- InvestiBrew

- Posts

- 🗞 Everyone Says "Follow the Money", Here's How You Actually Do It

🗞 Everyone Says "Follow the Money", Here's How You Actually Do It

Sayings become sayings because they sound nice, but then you are left with the question of how to actually execute. Let's change tha

WHILE YOU POUR THE JOE… ☕️

Intel stock is up over 20% since I sent this message to our WhatsApp group members.. 📈

We were discussing whether there were still any opportunities in the technology sector, specifically in the entire semiconductor race and AI onshoring deal.

What would you do if you were tasked with finding the best opportunities there?

My guess is you’d default to your old habits and what you think actually works, which is charts probably..

Everyone hated $INTC because of bad chart patterns, fundamentals, and a bunch other factors.

I loved it at $19 and even at $21 I was still bullish on it for reasons I later outlined to our members.

You can’t make consistent money in the market by looking at what literally everyone has access to.

Think about it, a 15-year-old kid in India can open up Tradingview after 10 hours of YouTube courses on technical analysis and do exactly what you do, if not better.

What most people can’t do?

Come up with trade ideas the way Goldman Sachs does, simply because they’d have to live it.

Which is exactly why I can give you trade ideas you won’t find posted anywhere else.

However, I started right where you are, and after 10 years, I managed to escape the lies we all get sold.

