauty in terms of a hedge, protecting us from the fall in DUOL stock.

Notice the difference now?

No stop losses, no technical nonsense, pure alpha generation.

How many times have they failed you, really?

Think of the thousands you’ve lost following them and implementing the worthless technical analysis advice they give you.

There’s a reason why successful businesses are franchised.

Like Goldman’s trading strategies in satellite offices.

You can spend thousands more (and years of education) to get there.

Or:

You can join us in the Deal Room to access each and every deal + model (7 Days Free)

Be a part of our professional trader network by completing The Sovereign Trader Program (10 cohort spots left until August 2026)

Thank you for being part of this deep dive.

Won’t be the last I host, so stay tuned…

To your success,

G 🫰