- InvestiBrew

- Posts

- 🗞 No More Cuts?

🗞 No More Cuts?

Traders around the world are beginning to bet the other way, here's who gets burnt and how you can escape unscathed.

WHILE YOU POUR THE JOE… ☕️

We in Paris

Yours truly is going on a European tour, again.

This time it’s more business than pleasure, as I’ll be conducting field research for a company we plan on buying big. 📈

And I mean big, like 25% of total assets big.

It has over 80% upside built in 🔥, and the best part is we have the perfect hedge in place if the idea is wrong.

This hedge is so good that the deal pretty much finances itself.

The entire financial/valuation model is made and ready to go, along with a thesis breakdown for you.

Included in your 7-Day Free Trial of the InvestiBrew Deal Room ⬇️

Speaking of field research, let’s get on with today’s email 📧…

POWELL’S DILEMA

No More Cuts

In our last newsletter, we left off with the idea that the Fed is now enacting recessionary cuts. 🐻

After all, real rates are sitting at only 1.5% leaving not that much room for cuts to be effective now.

Not only that,

But inflation is heading back to 3% while unemployment remains at 4%+, all told there isn’t much economic growth happening besides the whole AI capex cycle.

Jan 2026 Rate Cut Odds, CME Fed Watchtool

This is why, after yesterday’s rate cut (which was a given), markets aren’t expecting much more to come from the Fed in January’s meeting.

It would be a disaster if they do, or an outright admission of a recession in the U.S. economy.

Now this has some implications for financial markets and some asset classes in particular:

Global Yields on The Rise

Bonds have been on my radar for a while, you all know that.

While I still think they have one of the best risk/reward ratios out there, it doesn’t mean you should ignore some of the risks:

Inflation resurgence

Potential stop to the rate-cutting cycle

Super cycle in real assets

And the most important one of all, the global rise of yields happening as a result of all these previous points.

As you can see, traders around the world are betting that rate cuts won’t be as aggressive or as extended as everyone had originally thought.

This makes for a considerable tail risk in the bond market, but it’s not all bad news from here:

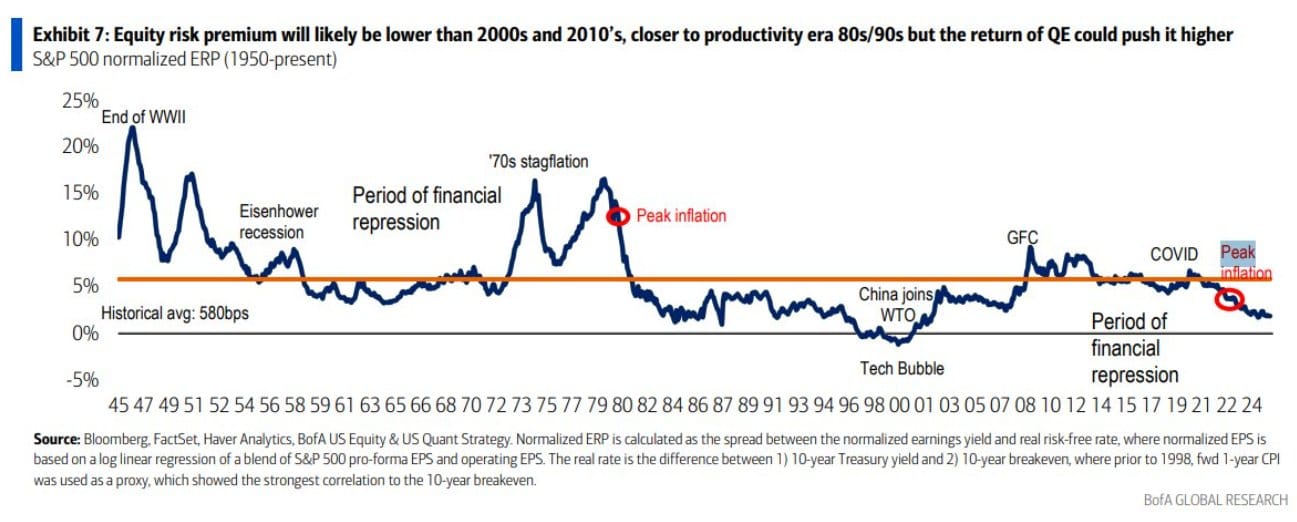

Equity Risk Premiums Tightening

Right now, equity risk premiums are tightening (or widening, depending on how you look at it).

They’re at levels not seen since the dot-com bubble, but this is really the best way I can describe what’s going on:

Complacency for the “stocks only go up” narrative is near an all-time high

All while underlying fundamentals, growth especially, are deviating from both this view and valuations themselves.

S&P 500 quarterly returns vs Services PMI

Now this is exactly where I want to remind you of this relationship.

Services PMI vs S&P 500 returns (monthly)

With an average correlation of over 50%, the current deviation in S&P 500 monthly returns away from the Services PMI index should worry you.

Especially now that the global landscape looks like no more rate cuts for a while.

Recall that this also could mean a rebound in Services PMI readings to catch up to the S&P 500, so it’s not all bad news and bearish biases for the sector:

Services PMI Industry Trends, InvestiBrew

I will say it again, we have the following biases for the services sector right now:

Bullish on: Finance & Insurance breakout

Bearish on: Construction & Real Estate breakdown

That said, I have done some digging into the names I want to keep in mind for my portfolio, and that of the Deal Room members.

This is what I’ve got so far ⬇️

Industry Spread Comps, InvestiBrew

For the construction and real estate industry, we have a three-way relationship happening for stock selection:

Home builders are a mix of longs and a hedge, since some in the space are way too overvalued and others offer great upside potential right now

Wood products have the most EPS growth potential, and trade at a forward P/E premium to industry peers (also massively bullish)

In that order, I want to buy Tri Pointe Homes (TPH) and short Lennar (LEN) at some point in a long/short equity portfolio.

Then for finance:

Financial Transaction Services & Miscellaneous Services take the cake

Under which I would like to buy Wise Plc (WIZEY) and Chime Financial (CHYM) at some point as well in a net long play, also keeping Synchrony Financial (SYF) as a short candidate in case we need to start hedging.

These “at some point” prices aren’t a guess; they’ve been given out to our Deal Room members already, with an entire financial model to go with as such:

InvestiBrew Deal Room Chat

So do yourself a favor, and grab a 7 Day Free trial.

Going back to my turnarounds in homebuilders despite my overall bearish bias on the space…

There’s an amazing opportunity happening right now in the commercial real estate sector, I mean, we’ve all seen the headlines, right?

Default rates and swaps are worse than 2008, and I can bet you’re banging your head for not buying property back in the crash.

Well, now you can redeem yourself ⬇️

A New way to Earn Income from Real Estate

Commercial property prices are down as much as 40%, and AARE is buying income-producing buildings at rare discounts. Their new REIT lets everyday investors in on the opportunity, paying out at least 90% of its income through dividends. You can even get up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

GO AND MAKE IT HAPPEN

Taking Inventory

I’m blowing the dust off this old gem I had made for you…

It’s a completely free 5-day email crash course on idea-generation and the foundational concepts of long/short equity trading.

Most of the people who have taken it have seen massive improvements in how they approach the market, so I can only hope it does the same for you. 🧠

IF you’re one of the previous takers, then please feel free to reply to this newsletter with any other topics you’d like me to tackle in the same 5-day crash course manner.

Would love to be the one who helps you get there.

To your success,

G 🥃