Speaking of trade ideas, let’s get on with today’s email 📧…

CONTRARIAN VIEWPOINT

Crowded Markets

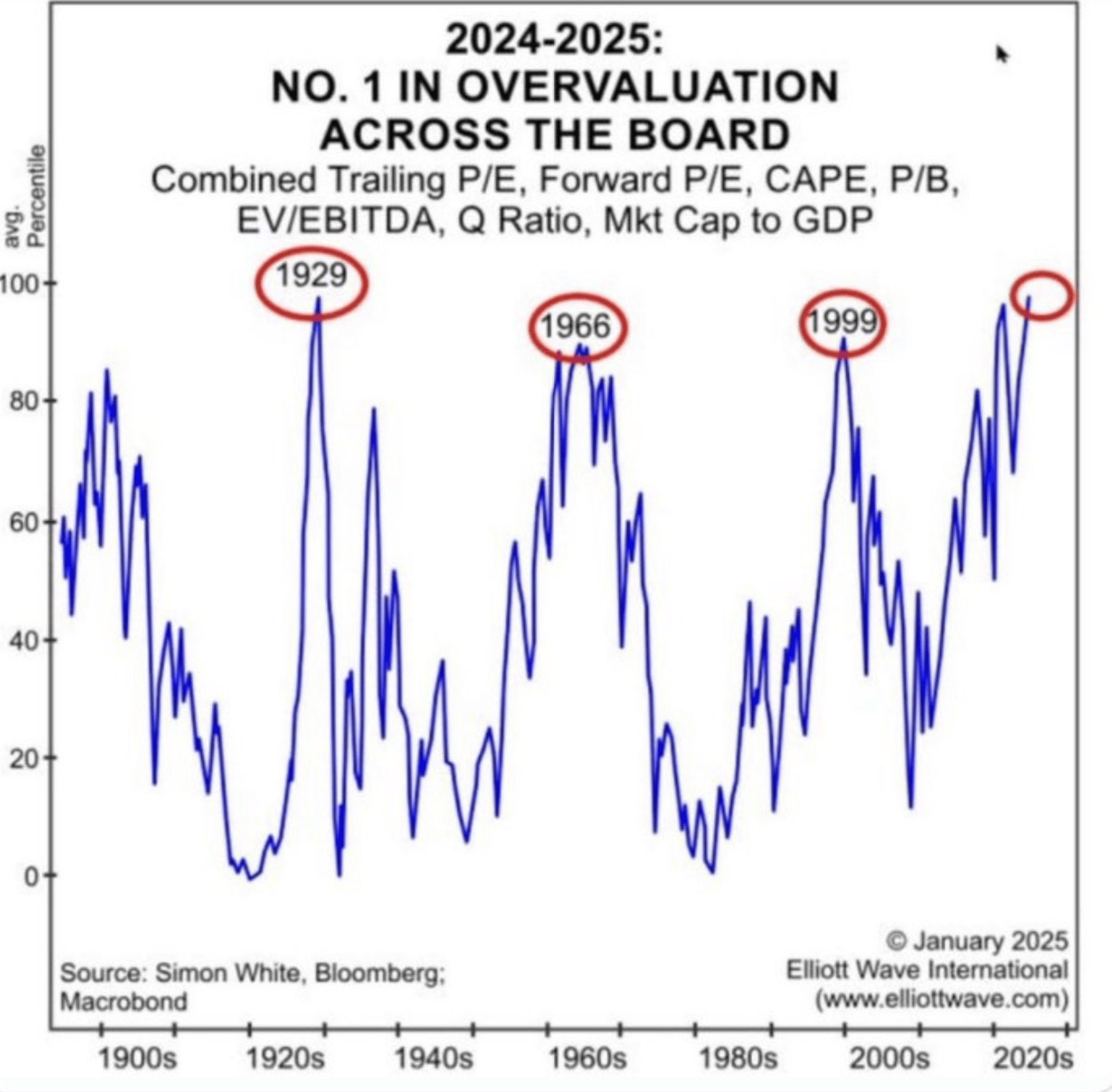

We are now facing the most expensive stock market in history, but it’s not just the stock market.

We have pretty much all other asset classes (except bonds) trading at the upper valuation ranges, and no, this time it won’t be different. 👀

Here’s what I think about this situation:

Most economic data is looking anemic, we’re in a recession yet there’s no admisson of it yet, masked by all the new spending

With little options left as to where money can be invested and flow into, it makes sense to stay in stocks

Which is why I believe the stock market will keep going up until the Fed cuts interest rates. 📉

However, the real upside potential is not in holding the $SPY $QQQ or its largest constituents, not to say you won’t make money there.

But,

If you want to have more upside AND keep your downside small, then I would refer you to this newsletter post about mid-cap stocks and why they will likely outperform.

Now here’s other data to remind you where we are in the cycle: ⬇️

I’ve mentioned in the past that most of the returns in the S&P 500 have come from P/E expansions, and not actual EPS growth.

Well consdiering that most of the S&P 500 is now centered around the Mag 7, and those have seen their EPS growth fall consistently, you tell me where the market should be headed.

Even housing data is not having a good time, oversupply and not a lot of demand right now.

Keep this one in mind, it will be a key datapoint to consider when we start spreading out our long/short ideas within the services sector.

Speaking of which…

Latest Mid-Cap Picks

Now that we’ve covered some of the reasons why the market may keep moving higher, and why mid-caps are the best place to be. 👀

Let’s go over a couple of picks I came across this weekend when doing some research.

Remember when we told you the Services PMI price gauge would place upward pressure on the CPI / PCE / PPI?

Well, we just had the hottest PPI reading since 2022, and it mostly came from services.

While most of your Twitter and YouTube feed was telling you it will come cooler, and the market would be happy about it, we were saying the opposite.

What we didn’t say is that the market would come down from a hot PPI.

Why?

Because we understand complacency is at an all-time high, and again that the market won’t go anywhere until the Fed cuts rates. 🕐️

From that data, our Sovereign Trader alumni are already digging up ideas within the services sector, finding which specific industries are primed to make a big move.

As you can see, the following are breaking out aggressively over the quarter:

Wholesale Trade

Finance & Insurance

Retail Trade

Now we already gave you our long/short trade idea within wholesale and retail, you can watch the whole thing in this YouTube Video ⬇️

That leaves us with: Finance & Insurance.

Look, at this point you are walking into the sort of information and insights we get paid thousands to deliver.

The reason I am giving you part of it here for free is beacsue I believe saving always comes at a cost.

Think about it:

Saving money by taking a bus rather than a taxi costs you your time

Saving money on cheaper food costs you your health

And saving money on education costs you your entire future

So I’m giving you an opening, a chance to not waste time, a shot at taking your trading account to what it really should be (a ticket to a better life)

You won’t get rich from this, but you also won’t become poor. What this will do is give you the skills necessary to monetize inside and outside the markets.

Out of 150 stocks, these are the ones that made me interested in looking furhter for a trade idea.

Specifically:

Long Candidates: $APLD, $UPST, $RKT

Short Candidates: $MS, $JPM, $AMP, $TROW

And that’s the task we will be taking on in our next newsletter.

Which of these will make it into our screening process, whether long or short, and how we plan to structure the trades themselves.

Just the way I learned inside Goldman Sachs, and how nobody else will be showing you.

Until then, and to your success,

G 🫰

GO AND MAKE IT HAPPEN

Better Circles

The bulk of the smartest traders and analysts are surely on Twitter & LinkedIn.

Which is also where 90% of our followers come from, and why they enjoy these insights so much.

Staying true to my community focus, we’ve opened a free WhatsApp group for you to drop in and see what is happening live behind the scenes.

The best ideas and company picks end up getting a deep dive, where you can rest assured an entire team will be with you throughout a trade or investment

Join the Community ⬇️

To your success,

G. 🥃